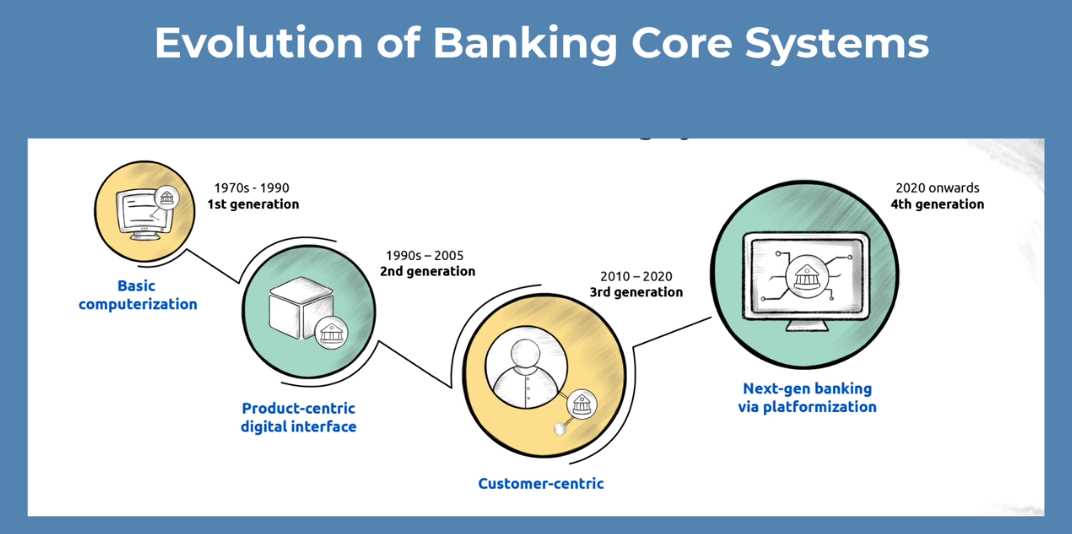

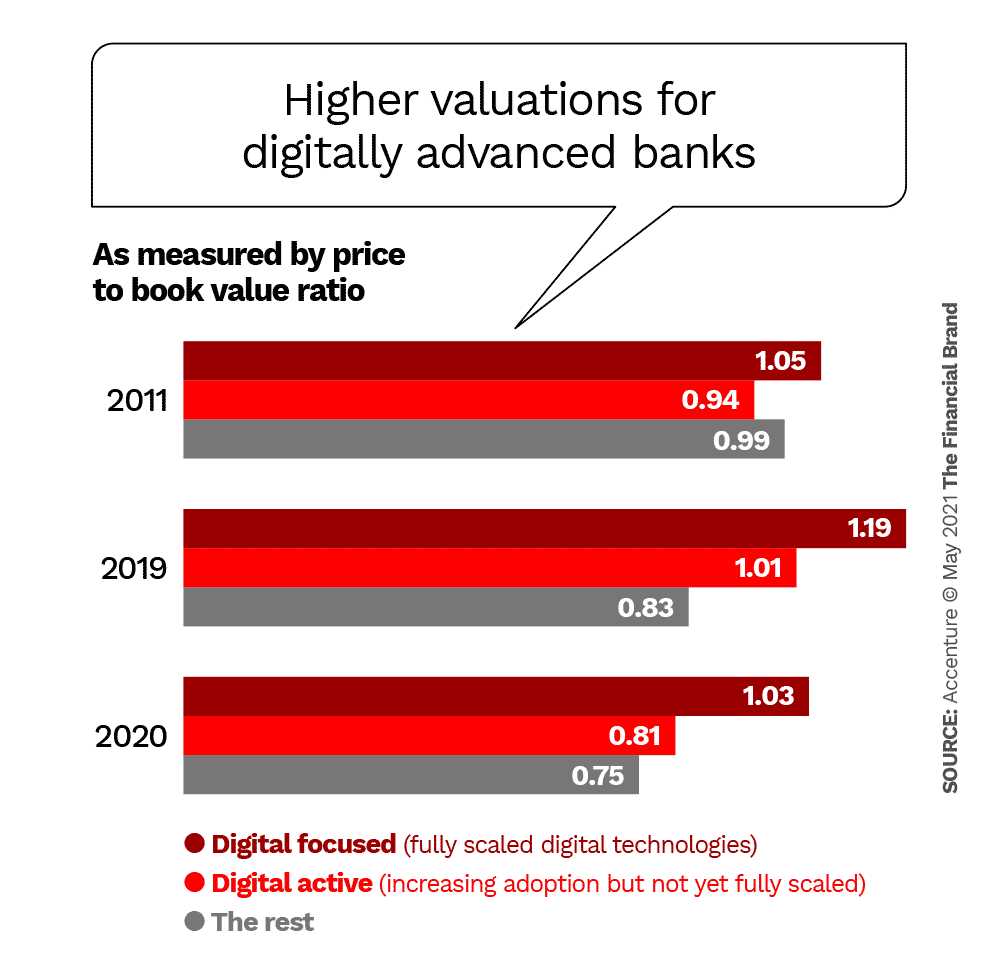

In an increasingly digitized world, digital banking systems have become the backbone of modern financial services. From accessing accounts to making transactions, these systems offer convenience and efficiency to millions of users worldwide. However, beneath the shiny surface lies a vulnerable underbelly that threatens the security and integrity of these platforms.

With cybercrime on the rise, it is imperative to scrutinize the weaknesses that exist within digital banking systems. The Achilles’ Heel of DeBank refers to the specific vulnerabilities that can be exploited by malicious actors to gain unauthorized access, steal sensitive information, or disrupt the functioning of these systems.

One of the primary weaknesses lies in the authentication process used by digital banking systems. While passwords are commonly used as a means of verifying user identity, they are not foolproof. Weak or reused passwords, coupled with the prevalence of social engineering techniques, create opportunities for attackers to bypass authentication protocols and gain unauthorized access to accounts.

Another vulnerability stems from the infiltration of malware and phishing attacks. Sophisticated malware can infect users’ devices and steal their banking credentials, compromising the security of their accounts. Phishing attacks, on the other hand, trick users into revealing their login information through deceptive emails or websites designed to mimic legitimate banking platforms.

The Risks of Digital Banking Systems: Uncovering the Vulnerabilities in DeBank

While digital banking systems such as DeBank provide convenience and accessibility to users, they also come with inherent risks and vulnerabilities. It is important for users to be aware of these risks in order to protect their financial information and assets.

One of the main vulnerabilities in digital banking systems is the potential for cyber attacks. Hackers are constantly developing new methods to exploit weaknesses and gain unauthorized access to sensitive data. This puts both the bank and its customers at risk of financial fraud and identity theft.

Another vulnerability is the reliance on technology and infrastructure. Digital banking systems require a stable and secure technological infrastructure to function properly. Any disruption or failure in the system could potentially cause inconvenience to customers and result in financial losses.

Additionally, the use of mobile devices for digital banking introduces another layer of vulnerability. Mobile devices are more susceptible to loss or theft, and if not properly secured, can provide easy access for unauthorized individuals to user accounts and information.

