In today’s rapidly changing world, banking has become more than just a necessity – it has transformed into a lifestyle. With the rise of technology and the increasing demand for convenience, the traditional banking system is no longer able to keep up with the needs of the modern consumer. Thankfully, Debanks has emerged as the ultimate solution to revolutionize the way we bank.

Debanks is not your typical bank. It is a cutting-edge financial platform that offers a myriad of innovative services and features designed to cater to the unique needs and preferences of its users. With Debanks, you no longer have to settle for the limitations of traditional banking. Say goodbye to long queues, paperwork, and impersonal service. Say hello to a new era of banking.

What sets Debanks apart from the rest? First and foremost, it is the unparalleled convenience it offers. With Debanks, you have access to all your financial needs at your fingertips. From opening a new account to applying for a loan, everything can be done with just a few clicks. No more wasting time and energy on tedious processes – Debanks streamlines and simplifies your banking experience like never before.

What is Debank?

Debank is a revolutionary digital banking platform that is transforming the way people manage their finances. It combines innovative technology with a user-friendly interface to provide a seamless banking experience. With Debank, users can access their accounts, make transactions, and track their spending all in one place.

One of the key features of Debank is its ability to connect with various financial institutions, allowing users to consolidate all of their accounts into a single dashboard. This eliminates the need to juggle multiple banking apps and websites, making it easier than ever to stay on top of your finances.

Benefits of Debank

Debank offers numerous benefits to its users. Firstly, it provides a comprehensive overview of your financial situation, giving you a clear picture of your income, expenses, and savings. This makes budgeting and financial planning more efficient and effective.

Secondly, Debank offers advanced security measures to ensure the safety of your personal and financial information. With features such as multi-factor authentication and real-time fraud monitoring, you can have peace of mind knowing that your data is protected.

Lastly, Debank is designed to be user-friendly and intuitive. Whether you are a tech-savvy individual or a novice user, you will find the platform easy to navigate and understand. It also offers personalized recommendations and insights to help you make informed financial decisions.

Overall, Debank is revolutionizing the banking industry by offering a digital banking experience that is convenient, secure, and user-friendly. Whether you are a busy professional, a small business owner, or a student, Debank can benefit anyone who wants to take control of their finances. To learn more about Debank, visit Who benefits from debank.

How does Debank Work?

Debank is revolutionizing the banking industry by offering a seamless and secure way to manage your finances. Using cutting-edge technology, Debank provides a wide range of features and benefits that make traditional banking obsolete.

Smart Contract Integration

One of the key features of Debank is its integration with smart contracts. By leveraging blockchain technology, Debank is able to execute transactions and perform financial operations in a transparent and decentralized manner. This eliminates the need for intermediaries such as banks and minimizes the risk of fraud or manipulation.

User-Friendly Interface

Debank understands that not everyone is familiar with blockchain technology or cryptocurrencies. That’s why it has developed a user-friendly interface that simplifies the process of managing your finances. Whether you want to send money, pay bills, or invest in cryptocurrencies, Debank makes it effortless and intuitive.

With Debank, you can easily track your transactions, view your account balance, and access your financial history all in one place. The platform also provides real-time updates and notifications, so you are always informed about the status of your transactions.

Furthermore, Debank’s interface is highly customizable, allowing you to personalize it according to your preferences. You can choose your preferred language, adjust the display settings, and even set up security measures such as two-factor authentication.

Overall, Debank is designed to provide a seamless and convenient banking experience for its users. By combining smart contracts with a user-friendly interface, Debank empowers individuals to take control of their finances and embrace the future of banking.

The benefits of Debank

Debank offers a wide range of benefits that make it the future of banking. Here are some of the key advantages:

1. Seamless and convenient

With Debank, banking becomes seamless and convenient. Customers can access their accounts, make transactions, and manage their finances from anywhere at any time. There’s no need to visit physical branches or wait in line, as all operations can be done online.

2. Enhanced security

Debank leverages cutting-edge security technologies to protect customers’ finances and personal information. These measures include encryption, multi-factor authentication, and constant monitoring for suspicious activities. This ensures the safety and privacy of customers’ data and gives them peace of mind.

