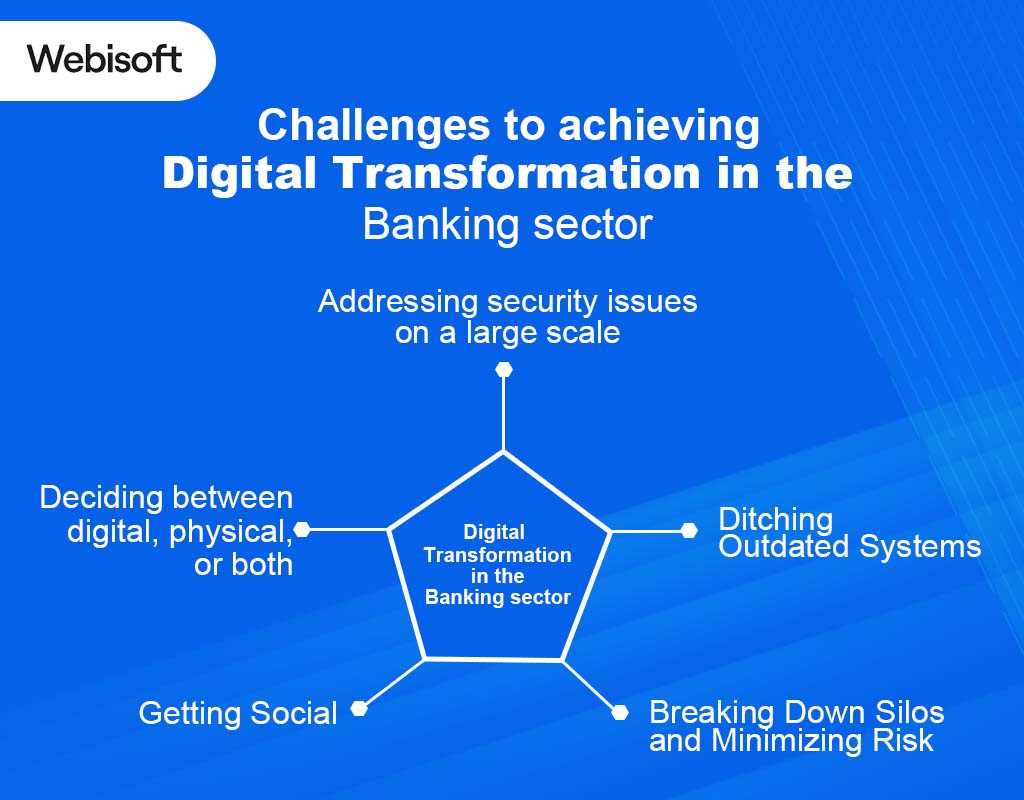

In today’s fast-paced and interconnected world, digital banking has become an essential part of our everyday lives. It offers convenience, accessibility, and real-time financial transactions at the touch of a button. However, along with these benefits, there are also certain weaknesses that digital banking systems face.

One of the main weaknesses is the potential for cyber threats and security breaches. As hackers become increasingly sophisticated, financial institutions need to invest in robust cybersecurity measures to protect their customers’ sensitive information. Implementing strong encryption protocols, multi-factor authentication, and regularly updating security software can help strengthen the shield against these threats.

Another weakness in digital banking is the lack of personal touch and human interaction. While technology has made banking more convenient, it has also taken away the personal connection between customers and their financial institutions. This can lead to a sense of detachment and mistrust. To overcome this weakness, banks should strive to provide personalized customer service and support through various channels, such as online chatbots or dedicated customer service representatives.

Furthermore, digital banking systems are often susceptible to technological glitches and system failures. These can disrupt vital financial services and cause inconvenience to customers. Banks need to invest in robust infrastructure and regularly test their systems to ensure they can handle the increasing volume of digital transactions. Additionally, backup plans and alternative channels should be in place to minimize disruptions and provide seamless banking services.

In conclusion, while digital banking offers numerous advantages, it is not without its weaknesses. By focusing on cybersecurity, enhancing customer support, and investing in robust infrastructure, financial institutions can strengthen the shield and overcome these weaknesses. It is crucial to prioritize the protection of customer data, restore personal touch, and ensure a seamless banking experience in the digital era.