Furthermore, social engineering attacks pose a significant risk to digital banking systems. Phishing emails, fraudulent websites, and other tactics are used by cyber criminals to trick users into revealing their login credentials or personal information. These attacks can easily go unnoticed and lead to financial loss.

It is essential for users to stay informed and take necessary precautions to mitigate these risks. This can include regularly updating passwords, installing security software on devices, and being cautious about sharing personal information online. Banks also have a responsibility to invest in robust security measures and educate their customers about potential risks and best practices.

In conclusion, while digital banking systems offer many benefits, it is important to understand and address the vulnerabilities they present. By being aware of the risks and taking appropriate actions to protect oneself, users can safely enjoy the convenience of online banking. To learn more about DeBank’s security measures, visit How to get debank.

Security Concerns in Digital Banking

In today’s increasingly digitized world, digital banking has become the norm for many individuals and businesses. While the convenience and ease of use of digital banking systems cannot be denied, it is important to be aware of the security concerns that come with this technology. This article highlights some of the key security risks associated with digital banking and offers suggestions to mitigate them.

1. Unauthorized Access

One of the major concerns in digital banking is unauthorized access to accounts and sensitive information. Hackers and cybercriminals employ various techniques such as phishing, malware, and password cracking to gain unauthorized access. Once they gain access, they can steal funds, manipulate transactions, and even commit identity theft.

To mitigate this risk, it is crucial for banks and customers to implement strong authentication measures. Two-factor authentication, biometrics, and secure password practices can help ensure that only authorized individuals can access the digital banking system.

2. Data Breaches

Data breaches pose a significant threat to digital banking systems. Cybercriminals target banks and financial institutions to gain access to large volumes of customer data, including personal and financial information. This data can then be sold on the dark web or used for various malicious activities.

To protect against data breaches, banks should employ robust security measures such as encryption, firewalls, and intrusion detection systems. Regular security audits and employee training can also help identify vulnerabilities and prevent data breaches.