3. Lower fees and costs

Traditional banks often charge exorbitant fees for various services such as ATM withdrawals, account maintenance, and transfers. Debank aims to eliminate or significantly reduce these fees, making banking more affordable for customers. This can result in substantial savings over time.

4. Personalized experiences

Debank provides personalized experiences tailored to individual customers’ needs and preferences. Through advanced algorithms and artificial intelligence, customers can receive customized financial advice, recommendations, and offers that align with their goals and interests.

5. Access to a global network

Debank transcends physical boundaries, allowing customers to access their accounts and perform transactions globally. This enables seamless international transfers, currency conversions, and cross-border payments, making it ideal for individuals and businesses with an international presence.

6. Innovative financial products

Debank is at the forefront of innovation, offering a wide range of cutting-edge financial products and services. These include digital wallets, peer-to-peer lending platforms, cryptocurrency integrations, and more. By embracing emerging technologies, Debank opens up new possibilities for customers and keeps pace with the changing landscape of finance.

With its numerous benefits, Debank proves to be a game-changer in the banking industry. As more customers embrace the future of banking, traditional banks may need to adapt or risk becoming obsolete.

Use Cases

Debank is revolutionizing the banking industry with its innovative use cases. Here are some examples of how customers can benefit from this groundbreaking technology:

1. Instant Money Transfers

With Debank, customers can enjoy instant and seamless money transfers to anyone, anywhere in the world. Whether you need to send money to a family member or make a business transaction, Debank ensures speedy and secure transfers that save you time and hassle.

2. Contactless Payments

Debank enables contactless payments, allowing customers to simply wave their phone or card over a payment terminal to complete a transaction. This convenient and secure payment method eliminates the need for physical cash or cards, making transactions faster and more hygienic.

Moreover, Debank’s contactless payment feature provides an added layer of security by generating unique transaction codes for each payment, reducing the risk of fraud and unauthorized access to customer accounts.

Debank is committed to continuously expanding its use cases to meet the evolving needs of its customers. Stay tuned for more exciting features and benefits!

Debank for individuals

Debank is revolutionizing the banking industry by providing a range of innovative services designed to make banking easier and more convenient for individuals. Whether you’re looking to manage your finances, access loans, or invest your money, Debank has you covered.

Manage your finances with ease

With Debank, you can easily track your spending, set budgeting goals, and receive personalized insights into your financial habits. Our user-friendly interface makes it simple to view all of your accounts in one place, giving you a comprehensive overview of your financial situation.

Debank’s powerful analytics tools allow you to analyze your spending patterns, identify areas where you can save money, and make informed financial decisions. You can also set up automatic bill payments and receive alerts to ensure you never miss a payment.

Access loans and credit

Need extra funds for a big purchase or unexpected expense? Debank offers a range of loan options to suit your needs. Our streamlined application process makes it quick and easy to apply for a loan, and our competitive interest rates ensure you get the best deal possible.

Debank also provides credit cards with flexible repayment options and rewards programs. Whether you’re looking to earn cashback, travel rewards, or other perks, we have a credit card that’s right for you.

| Key Features | Benefits |

|---|---|

| Comprehensive financial management tools | Gain control over your finances |

| Flexible loan options | Access funds when you need them |

| Competitive interest rates | Save money on borrowing |

| Rewards programs | Get rewarded for your spending |

Experience the future of banking with Debank. Sign up today and take the first step towards a simpler, more convenient banking experience.

Debank for businesses

Debank offers a range of innovative solutions designed specifically for businesses. Our cutting-edge technology and advanced banking features give businesses the tools they need to thrive in the modern world.

With Debank, businesses can easily manage their finances and streamline their operations. Our integrated dashboard provides real-time insights into cash flow, expenses, and revenue, allowing businesses to make informed decisions and optimize their financial strategies.

One of the key features of Debank for businesses is our seamless payment processing system. Using our secure and efficient platform, businesses can effortlessly accept payments from customers, whether it’s through credit cards, mobile wallets, or other digital payment methods. This eliminates the hassle of traditional payment methods and reduces transaction costs.

