In today’s fast-paced world, banking has become an essential part of our lives. Whether it’s managing finances, making payments, or saving for the future, we all need a reliable and convenient banking solution. That’s where Debank comes in. Debank is revolutionizing the way we bank by providing a simple, user-friendly platform that caters to all our banking needs.

With Debank, you can say goodbye to the hassle of traditional banking. No more long queues, complex procedures, or hidden fees. Debank offers a streamlined experience, allowing you to manage your finances with ease. Whether you need to check your account balance, transfer funds, or pay bills, all you need is a few clicks on your computer or smartphone.

One of the key features that sets Debank apart is its emphasis on security. Your financial information is precious, and Debank understands that. That’s why they have implemented state-of-the-art security measures to ensure that your data is protected at all times. With Debank, you can have peace of mind knowing that your personal and financial information is in safe hands.

But that’s not all – Debank also offers a range of additional features to enhance your banking experience. From personalized financial insights to budgeting tools, Debank empowers you to make smarter financial decisions. Want to track your expenses? Debank has got you covered. Need help managing your investments? Debank has the right tools for you.

So, if you’re tired of the complexities and frustrations of traditional banking, it’s time to give Debank a try. Simplify your banking experience, and take control of your finances with Debank. Sign up today and discover a new way to bank.

The Future of Banking

The banking industry is undergoing a profound transformation, driven by rapid technological advancements and changing consumer expectations. Traditional brick-and-mortar banks are being challenged by innovative fintech companies that offer digital solutions and streamlined customer experiences. The future of banking lies in embracing technology to create a more convenient, secure, and efficient banking ecosystem.