It is also essential for customers to remain vigilant and report any suspicious activities or requests for personal information immediately.

In conclusion, while digital banking provides numerous benefits, it is crucial to prioritize security to protect against unauthorized access and data breaches. By implementing strong authentication measures and employing robust security protocols, both banks and customers can ensure the safety of their digital banking systems.

The Achilles’ Heel of DeBank

As digital banking continues to gain popularity and become an integral part of our daily lives, it is important to recognize the potential weaknesses that exist in these systems. While digital banking offers many conveniences and advantages, it also presents certain vulnerabilities that can be exploited by cybercriminals.

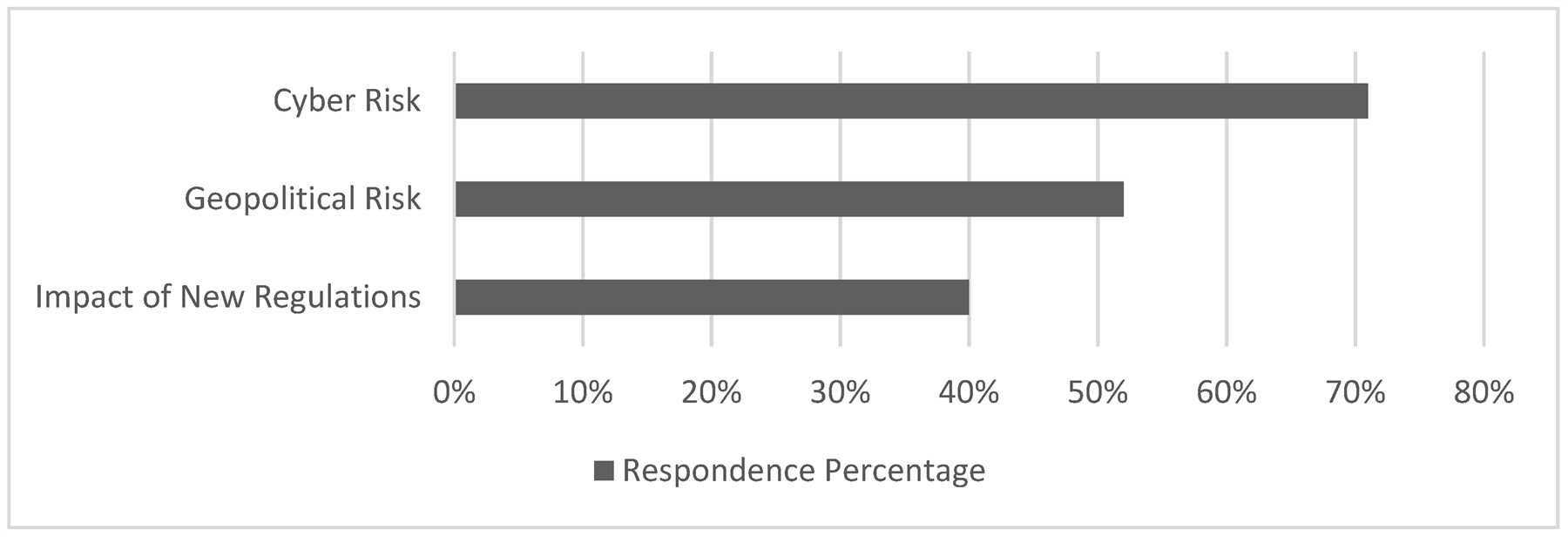

One of the main Achilles’ heels of DeBank, or any digital banking system, is the risk of cybersecurity breaches. As with any online platform, digital banks are susceptible to hacking attempts and data breaches. Cybercriminals are constantly developing new and sophisticated methods to gain unauthorized access to personal and financial information.

Another weakness of digital banking systems is the potential for glitches and technical failures. While digital banks strive to provide a seamless user experience, technical issues can arise, causing inconvenience and frustration for customers. These glitches can sometimes result in financial transactions not being executed properly or accounts being temporarily inaccessible.

Additionally, digital banks face the challenge of maintaining customer trust and confidence. Many individuals still have reservations about entrusting their financial information to an online platform, and any breach or failure can further erode this trust. It is crucial for digital banks to implement robust security measures and proactive communication strategies to address these concerns.

Moreover, the rapid advancement of technology introduces new vulnerabilities to digital banking systems. As digital banks adopt innovative features and services, they may inadvertently introduce new weaknesses that cybercriminals can exploit. It is a constant race to stay ahead of cyber threats and ensure that the systems are adequately protected.