Debank also allows businesses to automate their financial processes through our powerful API. This enables businesses to integrate their accounting and bookkeeping software with Debank, ensuring accurate and up-to-date financial data. By automating these processes, businesses can save time, reduce human error, and focus on growing their bottom line.

In addition, Debank offers a range of business lending solutions to help businesses access the capital they need to grow. Our streamlined lending process and competitive rates make it easy for businesses to secure the funding necessary for expansion, inventory management, or other business needs.

| Benefits of Debank for businesses: |

|---|

| 1. Streamlined financial management |

| 2. Secure and efficient payment processing |

| 3. Automated financial processes |

| 4. Access to business lending solutions |

Debank is the future of banking for businesses. With our comprehensive suite of banking solutions, businesses can stay ahead of the curve and achieve their goals with ease.

Features

Debank offers a wide range of innovative features to revolutionize the banking experience. With our advanced technology, customers can enjoy the following benefits:

1. Seamless Integration

Debank seamlessly integrates with your current banking system, allowing you to access all your accounts and transactions in one place. Say goodbye to the hassle of logging in to multiple apps or websites.

2. Real-Time Notifications

Stay informed about your finances with real-time notifications. Debank sends instant updates and alerts for account balances, transactions, and any important changes, ensuring you are always in control of your funds.

These are just a few of the features that make Debank the future of banking. With our user-friendly interface and cutting-edge technology, we are transforming the way people manage their money.

Seamless digital transactions

In today’s increasingly digital world, the way we make transactions is constantly evolving. Debank understands the need for seamless digital transactions, and is leading the way in providing innovative solutions for a faster, more secure, and efficient banking experience.

Efficiency and convenience

With Debank, users can enjoy the convenience of making transactions anytime and anywhere, without the need to visit a physical bank branch. Whether it’s transferring funds to friends and family, paying bills, or making purchases online, Debank’s digital platform provides a seamless and hassle-free experience.

Secure and reliable

When it comes to digital transactions, security is a top priority. Debank utilizes state-of-the-art encryption technology and robust authentication measures to ensure that all transactions are secure and protected from unauthorized access. Users can feel confident that their financial information is safe when using Debank’s platform.

| Benefits of Debank’s seamless digital transactions: |

|---|

| – Convenient and accessible anytime, anywhere |

| – Enhanced security and privacy |

| – Fast and efficient transaction processing |

| – Simplified account management |

| – Compatibility with various devices and platforms |

With Debank’s seamless digital transactions, users can experience a banking solution that is tailored to their needs and provides a level of convenience, security, and efficiency that traditional banking methods simply can’t match.

Advanced security measures

At Debank, we take security very seriously. We understand how important it is to protect your financial information and personal data. That’s why we have implemented advanced security measures to ensure the safety of your account.

First and foremost, we use state-of-the-art encryption technology to securely transmit and store your data. This helps to prevent unauthorized access and protect your information from being intercepted by hackers.

- We employ multi-factor authentication, requiring more than just a password to access your account. This adds an extra layer of security, ensuring that only you can access your funds.

- In addition, we continuously monitor our systems for any suspicious activity or attempted breaches. Our security team works around the clock to identify and respond to any potential threats.

- To further protect your account, we offer options for biometric authentication such as fingerprint or facial recognition. This adds an extra level of security, as these unique identifiers are difficult to replicate.

- Furthermore, we regularly conduct security audits and vulnerability assessments to identify and address any potential weaknesses in our systems.

Rest assured that your financial information and personal data are in safe hands with Debank. We are committed to providing you with the highest level of security so that you can bank with peace of mind.

Personal finance management

One of the key features that Debank offers is personal finance management. With Debank, users can gain full control over their finances and make informed decisions about their money.

Debank provides users with a comprehensive view of their financial health by aggregating all their accounts and transactions in one place. Users can connect their bank accounts, credit cards, and investment portfolios to Debank, allowing them to track their income and expenses in real-time.

With Debank’s personal finance management tools, users can set budgets, create savings goals, and monitor their spending habits. Debank categorizes transactions automatically, making it easy for users to see where their money is going and identify areas where they can cut back.