Digital Banking: The Future of Financial Services

Technology continues to revolutionize the way we live, work, and interact with the world around us. One area that has seen significant transformation is the financial sector, with the rise of digital banking.

Digital banking refers to the use of technology to provide banking services to customers. This includes online banking, mobile banking, and other digital platforms that allow individuals to manage their finances wherever and whenever they want.

With the rapid pace of technological advancements, digital banking is quickly becoming the future of financial services. It offers numerous advantages over traditional banking methods, making it increasingly popular among consumers.

One of the key benefits of digital banking is convenience. With a few clicks or taps, customers can access their accounts, make transactions, and even apply for loans or credit cards. There is no need to visit a physical branch or wait in long queues, as everything can be done from the comfort of one’s home or on the go.

Moreover, digital banking provides enhanced security measures to protect customers’ financial information. Advanced encryption techniques, user authentication methods, and real-time monitoring systems help safeguard sensitive data and prevent fraud.

Another advantage of digital banking is the ability to personalize and tailor financial services to individual needs. Through data analysis and artificial intelligence, banks can offer personalized recommendations, budgeting tools, and financial advice to help customers make informed decisions.

The future of digital banking looks promising, with the integration of emerging technologies such as blockchain and decentralized finance (DeFi). These technologies have the potential to revolutionize financial services by enabling secure, transparent, and efficient transactions.

For example, DeFi Portfolio debank is a platform that allows users to manage their decentralized finance assets in one place. It offers a range of features, including portfolio tracking, yield farming analytics, and risk assessment tools.

In conclusion, digital banking is reshaping the financial services industry. Its convenience, security, and personalized approach make it an attractive option for consumers. As technology continues to advance, the future of banking will undoubtedly be digital.

Understanding the Vulnerabilities

In the fast-paced digital world, where technology has become an integral part of our everyday lives, the rise of digital banking has brought about many conveniences and advantages. However, it has also opened up new vulnerabilities and risks that need to be understood in order to strengthen the security shield.

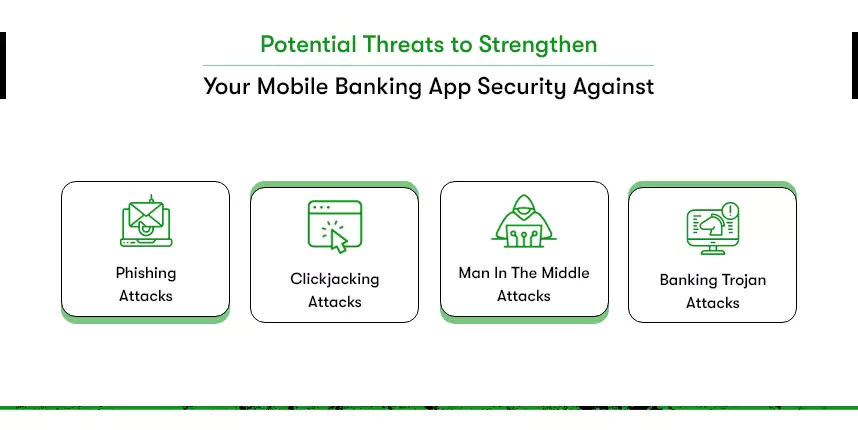

1. Phishing Attacks

Phishing attacks are one of the most common vulnerabilities in digital banking. Cybercriminals try to trick users into providing sensitive information such as usernames, passwords, and credit card details by masquerading as trustworthy entities. These attacks often occur through fraudulent emails, text messages, or phone calls.

2. Malware and Ransomware

Malware and ransomware pose a significant threat to digital banking systems. Malicious software can be used to steal sensitive information or gain unauthorized access to banking platforms. Ransomware, on the other hand, can encrypt user data and demand a ransom for its release, causing significant financial and reputational damage.

3. Weak Passwords

Weak passwords are another vulnerability that can be exploited by cybercriminals. Users often choose easily guessable passwords or reuse the same password across multiple platforms, making it easier for hackers to gain unauthorized access. Strong password policies and educating users on best practices can help mitigate this vulnerability.

4. Social Engineering

Social engineering is a technique used by cybercriminals to manipulate individuals into divulging sensitive information or performing actions that could compromise security. This can include impersonating trusted individuals, deceiving users into clicking on malicious links, or tricking them into providing login credentials.