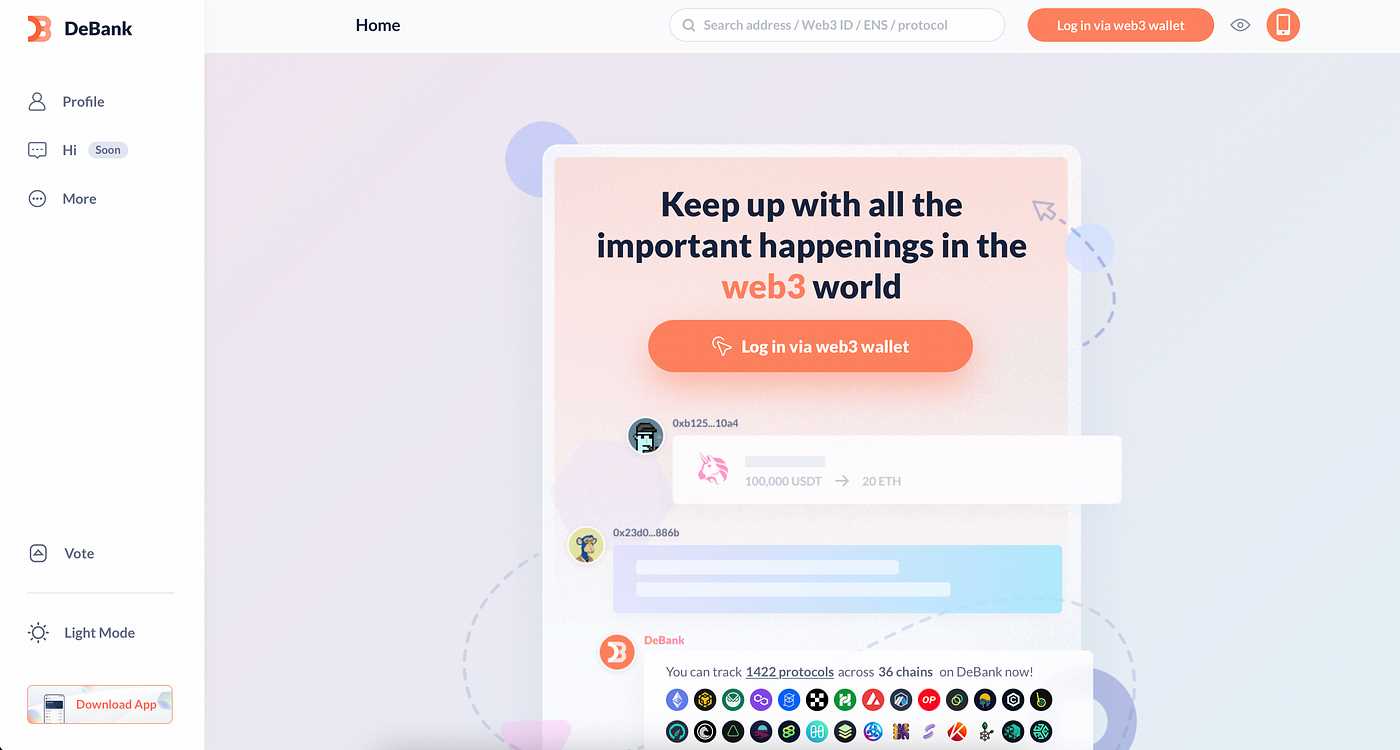

One of the key developments in the future of banking is the rise of cryptocurrencies and decentralized finance (DeFi). Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant popularity and acceptance, offering a decentralized and borderless digital currency system. DeFi platforms, like crypto debank, are leveraging blockchain technology to revolutionize various financial services, including lending, trading, and asset management.

Blockchain technology is poised to transform banking operations by enhancing security, transparency, and efficiency. With blockchain, transactions can be recorded and verified in a tamper-proof manner, eliminating the need for intermediaries and reducing the risk of fraud. This technology also enables faster cross-border transactions and reduces settlement times from days to minutes.

Furthermore, artificial intelligence and automation are playing an increasingly important role in the banking sector. AI-powered chatbots and virtual assistants are improving customer service by providing instant responses and personalized recommendations. Automation streamlines operational processes, reduces errors, and increases productivity.

Mobile banking and digital wallets are becoming the norm, allowing customers to manage their finances conveniently and securely from their smartphones. Biometric authentication methods, such as fingerprint and facial recognition, are replacing traditional passwords, enhancing security and user experience.

In conclusion, the future of banking is all about leveraging technology to create a seamless and customer-centric banking experience. The adoption of cryptocurrencies, blockchain, AI, and automation will revolutionize the way we bank. Whether it’s accessing financial services from the comfort of our homes or conducting instant cross-border transactions, the future of banking holds immense potential for innovation and convenience.

Key Features of Debank

Debank is a revolution in banking, offering a wide range of features that simplify banking and provide enhanced financial accessibility. Here are some of the key features of Debank:

|

1. Digital Wallet: Debank provides users with a secure and convenient digital wallet where they can store and manage their funds. This wallet allows users to make payments, track their expenses, and store receipts all in one place. It also offers seamless integration with other banking services, making it a convenient tool for managing personal finances. |

|

2. Instant Transfers: With Debank, users can enjoy instant transfers between different accounts and even across different banks. This feature eliminates the need for waiting times and costly transaction fees. Whether it’s paying a friend back for dinner or transferring money to a family member in need, Debank makes the process quick and hassle-free. |

|

3. Personalized Budgeting: Debank’s budgeting tools help users take control of their finances by providing personalized insights and recommendations. Users can set financial goals, track their spending habits, and receive notifications when they are approaching their budget limits. With Debank, managing your money becomes easier and more effective. |

|

4. Enhanced Security: Security is a top priority for Debank. The platform incorporates advanced encryption technology and multi-factor authentication to protect users’ financial information. Additionally, Debank constantly monitors for suspicious activities and provides real-time notifications to users, ensuring that their accounts are always secure. |

|

5. Intuitive User Interface: Debank’s user interface is designed to be intuitive and user-friendly. The platform offers a clean and organized layout, making it easy for users to navigate and find the information they need. Whether you’re a tech-savvy user or new to online banking, Debank provides a seamless experience for everyone. |

These are just a few of the key features that make Debank an innovative and reliable banking solution. With its focus on simplicity, security, and convenience, Debank is revolutionizing the way we bank.