In addition, Debank provides personalized recommendations and insights based on users’ spending patterns and financial goals. These recommendations can help users optimize their finances and improve their overall financial health.

Debank also offers features like bill reminders and payment tracking, helping users stay on top of their bills and avoid late fees. Users can set up automatic bill payments and receive notifications when payments are due.

Overall, Debank’s personal finance management tools empower users to take control of their finances and achieve their financial goals. With its user-friendly interface and powerful features, Debank is revolutionizing the way people manage their money.

AI-powered customer support

Debank revolutionizes customer support with the use of artificial intelligence (AI) technology. Our AI-powered customer support system is designed to enhance the banking experience for our users by providing instant and personalized assistance.

With the help of AI algorithms, our customer support system can understand the context of user inquiries and respond with relevant information and solutions. This eliminates the need for long wait times and repetitive conversations with human agents.

Our AI-powered customer support system can answer a wide range of inquiries, including account balance inquiries, transaction history, card activation, and much more. The system is constantly learning and improving, ensuring accurate and up-to-date information is provided to our users.

One of the key advantages of our AI-powered customer support system is its ability to handle multiple inquiries simultaneously. This means that users don’t have to wait in line for assistance, as the system can handle multiple conversations at the same time.

Furthermore, our AI-powered customer support system is available 24/7, ensuring that users can get the help they need anytime, anywhere. This allows for a seamless and convenient banking experience, even outside of traditional business hours.

In addition to instant assistance, our AI-powered customer support system can also provide personalized recommendations and suggestions based on user preferences and banking habits. This helps users make informed decisions and optimize their banking experience.

Overall, our AI-powered customer support system is a game-changer for the banking industry. With its ability to provide instant, personalized, and accurate assistance, Debank is shaping the future of customer support in the banking sector.