In conclusion, while digital banking offers tremendous benefits and convenience, it is not without its vulnerabilities. Cybersecurity breaches, technical failures, customer trust, and evolving technology all pose potential weaknesses to digital banking systems like DeBank. It is essential for banks and customers alike to remain vigilant and take necessary precautions to mitigate these risks.

Vulnerability to Phishing Attacks

Phishing attacks pose a significant risk to digital banking systems, exploiting vulnerabilities in the technology and human behavior. Phishing involves the deceptive act of tricking individuals into sharing sensitive information, such as login credentials or personal data, by posing as a trustworthy entity.

One of the primary vulnerabilities of digital banking systems to phishing attacks is the reliance on email communication. Fraudsters can impersonate banks and send out fraudulent emails that appear genuine, enticing recipients to click on malicious links or provide sensitive information. These fake emails often employ techniques such as urgency, fear, or promises of financial gain to manipulate recipients into taking action.

Another vulnerability arises from the growing popularity of mobile banking apps. With the increase in usage of smartphones and tablets, attackers have adapted their techniques to target mobile users through phishing scams. Unsuspecting users may download fraudulent apps or click on links disguised as legitimate banking services, unknowingly granting access to their accounts or sensitive information.

The social engineering aspect of phishing attacks also plays a significant role in exploiting human vulnerabilities. Attackers use various psychological tactics, such as impersonating authority figures or creating a sense of urgency, to persuade victims to disclose confidential information. In a digital banking context, this can lead to users inadvertently revealing their login credentials or other sensitive data to fraudsters.

Addressing the vulnerability to phishing attacks requires a multi-faceted approach. Digital banking systems must enhance security measures, such as implementing two-factor authentication, using encryption technologies, and regularly updating systems to defend against evolving phishing techniques. Additionally, educating users about the risks of phishing attacks and providing guidance on how to identify and report suspicious emails or activities can empower individuals to protect themselves.

Ultimately, mitigating the vulnerability to phishing attacks is crucial for digital banking systems to safeguard customer data and maintain trust in the digital banking experience. By remaining vigilant, continuously improving security measures, and educating users, banks can help combat the risks posed by phishing attacks in the digital era.

Weaknesses in Authentication Methods

Authentication methods play a crucial role in ensuring the security of digital banking systems. However, they are not without their weaknesses. In this section, we will explore some of the vulnerabilities associated with various authentication methods used in digital banking.

Password-based authentication: One of the most common authentication methods is password-based authentication. While passwords can be effective when complex and kept secret, they are still vulnerable to several weaknesses. Users often choose weak passwords or reuse the same password across multiple accounts, which can make it easier for attackers to gain unauthorized access. Additionally, passwords can be compromised through techniques such as phishing or keylogging.

Two-factor authentication (2FA): Two-factor authentication is an additional layer of security that requires users to provide two different types of credentials for authentication, typically something they know (like a password) and something they have (like a mobile device or security token). While 2FA provides an extra level of security, it is not flawless. Social engineering attacks can trick users into providing both factors, rendering the additional security ineffective. Moreover, if the second factor (e.g., a mobile device) is lost or stolen, an attacker might gain unauthorized access.

Biometric authentication: Biometric authentication, such as fingerprint or facial recognition, offers a convenient and secure way of verifying a user’s identity. Nevertheless, it is not immune to weaknesses. Biometric data can be stolen or replicated, potentially enabling an attacker to bypass the authentication system. Moreover, biometric authentication methods may not be widely supported across all devices, limiting their effectiveness.

Single sign-on (SSO) authentication: SSO authentication allows users to access multiple applications or systems with a single set of credentials. However, this convenience comes at a cost. If an attacker gains control over a user’s SSO account, they can potentially access all the linked systems and applications. Additionally, SSO relies heavily on the security of the identity provider, and if compromised, it can expose all connected accounts.

Multifactor authentication (MFA): MFA combines multiple authentication factors to enhance security. While MFA is generally considered more secure, it is still subject to weaknesses. If the additional factors used in MFA (such as personal questions or security tokens) are not properly implemented, they can be susceptible to social engineering attacks or physical theft, respectively.

Conclusion: While authentication methods are essential for securing digital banking systems, they are not foolproof. Each method has its weaknesses that can be exploited by attackers. Effective measures, such as regular password updates, user education, and continuous monitoring of authentication systems, are necessary to mitigate these vulnerabilities and ensure the security of digital banking.