Secure and Convenient

Debank offers a secure and convenient way to manage your banking needs. Our platform utilizes advanced encryption and authentication protocols to ensure the safety of your personal information and financial transactions.

With Debank, you can securely access your accounts, make payments, and transfer funds anytime, anywhere. Our system is designed to protect your sensitive data and prevent unauthorized access.

Our platform also provides a convenient user experience. With a user-friendly interface and intuitive navigation, you can easily view your account balances, transaction history, and other banking details. You can also set up alerts and notifications to keep track of your account activity.

In addition, Debank offers features like mobile banking and online bill payment, allowing you to manage your finances on the go. Our mobile app enables you to perform banking tasks from your smartphone or tablet, providing flexibility and convenience.

Advanced Security Measures

Debank prioritizes the security of your data. We employ industry-leading security measures, including secure socket layer (SSL) encryption and multi-factor authentication, to protect your information from hackers and cyber threats.

All data transmitted between your device and our servers is encrypted, ensuring that your personal and financial information remains confidential. Our system is regularly updated to incorporate the latest security technologies and protocols.

Easy-to-Use Interface

Debank understands the importance of simplicity and ease of use. Our platform features an intuitive interface that requires no technical expertise. Whether you are a beginner or an experienced user, you can quickly navigate through the platform and access the services you need.

We also provide step-by-step tutorials and helpful resources to guide you through the banking process. Our support team is available 24/7 to assist you with any questions or issues you may have.

Experience the security and convenience of Debank. Sign up today and simplify your banking experience!

Easy Account Setup

Setting up a bank account can sometimes be a complex and time-consuming process. However, with Debank, the account setup is made easy and hassle-free. Whether you are an individual or a business, you can take advantage of the simple steps to create your account.

Individual Account Setup

For individuals, opening a bank account with Debank is a breeze. All you need to do is follow these steps:

- Visit the Debank website and click on the “Open Account” button.

- Fill out the online application form with your personal information, such as your full name, date of birth, and contact details.

- Submit any necessary identification documents, such as your passport or driver’s license.

- Review and agree to the terms and conditions of the account.

- Confirm your account details and set up a username and password.

- Once your account is verified, you will receive a confirmation email, and you’re ready to start banking with Debank!

With these simple steps, individuals can quickly set up their bank account and enjoy the benefits of Debank’s user-friendly interface and streamlined services.

Business Account Setup

For businesses, Debank provides an equally simple process to set up an account. Here’s how:

- Visit the Debank website and click on the “Open Business Account” button.

- Complete the online application form with your business information, such as your company name, business address, and contact details.

- Submit any required business documentation, including your business registration certificate and tax identification number.

- Review and agree to the terms and conditions of the business account.

- Confirm your account details and set up a username and password.

- Once your account is verified, you will receive a confirmation email, and your business can start benefiting from Debank’s innovative banking solutions.

With Debank’s easy account setup process, businesses can quickly get started with managing their finances and accessing the wide range of tools and services available.

| Benefit | Individual Account | Business Account |

|---|---|---|

| Convenience | ✓ | ✓ |

| Efficiency | ✓ | ✓ |

| Simplicity | ✓ | ✓ |

Regardless of whether you’re an individual or business, Debank’s easy account setup process ensures that you can start managing your finances efficiently and securely in no time.

Mobile Banking Revolution

Mobile banking has completely revolutionized the way we manage our finances. With the advancement of technology, smartphones have become an integral part of our daily lives, and so has mobile banking. This convenient and accessible method of banking has made traditional banking practices seem outdated and time-consuming.