5. Insider Threats

Insider threats refer to the risk posed by individuals with legitimate access to banking systems who may intentionally or unintentionally cause harm. This can include employees, contractors, or other individuals with authorized access who misuse their privileges, leak sensitive information, or engage in fraudulent activities.

Understanding these vulnerabilities is crucial in developing strategies to strengthen the shield of digital banking. By implementing robust security measures, educating users on best practices, and continuously monitoring for threats, banks can minimize the risks and provide a secure and seamless banking experience for their customers.

Cybersecurity Threats in the Digital Banking Environment

As digital banking continues to gain popularity, so do the cybersecurity threats that target this industry. Financial institutions find themselves vulnerable to various types of attacks, ranging from phishing scams to sophisticated hacking techniques. It is imperative for banks to understand these threats and implement robust security measures to safeguard their customers’ sensitive information and financial assets.

1. Phishing Attacks

One of the most common cybersecurity threats faced by digital banks is phishing attacks. Hackers send fraudulent emails or text messages, posing as legitimate financial institutions, with the intention of tricking recipients into revealing their personal information. These attacks can be highly effective as they exploit human vulnerabilities and deceive customers into sharing their login credentials or other sensitive data.

2. Malware and Ransomware

Malware and ransomware are significant threats to digital banking operations. Cybercriminals can use malicious software to gain unauthorized access to a bank’s network or infect customers’ devices, giving them control over sensitive data. Ransomware attacks can encrypt data, rendering it inaccessible, and demand a ransom for its release. This can severely disrupt banking operations and lead to financial losses.

3. Data Breaches

Data breaches pose a serious threat to digital banking institutions and their customers. Hackers target vulnerabilities in a bank’s network infrastructure, exploiting weaknesses in security protocols or gaining access through compromised employee accounts. Once inside, they can access and steal large amounts of customer data, including personal and financial information. This can lead to identity theft, financial fraud, and reputational damage.

4. Insider Threats

Insider threats refer to malicious activities initiated by individuals within an organization. In the digital banking environment, these threats can come from disgruntled employees or those with ill intent. Insider threats can involve the unauthorized release of sensitive customer data, tampering with systems or transactions, or providing access to external entities. Banks must implement strict access controls, monitoring systems, and employee training to mitigate the risk of insider threats.

5. Social Engineering

Social engineering attacks exploit human psychology to manipulate individuals into divulging sensitive information or taking certain actions. In the digital banking environment, this can involve tricking customers into revealing their usernames, passwords, or other personal details through phone calls, emails, or fake websites. It is crucial for banks to educate customers about the risks of social engineering and provide clear guidelines on how to identify and report such attempts.

In conclusion, the digital banking environment is susceptible to a range of cybersecurity threats. Understanding and mitigating these threats is essential for banks to maintain the trust of their customers and ensure the security of their financial transactions. By implementing robust security measures, investing in advanced technologies, and fostering a cybersecurity-conscious culture, banks can strengthen their defenses and protect themselves and their customers from cyber attacks.

Protecting User Data: Best Practices for Digital Banks

In today’s digital age, where banking transactions are increasingly conducted online, it is crucial for digital banks to prioritize the protection of user data. Cybersecurity and data breaches pose significant risks to both the reputation and financial well-being of users. To mitigate these risks, digital banks must employ best practices to safeguard user data.

Establishing Strong Authentication Measures

One of the fundamental steps in protecting user data is to implement robust authentication measures. Digital banks should require users to authenticate themselves using multifactor authentication methods. This ensures that user data remains secure even if one factor (such as a password) is compromised.

Encrypting User Data

Encryption is a key practice that digital banks should adopt to protect user data. By encrypting user data at rest and in transit, digital banks can ensure that even if the data is intercepted, it remains unreadable to unauthorized parties. Implementing strong encryption algorithms is essential to safeguard user data from potential breaches.

Regularly Updating Security Measures

Digital banks should constantly update their security measures to keep up with evolving cyber threats. This includes promptly patching any vulnerabilities discovered in their systems and implementing the latest security protocols. Regular security audits can also help identify and address any weaknesses in the security infrastructure.