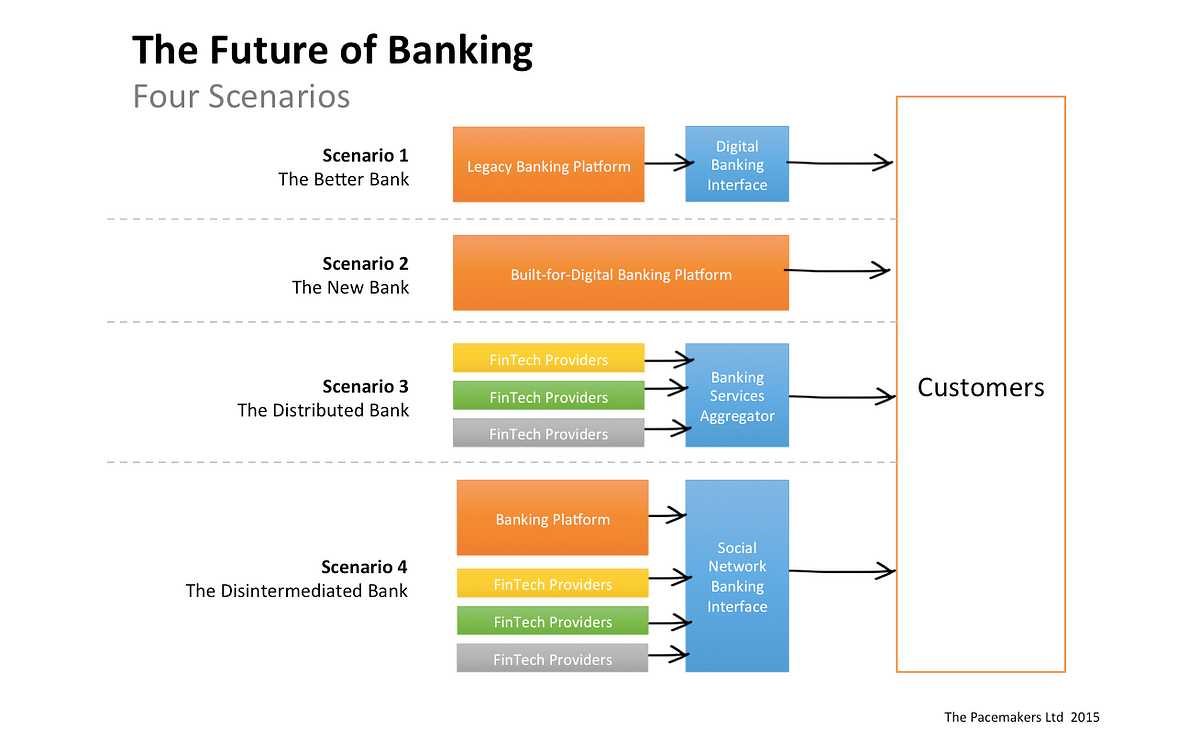

Integration

Integration is a key aspect of the future of banking. With the rapid advancement of technology, banks need to integrate various systems and platforms to provide seamless and efficient banking services to their customers.

One of the main areas of integration in banking is the integration of digital and traditional banking channels. Today, customers expect to be able to access their bank accounts and perform transactions through multiple channels, such as mobile apps, online banking platforms, and ATMs. Banks need to ensure that these channels are seamlessly connected, allowing customers to switch between them without any disruption.

Integration is also crucial when it comes to partnering with third-party fintech companies. Many banks are now collaborating with fintech startups to offer innovative financial products and services. This requires integrating the banks’ existing systems with the fintech platforms to enable smooth data exchange and transaction processing.

Furthermore, integration plays a vital role in data management and analytics. Banks deal with vast amounts of customer data, and integrating data from various sources allows banks to gain valuable insights and offer personalized services to their customers. Proper integration of data also helps banks meet regulatory requirements, such as anti-money laundering and customer identification.

Overall, integration is the foundation of the future of banking. Banks that successfully integrate their systems, channels, and data will be able to provide efficient, personalized, and secure banking services to their customers, staying ahead in the rapidly evolving digital landscape.

Integrating Debank with other services

Debank is not just another banking app, it is a platform that aims to revolutionize the way people handle their finances. With its user-friendly interface and comprehensive features, Debank can be seamlessly integrated with other services to provide a seamless banking experience.

1. Integration with Payment Gateways

Debank can be integrated with popular payment gateways such as PayPal, Stripe, and Square, allowing users to securely send and receive money directly from their Debank accounts. This integration enables users to have a centralized platform for all their financial transactions, making it convenient and efficient.

2. Integration with Budgeting Apps

Debank can also be integrated with popular budgeting apps like Mint and YNAB, providing users with a holistic view of their financial health. By syncing their Debank accounts with these apps, users can track their income, expenses, and savings in real-time, helping them make informed financial decisions.

By integrating Debank with payment gateways and budgeting apps, users can streamline their financial management process, saving time and effort.

Furthermore, Debank can also be integrated with other services such as investment platforms, allowing users to manage their investment portfolios directly within the app. This integration provides users with a comprehensive overview of their finances, helping them achieve their financial goals.

Debank’s open API allows for easy integration with other services, making it a versatile platform that can meet the diverse needs of its users. With its focus on user experience and security, Debank is paving the way for the future of banking.

Whether you are a tech-savvy individual or a business owner, the integration capabilities of Debank can provide you with a seamless and efficient banking experience. Embrace the future of banking with Debank and unlock a world of possibilities.

Debank partnerships

In order to provide a comprehensive and seamless banking experience, Debank has established strategic partnerships with various financial institutions and tech companies. These partnerships enable Debank to offer a wide range of services and products to its customers.

One of Debank’s key partnerships is with XYZ Bank, a leading financial institution with a strong presence in the market. Together, Debank and XYZ Bank have developed innovative financial solutions that leverage the latest technologies such as blockchain and artificial intelligence.

Debank has also formed partnerships with several fintech start-ups to expand its product offering and reach. These partnerships allow Debank to integrate cutting-edge technologies and features into its platform, providing customers with access to advanced financial tools and services.