One of the main advantages of mobile banking is its convenience. Gone are the days when you had to physically visit a bank branch to perform basic transactions, such as checking your account balance or transferring funds. With mobile banking, you can now do all this and more with just a few taps on your smartphone. Whether you are at home, at work, or on the go, you can access your bank account anytime, anywhere.

Mobile banking also provides a higher level of security compared to traditional banking methods. Most banking apps have multiple layers of authentication, including biometric identification and secure login processes, ensuring that your personal and financial information remains safe and protected. In addition, you can easily monitor your account activity in real-time, receive instant notifications for any suspicious transactions, and take immediate action if required.

Furthermore, mobile banking offers a wide range of features and services that make managing your finances easier than ever before. From paying bills and making online purchases to setting up automatic savings and budgeting tools, mobile banking apps provide a comprehensive platform to handle all your financial needs. With just a few taps, you can easily stay on top of your finances and make informed decisions.

The mobile banking revolution has also paved the way for innovative fintech solutions like Debank. Debank is a revolutionary banking platform that simplifies banking even further. With Debank, you can link all your bank accounts, credit cards, and investments in one place, making it easier to track and manage your overall financial portfolio. It provides real-time insights and analytics, helping you make smarter financial decisions.

In conclusion, the mobile banking revolution has transformed the way we bank, making it easier, more convenient, and more secure. With a wide range of features and services, mobile banking has become an essential part of our daily lives. Coupled with innovative platforms like Debank, the future of banking looks bright and promising.

Efficient Money Management

Efficient money management is essential for individuals looking to gain control over their finances and achieve their financial goals. With the help of Debank, you can simplify the process and make it easier to manage your money effectively.

Track Your Spending

One of the key aspects of efficient money management is tracking your spending. Debank allows you to connect your bank accounts and automatically categorize your expenses. This gives you a clear overview of where your money is going and helps you identify areas where you can cut back.

Create a Budget

A budget is a powerful tool for managing your money. Debank provides you with the ability to create a personalized budget based on your income and expenses. You can set spending limits for different categories and track your progress in staying within those limits. This helps you prioritize your spending and avoid overspending.

Set Financial Goals

Efficient money management involves setting clear financial goals. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, Debank allows you to set your goals and track your progress. This keeps you motivated and focused on achieving your financial objectives.

Automate Your Savings

Saving money can be challenging, but Debank makes it easier by allowing you to automate your savings. You can set up recurring transfers from your checking account to a savings account, ensuring that you consistently save money every month. This helps you build up your savings over time without having to think about it.

Monitor Your Investments

If you’re investing your money, Debank provides you with a comprehensive overview of your investment portfolio. You can track the performance of your investments and monitor any changes in value. This helps you make informed decisions about your investments and adjust your strategy as needed.

Stay on Top of Bills and Payments

Efficient money management requires you to stay on top of your bills and payments. Debank helps you streamline this process by sending you reminders for upcoming due dates and allowing you to make payments directly from the app. This helps you avoid late fees and ensures that you stay on track with your financial obligations.

Protect Your Personal Information

With the increasing prevalence of online fraud and identity theft, it’s crucial to protect your personal information. Debank takes security seriously and employs advanced encryption and security measures to keep your data safe. This allows you to manage your money with peace of mind and focus on your financial goals.

In conclusion, efficient money management is key to taking control of your finances. With the help of Debank, you can simplify and streamline the process, making it easier to track your spending, create a budget, set financial goals, automate your savings, monitor your investments, stay on top of bills and payments, and protect your personal information.

Access to Multiple Financial Services

Debank provides users with access to a wide range of financial services, making it a one-stop solution for all your banking needs. With Debank, you can easily manage your accounts, transfer funds, pay bills, and even apply for loans all in one place.

By consolidating all your financial accounts into one platform, Debank simplifies your banking experience and eliminates the need to juggle multiple banking apps or websites. With just a few clicks, you can access all your accounts, view balances, and track transactions.