Educating Users about Security Best Practices

While digital banks have a responsibility to protect user data, users themselves play a vital role in ensuring their own security. Digital banks should educate their users about security best practices, such as the importance of strong, unique passwords and the risks associated with sharing personal information online. By empowering users with knowledge, digital banks can collectively strengthen the security of their platforms.

- Implement multifactor authentication methods

- Encrypt user data at rest and in transit

- Regularly update security measures and patch vulnerabilities

- Educate users about security best practices

By following these best practices, digital banks can enhance the security of user data and build trust with their customers. By investing in robust security measures and staying vigilant against emerging threats, digital banks can create a secure environment for users to manage their finances online.

Utilizing Advanced Encryption Methods

Ensuring that digital banking platforms remain secure is a top priority for financial institutions. One of the key ways to strengthen the shield against potential vulnerabilities is by utilizing advanced encryption methods.

Encryption is the process of converting sensitive information into a code that is unreadable without the decryption key. Advanced encryption methods use complex algorithms to ensure that data transferred between a user’s device and the banking platform is secure and protected from unauthorized access.

There are several advanced encryption methods that can be employed by digital banking platforms:

1. Symmetric Key Encryption

Symmetric key encryption uses the same key for both the encryption and decryption processes. This method is commonly used for encrypting large amounts of data quickly. However, the key must be securely shared between the sender and receiver.

2. Asymmetric Key Encryption

Asymmetric key encryption, also known as public-key encryption, uses separate keys for encryption and decryption. The encryption key is publicly accessible, while the decryption key is kept private. This method eliminates the need for securely sharing a key but can be computationally more intensive.

By utilizing a combination of symmetric and asymmetric key encryption, digital banking platforms can provide a strong defense against potential security breaches.

Additional layers of security can also be added through the use of hash functions, which convert data into a fixed-length string of characters. These hash functions ensure the integrity of data by generating a unique hash value for each piece of information. In the event of any tampering, the hash value will change, alerting both the user and the banking platform.

Furthermore, digital banking platforms can also implement multi-factor authentication, requiring users to provide additional forms of identification, such as a fingerprint or one-time password, to access their accounts. This adds an extra layer of security, making it more difficult for unauthorized individuals to gain access to sensitive information.

Overall, by utilizing advanced encryption methods, digital banking platforms can significantly enhance their security capabilities and better protect user information from potential vulnerabilities.

Implementing Multi-factor Authentication

In order to overcome the weaknesses in digital banking and strengthen the overall security, implementing multi-factor authentication (MFA) is a crucial step. MFA adds an extra layer of security by requiring users to provide multiple forms of identification before accessing their accounts.

What is Multi-factor Authentication?

Multi-factor authentication is a security measure that requires users to provide two or more types of identification to verify their identity. These factors typically include something the user knows (such as a password or PIN), something the user has (such as a mobile device or smart card), or something the user is (such as a fingerprint or facial recognition).

How does Multi-factor Authentication work?

When a user attempts to access their digital banking account, they are prompted to enter their username and password as the first factor of authentication. Once this information is verified, they are then required to provide an additional form of identification. This could be a one-time password sent to their mobile device, a fingerprint scan, or answering security questions.

MFA is particularly effective in preventing unauthorized access to digital banking accounts as it adds an extra layer of security. Even if a hacker manages to obtain a user’s password, they will still be unable to access the account without the additional factor of authentication.

Benefits of Multi-factor Authentication in Digital Banking:

1. Enhanced Security: MFA significantly reduces the risk of unauthorized access and protects sensitive customer data.

2. Improved User Experience: While adding an extra step in the authentication process, MFA also reassures the users that their accounts are well-protected, increasing their trust in the digital banking platform.

3. Compliance with Regulations: Implementing MFA helps financial institutions comply with industry regulations and standards regarding data security and customer authentication.

Conclusion

Multi-factor authentication is an essential security measure for digital banking platforms. By implementing MFA, financial institutions can strengthen their security systems, protect customer accounts, and enhance their overall reputation. Users can feel more confident that their personal and financial information is well-protected, resulting in increased trust and loyalty.

Building a Robust Fraud Detection System

The rise of digital banking has brought significant advantages for both consumers and financial institutions. However, it has also opened up new opportunities for fraudulent activities. To protect themselves and their customers, banks need to establish a robust fraud detection system that can identify and prevent fraudulent transactions.