Furthermore, Debank has partnered with renowned tech companies, such as ABC Tech and DEF Solutions, to enhance its infrastructure and security. These partnerships ensure that Debank’s platform is robust, secure, and able to handle a high volume of transactions.

| Partners | Description |

|---|---|

| XYZ Bank | Leading financial institution with innovative solutions |

| Fintech start-ups | Provides access to cutting-edge technologies and features |

| ABC Tech | Enhances infrastructure and security |

| DEF Solutions | Improves platform scalability and performance |

These partnerships are a testament to Debank’s commitment to delivering the best banking experience to its customers. By collaborating with industry leaders and leveraging the latest technologies, Debank is able to stay at the forefront of innovation in the banking sector.

Through its partnerships, Debank aims to continuously enhance its products and services, ensuring that customers have access to the most advanced and personalized banking solutions available in the market.

Adoption

The adoption of Debunk has been steadily increasing since its introduction to the market. The platform’s user-friendly interface and innovative features have attracted a wide range of consumers, from tech-savvy millennials to older generations looking to modernize their banking experience.

One of the key factors driving adoption is the seamless integration of traditional banking services with blockchain technology. Debunk allows users to access their accounts, make payments, and manage their finances through a decentralized network, ensuring the security and transparency of transactions.

Furthermore, Debunk has established partnerships with leading financial institutions and cryptocurrency exchanges, expanding its reach and accessibility. This collaboration has enabled users to easily convert their traditional currency into digital assets, providing them with a broader range of investment opportunities.

The adoption of Debunk has also been fueled by the growing demand for mobile banking solutions. The platform’s mobile app allows users to access their accounts on the go, providing them with convenience and flexibility. This has become particularly relevant in today’s fast-paced world, where people are constantly on the move and require instant access to their financial information.

Overall, the adoption of Debunk highlights the shift towards a more decentralized and technology-driven banking system. With its user-friendly interface, seamless integration of traditional banking services with blockchain technology, and partnerships with leading financial institutions, Debunk is positioned to revolutionize the future of banking.

Global trends in Debank adoption

As technology continues to evolve, the adoption of debanking is on the rise worldwide. Debank, a digital banking system that aims to revolutionize traditional banking, offers various benefits and has witnessed global trends in its adoption.

1. Increasing user base

The number of users embracing debank is growing rapidly across the globe. With its user-friendly interface and convenience, more and more individuals are opting for debank over traditional banks. The ease of accessing banking services from anywhere at any time has made debank a popular choice.

2. Expansion of Debank services

Debank is not limited to just basic banking services. It offers a wide array of financial services such as loans, investments, and even insurance. This expansion of services has attracted a diverse range of users, from individuals to small businesses to large corporations, further driving the global adoption of debank.

3. Enhancing financial inclusion

Debank has played a significant role in enhancing financial inclusion worldwide. Traditional banking services often have entry barriers and are not easily accessible for everyone. Debank, on the other hand, provides equal opportunities to individuals with limited access to traditional banks, thereby promoting financial inclusivity and bridging the gap between different socio-economic groups.

4. Seamless cross-border transactions

With the increasing globalization of businesses and individuals, cross-border transactions have become common. Debank offers a seamless and efficient way to make international payments and transfers. The adoption of debank has simplified cross-border financial transactions, reducing costs and ensuring faster processing times.

5. Embracing blockchain technology

Debank leverages the power of blockchain technology, which enhances security, transparency, and trust in financial transactions. The global adoption of blockchain has positively influenced the adoption of debank, as users recognize the potential of this technology to revolutionize traditional banking systems.

Overall, the global trends in debank adoption are indicative of the growing acceptance and recognition of the benefits it offers. As more individuals and businesses realize the potential of debank, its adoption is expected to continue increasing in the future.

FAQ:,

How is Debank changing the future of banking?

Debank is changing the future of banking by implementing innovative technologies such as blockchain and artificial intelligence. These technologies allow for faster and more secure transactions, as well as personalized banking experiences for customers.

What are the benefits of using Debank?

There are several benefits of using Debank. Firstly, it offers faster and more secure transactions due to its implementation of blockchain technology. Secondly, it provides personalized banking experiences by using artificial intelligence to understand and meet the specific needs of each customer. Lastly, Debank allows for easy access to financial services and products, making banking more convenient and accessible for everyone.