Debank also offers a secure and convenient way to transfer funds between different accounts. Whether you need to send money to a friend, pay a bill, or make a deposit, Debank makes it easy and hassle-free.

Additionally, Debank provides access to various loan options, including personal loans, mortgages, and business loans. With competitive interest rates and flexible repayment terms, Debank helps you find the best financing solution for your needs.

Furthermore, Debank offers features like budgeting tools, financial planning, and investment options, allowing you to better manage your finances and make informed decisions about your money.

With Debank’s access to multiple financial services, you no longer have to deal with the complexities of traditional banking. Whether you’re a seasoned investor or just starting on your financial journey, Debank has something for everyone.

Smart Budgeting Tools

Debank offers a range of smart budgeting tools to help you manage your finances effectively. These tools provide you with a clear overview of your income and expenses, allowing you to make informed financial decisions.

Expense tracking

With Debank’s expense tracking feature, you can easily monitor your spending habits. The tool categorizes your expenses automatically, making it easy for you to see where your money is going. Whether it’s groceries, dining out, or entertainment, you can track it all and gain valuable insights.

Goal setting and tracking

Setting financial goals is an essential part of budgeting, and Debank makes it easier than ever. You can set specific targets for saving or debt repayment and track your progress towards them. The tool provides visual representations of your goals, motivating you to stay on track and achieve financial success.

| Benefits of smart budgeting tools: |

|---|

| 1. Better financial awareness |

| 2. Improved spending habits |

| 3. Increased savings and debt reduction |

| 4. Clear visibility of income and expenses |

By leveraging Debank’s smart budgeting tools, you can take control of your financial future. Start budgeting smarter today and make your money work harder for you.

/7 Customer Support

At Debank, we prioritize providing excellent customer support to ensure the best banking experience for our users. Our dedicated support team is available 24/7 to assist you with any questions or concerns you may have.

If you need help with any aspect of our banking services, you can reach out to our customer support team via phone, email, or live chat. We have agents standing by around the clock to provide timely and efficient assistance.

Professional and Knowledgeable Staff

Our customer support team consists of highly trained professionals who are well-versed in all aspects of our banking platform. They possess in-depth knowledge of our services, features, and functionality, allowing them to provide accurate and helpful guidance.

Whether you have a technical issue, need assistance with a transaction, or have a general inquiry about our banking services, our support team is here to assist you. They will work diligently to address your concerns and provide the necessary solutions.

Fast Response Time

When you contact our customer support team, you can expect a fast response time. We understand the importance of prompt assistance, which is why we prioritize timely responses to ensure minimal disruptions to your banking experience.

Our support agents are trained to quickly assess and address your queries or concerns. They will strive to provide you with comprehensive and helpful solutions in a timely manner, allowing you to resume your banking activities without any delay.

Whether you have a question about your account balance, need help with a transaction, or require assistance with our digital banking services, our support team is ready to assist you promptly.

At Debank, we are committed to simplifying banking for our users. Our reliable and accessible 24/7 customer support ensures that you receive the assistance you need whenever you need it. Feel free to reach out to our support team anytime – we’re here to help!

Global Accessibility

Debank is committed to making banking services accessible to people around the world, regardless of their location or financial status. With our digital platform, customers can access their accounts and perform transactions from anywhere, at any time.

We offer multi-language support, ensuring that our services are available to individuals who speak different languages. Whether you speak English, Spanish, French, Mandarin, or any other language, you can easily navigate our platform and understand the information provided.

Furthermore, our user-friendly interface and intuitive design make it easy for individuals of all technological abilities to use our services. We prioritize accessibility features, such as keyboard navigation and screen reader compatibility, to ensure that everyone can access and use our platform.

In addition, Debank works with financial institutions around the globe to expand our reach and provide access to a wider range of banking services. Through partnerships with local banks, we aim to bring our simplified banking experience to individuals in regions where traditional banking services may be limited or inaccessible.