Data Collection and Analysis

Building a robust fraud detection system starts with collecting and analyzing data. Banks need to gather information about customer transactions, account activities, and user behavior patterns. This data can help in identifying suspicious activities and patterns that may indicate fraud.

Advanced analytics techniques, such as machine learning and artificial intelligence, can be employed to detect anomalies and deviations from normal behavior. By analyzing historical data, the system can learn what constitutes normal activity and flag any deviations as potential fraudulent actions.

Real-time Monitoring and Alerts

To effectively detect and prevent fraud, the system should be capable of monitoring transactions in real-time. Using real-time monitoring, the system can analyze each transaction as it occurs and compare it against known fraud patterns and rules.

When a potentially fraudulent transaction is identified, the system should generate an alert to notify the bank’s fraud detection team. These alerts can be triggered by various factors, such as suspicious transaction amounts, unusual geolocation, or multiple transactions within a short period of time.

- Real-time monitoring allows for immediate action to be taken to block or investigate potentially fraudulent transactions, minimizing the impact on customers and the bank.

- It is important to continuously update and refine fraud patterns and rules based on new data and emerging fraud tactics to stay ahead of fraudsters.

Fraud Prevention Measures

In addition to detection, a robust fraud detection system should also include prevention measures. These measures can include multi-factor authentication, transaction verification, and limits on transaction amounts.

By implementing multi-factor authentication, banks can add an extra layer of security to verify the identity of customers. This can involve the use of biometrics, one-time passwords, or device verification.

Transaction verification can be performed through various methods, such as SMS alerts, email confirmations, or push notifications. This helps ensure that customers are aware of and can confirm the validity of their transactions, reducing the likelihood of fraudulent activity.

Setting transaction limits can also help prevent fraud by placing restrictions on the maximum amount that can be transacted within a certain time frame. This can help mitigate the impact of potential fraudulent transactions and provide an additional layer of protection.

In conclusion, building a robust fraud detection system is crucial for banks to combat the increasing threat of digital fraud. By collecting and analyzing data, monitoring transactions in real-time, and implementing prevention measures, banks can protect themselves and their customers from financial losses and maintain trust in the digital banking ecosystem.

Educating Customers on Online Security

One of the most crucial aspects of strengthening the shield in digital banking is educating customers on online security. With the increasing prevalence of cyber threats and the sophistication of hackers, it is imperative that customers are aware of the potential risks and take proactive measures to protect themselves.

The Importance of Online Security Awareness

Many customers are unaware of the various threats that exist in the digital banking landscape. They may not realize that their personal and financial information is at risk every time they access their accounts online or make transactions. By educating customers on the importance of online security, banks can empower them to take necessary precautions and avoid falling victim to scams, phishing attacks, and other fraudulent activities.

Best Practices for Online Security

When educating customers on online security, it is essential to emphasize best practices that can help protect their digital assets. Some key recommendations include:

| Best Practice | Description |

|---|---|

| Use strong, unique passwords | Encourage customers to create complex passwords that are not easily guessable. It is also important to stress the importance of using a different password for each online account. |

| Enable two-factor authentication | Explain the benefits of two-factor authentication, which adds an extra layer of security by requiring a second form of verification, such as a unique code sent to a mobile device, in addition to a password. |

| Be cautious of phishing attempts | Warn customers about the dangers of phishing emails, texts, and phone calls that attempt to trick them into revealing sensitive information. Advise them to always verify the source before clicking on any links or providing personal data. |

| Regularly update security software | Highlight the importance of keeping devices and security software up-to-date to protect against the latest threats and vulnerabilities. |

| Monitor accounts regularly | Encourage customers to frequently review their account activity and report any suspicious transactions or unauthorized access immediately. |

By equipping customers with the knowledge and tools to protect themselves, banks can strengthen the overall security of their digital platforms and build trust with their customers.

Collaboration with Law Enforcement Agencies

One of the key strategies for strengthening the shield in digital banking is effective collaboration with law enforcement agencies. In an era of increasing cyber threats and financial crimes, close cooperation between banks and law enforcement is crucial to ensuring the security and integrity of digital banking systems.

Information Sharing

The foundation of collaboration with law enforcement agencies lies in the sharing of information. Banks and financial institutions possess valuable insights into the latest cyber threats and fraudulent activities. By sharing this information with law enforcement agencies, both parties can gain a better understanding of the evolving tactics used by cybercriminals and work together to develop strategies to combat them.

Regular and timely information sharing can help law enforcement agencies stay ahead of cybercriminals, identify patterns of criminal activity, and take proactive measures to prevent financial crimes. It also enables banks to enhance their own security measures and better protect their customers.

Joint Investigations

Collaboration with law enforcement agencies extends beyond information sharing to joint investigations. When a cyberattack or a financial crime occurs, banks and law enforcement can work together to investigate the incident, gather evidence, and identify the perpetrators.

By combining their expertise and resources, banks and law enforcement agencies can accelerate the investigation process and increase the chances of apprehending cybercriminals. Joint investigations also send a strong message to potential criminals that the digital banking industry is united in its efforts to combat cyber threats and financial crimes.

Training and Education

Another important aspect of collaboration with law enforcement agencies is training and education. Banks can help train law enforcement personnel on the latest trends in digital banking, common attack techniques, and methods to detect and prevent financial crimes.

Conversely, law enforcement agencies can provide banks with insights into the legal and regulatory frameworks governing financial crimes. This exchange of knowledge and expertise ensures that both parties are well-equipped to respond effectively to cyber threats and financial crimes.

- Promote stronger partnerships between banks and law enforcement agencies;

- Enable proactive measures to prevent financial crimes;

- Accelerate investigations and increase chances of apprehending cybercriminals;

- Enhance knowledge and expertise in digital banking security.

In conclusion, collaboration with law enforcement agencies is essential for strengthening the shield in digital banking. By sharing information, conducting joint investigations, and fostering training and education, banks and law enforcement can work together to protect the integrity of digital banking systems and ensure the safety of customers’ financial transactions.

Strengthening Internal Controls

Effective internal controls are critical for ensuring the security and integrity of digital banking systems. These controls help mitigate risks and prevent fraudulent activities, providing a strong shield against potential threats. Here are some strategies to strengthen internal controls:

- Implement a Segregation of Duties framework: By separating critical functions and assigning them to different individuals, banks can reduce the risk of unauthorized access and collusion.

- Establish clear approval and authorization processes: Clearly defining the steps required for approving and authorizing transactions can prevent unauthorized activities and ensure accountability.

- Regularly review and update access rights: Conduct periodic reviews of user access rights to ensure that individuals have the appropriate level of access according to their roles and responsibilities.

- Monitor and analyze system logs: Regularly reviewing system logs can help identify any suspicious activities, allowing banks to take immediate action and prevent potential security breaches.

- Implement multi-factor authentication: Using multiple authentication factors, such as passwords, tokens, or biometrics, can enhance security by adding an extra layer of protection against unauthorized access.

- Establish an Incident Response Plan: Having a well-defined plan in place for responding to security incidents can help minimize the impact and recovery time in the event of a breach.

By implementing these strategies, banks can strengthen their internal controls and reduce the vulnerabilities in their digital banking systems. This will not only protect their customers’ financial information but also enhance their reputation as a trusted financial institution.