By prioritizing global accessibility, Debank is empowering individuals worldwide with the tools and resources they need to securely manage their finances. We believe that everyone should have equal opportunities to access banking services, and we’re working towards making that a reality.

Transforming the Banking Experience

Debank is revolutionizing the way we think about banking. With its innovative technology and user-friendly interface, it is transforming the banking experience for customers around the world.

Streamlined Processes

Gone are the days of waiting in long queues at the bank. Debank allows customers to conduct their banking transactions with just a few clicks. Whether it’s transferring funds, paying bills, or applying for a loan, Debank streamlines the process to save customers valuable time and effort.

With Debank, customers can access their accounts from anywhere, at any time. The user-friendly interface makes it easy to navigate through the various features and functionalities, ensuring a seamless and convenient banking experience.

Enhanced Security

Security is a top priority for Debank. The platform utilizes the latest encryption technology to protect customer information and transactions. From secure login processes to advanced data encryption, Debank ensures that customer data is safeguarded at all times.

Debank also offers additional security features, such as two-factor authentication and biometric login options, to further protect customer accounts. With these measures in place, customers can have peace of mind knowing that their banking experience is secure and protected.

| Benefits of Debank |

|---|

| Convenience |

| Accessibility |

| Efficiency |

| Security |

Debank is truly transforming the banking experience by providing customers with a convenient, accessible, and secure platform. With its streamlined processes and enhanced security measures, Debank is paving the way for a new era of banking.

Get Started with Debank Today

Debank is revolutionizing the banking industry by simplifying the banking process and making it easier for everyone to manage their finances. Whether you’re new to banking or a seasoned pro, here’s everything you need to know to get started with Debank today.

Create an Account

The first step in getting started with Debank is to create an account. Simply visit our website and click on the “Sign Up” button. You’ll be asked to provide some basic information, such as your name, email address, and password. Once you’ve filled out the form, click “Submit” and your account will be created.

Add Your Bank Accounts

After creating your account, the next step is to add your bank accounts. Debank supports a wide range of banks, so chances are you’ll be able to connect all of your accounts in one place. To add a bank account, simply click on the “Add Account” button and follow the prompts. You may be asked to provide your bank’s login credentials or answer security questions to verify your identity. Once your account is connected, you’ll be able to view your account balance, recent transactions, and more.

| Features | Benefits |

|---|---|

| Manage Finances | Track your income and expenses, set budgets, and gain insights into your spending habits. |

| Secure Transactions | Debank uses industry-leading security measures to protect your sensitive financial information. |

| Real-time Notifications | Receive instant alerts for important account activities, such as large transactions or low balances. |

With Debank, you can streamline your banking experience and have all of your financial information in one place. Sign up today and take control of your finances like never before!

FAQ:,

What is Debank and how does it simplify banking?