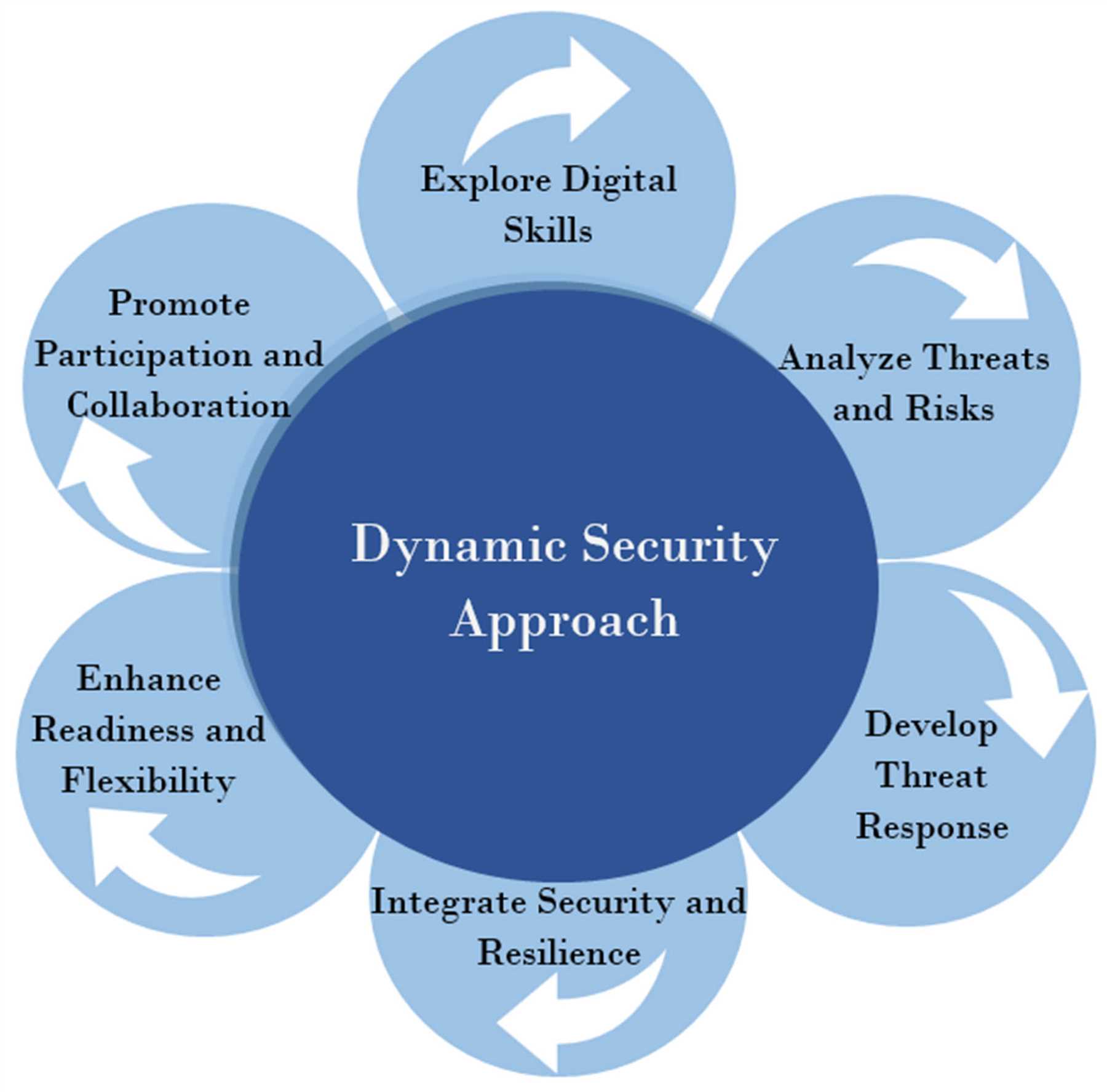

Regularly Assessing and Updating Security Measures

Ensuring the security of digital banking systems is an ongoing task that requires constant monitoring and updating. As cyber threats continue to evolve and become more sophisticated, it is crucial for financial institutions to regularly assess their security measures to detect and address any vulnerabilities.

Regular security assessments involve conducting comprehensive audits of the existing systems and networks to identify potential weaknesses. This process helps to ensure that all security controls and protocols are up to date and effective in defending against emerging threats.

Updating security measures is equally important as technology advances and new vulnerabilities are discovered. This includes implementing the latest security patches and updates provided by software vendors, as well as adopting advanced security technologies and solutions.

Financial institutions should also prioritize employee training and awareness programs to educate staff about the latest security threats and best practices. This can help prevent common human errors that can lead to security breaches, such as falling victim to phishing scams or using weak passwords.

In addition to internal assessments, financial institutions should also engage third-party security experts to perform external evaluations. These experts can provide an unbiased review of the bank’s security measures and identify any potential weaknesses that may have been overlooked.

By regularly assessing and updating security measures, financial institutions can stay one step ahead of cybercriminals and protect their customers’ sensitive data. This proactive approach is essential in the ever-changing digital landscape to ensure the strength and effectiveness of the bank’s security shield.

Investing in AI and Machine Learning Technologies

As the digital banking ecosystem continues to evolve, financial institutions must invest in cutting-edge technologies to strengthen their defenses against cyber threats and improve the overall customer experience. One technology that has gained significant traction in recent years is Artificial Intelligence (AI) and Machine Learning.

Enhanced Security

AI and Machine Learning technologies can significantly enhance the security of digital banking platforms by detecting and responding to potential threats in real-time. These technologies can analyze vast amounts of data to identify patterns and anomalies, enabling banks to proactively identify and prevent fraudulent activities.

By continuously learning from new data and detecting emerging patterns, AI-powered systems can evolve and adapt to changing cybersecurity risks. This proactive approach to security significantly reduces the risk of unauthorized access, data breaches, and other cyber threats.

Improved Customer Experience

In addition to enhanced security, AI and Machine Learning technologies can also improve the overall customer experience in digital banking. These technologies can analyze customer data to personalize and streamline the banking experience.

AI-powered chatbots can handle customer queries and provide instant support, reducing wait times and improving customer satisfaction. Machine Learning algorithms can analyze customer behavior and preferences to offer tailored product recommendations or personalized financial advice.

Furthermore, AI and Machine Learning can automate routine processes, such as loan approval or fraud detection, making banking transactions faster and more convenient for customers.

Investing in AI and Machine Learning technologies is crucial for financial institutions to stay ahead in the digital banking landscape. These technologies not only strengthen the security of digital platforms but also enhance the customer experience, ultimately leading to increased customer loyalty and satisfaction.

The Role of Regulatory Bodies in Ensuring Digital Banking Security

As the digital banking industry continues to grow and evolve, so do the risks and vulnerabilities associated with it. This is where regulatory bodies play a crucial role in ensuring the security of digital banking platforms.

Regulatory bodies are responsible for setting and enforcing standards and guidelines that financial institutions must follow to protect the interests of their customers. They work closely with banks and other financial institutions to establish best practices and ensure compliance with industry regulations.

Setting Security Standards

One of the main responsibilities of regulatory bodies is to set security standards for digital banking platforms. These standards help ensure that banks have robust security measures in place to protect against cyber threats, such as data breaches and identity theft.

Regulatory bodies collaborate with cybersecurity experts to develop guidelines that address the evolving nature of cyber threats. They assess the risks faced by digital banks and establish protocols that banks must adhere to in order to safeguard customer data and financial transactions.

Enforcing Compliance

Another crucial role of regulatory bodies is enforcing compliance with security standards. They conduct regular audits and assessments to ensure that banks are implementing the necessary security measures and following the established guidelines.

In cases where banks fail to meet the required standards, regulatory bodies have the authority to impose penalties and sanctions. This serves as a deterrent for financial institutions to neglect their security responsibilities and encourages them to continuously improve their security protocols.

It is essential for regulatory bodies to stay updated with the latest cyber threats and technological advancements to effectively regulate the digital banking industry.

Collaboration with Industry Stakeholders

Regulatory bodies work closely with industry stakeholders, such as banks, cybersecurity firms, and government agencies, to share information and collaborate on security initiatives. This collaboration helps in identifying new threats and developing effective strategies to mitigate them.

Furthermore, regulatory bodies foster transparency and trust by providing regular updates on the security measures implemented by banks. This allows customers to make informed decisions when choosing a digital banking provider and helps maintain the integrity of the digital banking ecosystem.

In conclusion, regulatory bodies play a vital role in ensuring the security of digital banking platforms. By setting and enforcing security standards, collaborating with industry stakeholders, and staying proactive in addressing emerging threats, they help build a robust and secure digital banking environment.

FAQ:,

What are the main weaknesses in digital banking?

The main weaknesses in digital banking include vulnerabilities in online security, risk of data breaches and identity theft, limited customer support options, and concerns over privacy and data protection.

How can digital banking overcome the weaknesses in online security?

Digital banking can overcome online security weaknesses by implementing strong authentication measures such as two-factor authentication, using encrypted communications and secure infrastructure, regularly updating security software, and educating customers about phishing and other cyber threats.

What are the potential risks of data breaches and identity theft in digital banking?

The potential risks of data breaches and identity theft in digital banking include unauthorized access to customer’s personal and financial information, fraudulent transactions, identity theft, and reputational damage to both customers and banks.

How can digital banking address customer support concerns?

Digital banking can address customer support concerns by providing various channels for assistance, such as online chat, email, and phone support. Banks can also invest in chatbots and virtual assistants to provide instant help and support to customers.