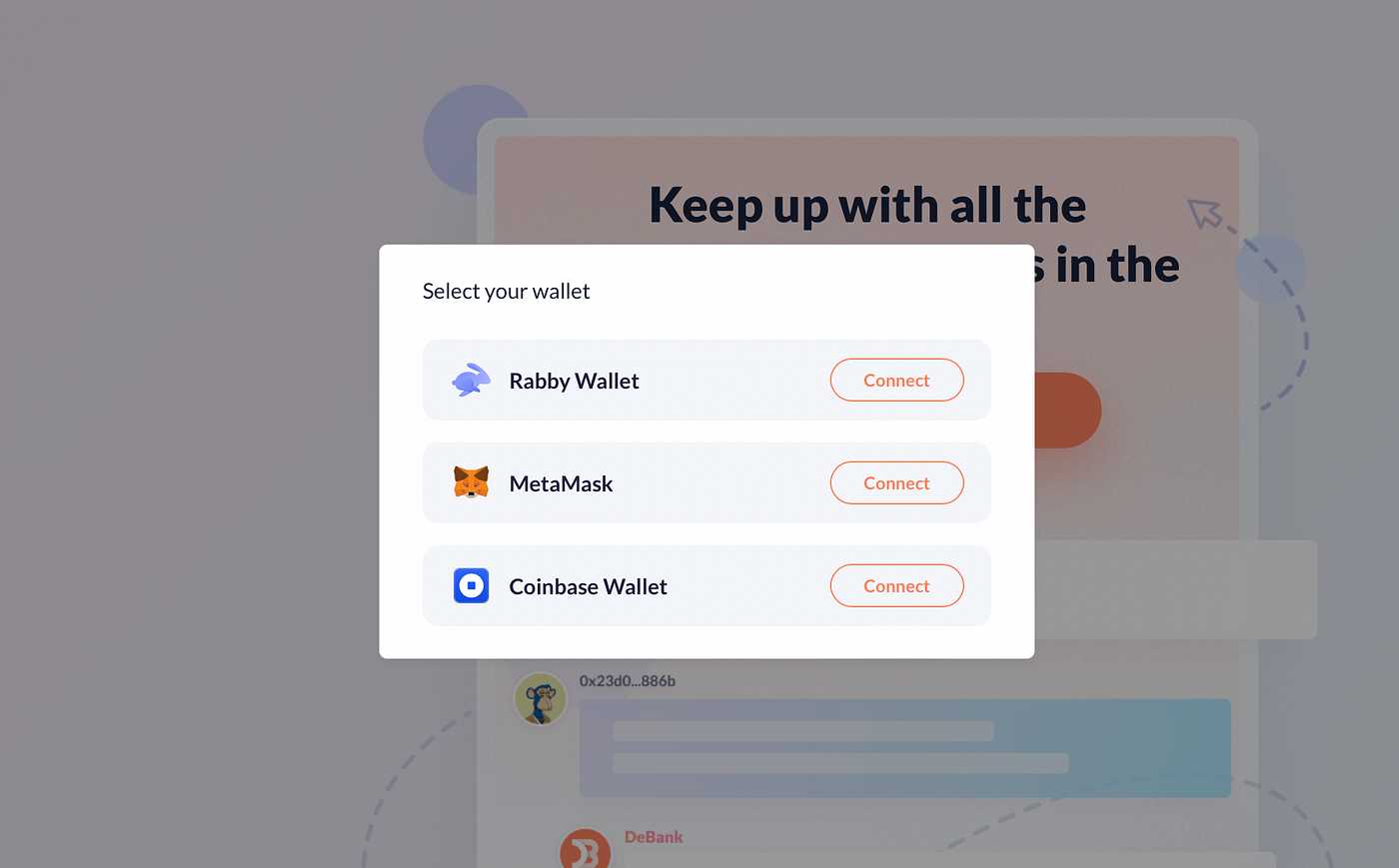

Debank is a blockchain-based platform that simplifies banking by providing a decentralized financial infrastructure. It allows users to manage their digital assets in one place, eliminating the need for multiple banking apps and platforms. Users can easily access and transact with their assets, track their financial history, and explore various DeFi opportunities.

What are the benefits of using Debank?

There are several benefits of using Debank. Firstly, it offers a simplified banking experience by consolidating all your digital assets in one place. Secondly, it provides greater control over your assets as it operates on a decentralized infrastructure. Lastly, Debank allows users to explore and participate in decentralized finance (DeFi) opportunities, providing potential for higher returns on investments.

Can I use Debank for traditional banking transactions?

No, Debank is not designed for traditional banking transactions. It focuses on simplifying digital asset management and providing access to decentralized finance opportunities. If you’re looking to perform traditional banking transactions, you should still rely on your regular banking apps or platforms.

Is Debank safe to use?

Debank is designed with security in mind. It utilizes blockchain technology, which provides a high level of security and transparency. However, it’s important for users to exercise caution and follow best security practices, such as enabling two-factor authentication and keeping their private keys secure. Additionally, it’s always advisable to do thorough research about any platform before using it to ensure its legitimacy and safety.