Data Breaches and Cyber Threats

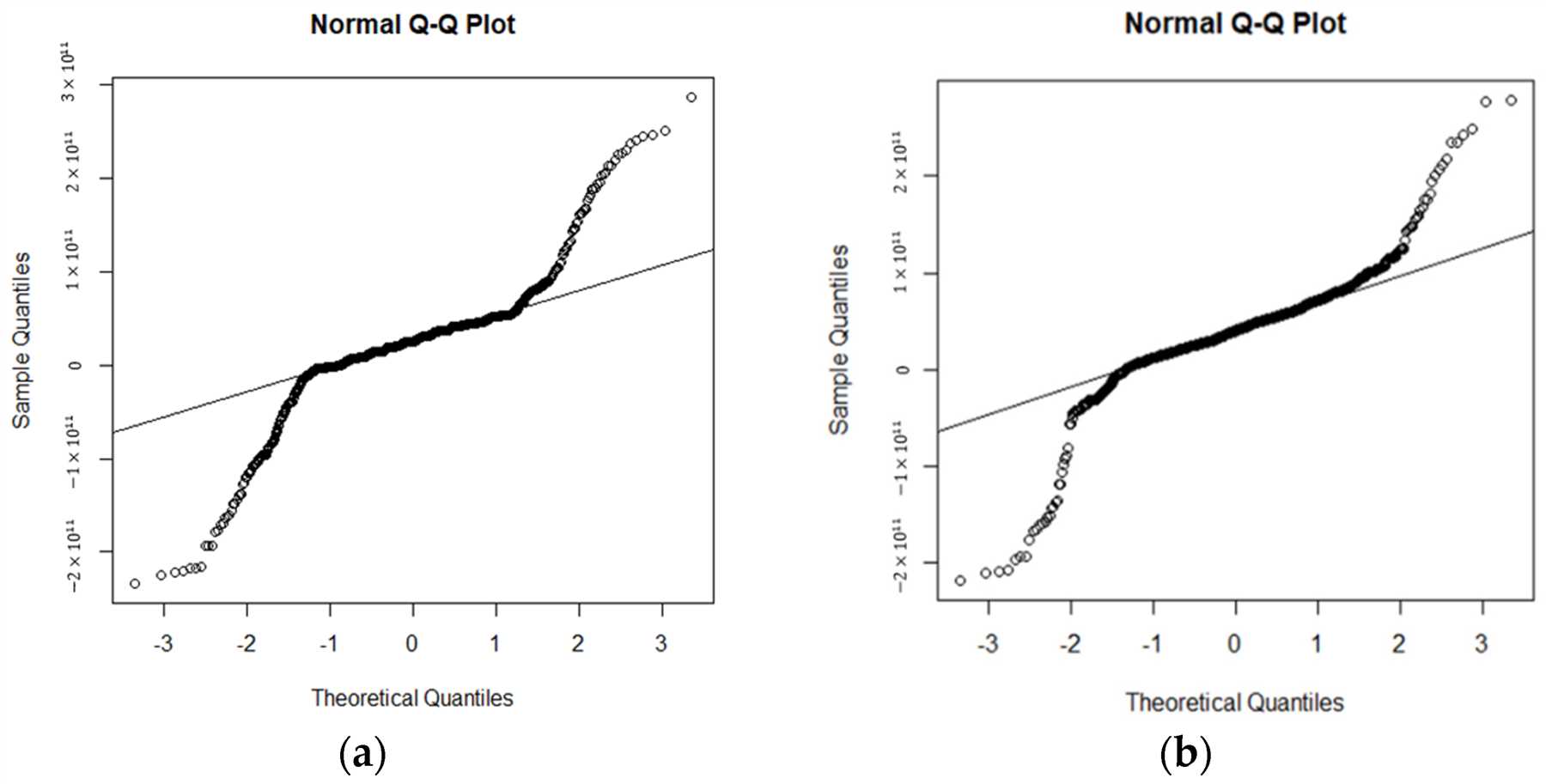

Data breaches and cyber threats pose significant risks to digital banking systems. As more banks and financial institutions adopt digital technologies, the potential for sensitive customer data to be compromised increases.

One of the major challenges banks face is the constant evolution of cyber threats. Hackers and cybercriminals are continuously developing new techniques to exploit vulnerabilities in digital banking systems, such as phishing attacks, malware, and ransomware.

Phishing attacks involve sending fraudulent emails or messages that appear to be from a legitimate source, asking customers to provide their personal information. These attacks are designed to deceive customers into revealing their login credentials or other sensitive data.

Malware is another common cyber threat that can be used to gain unauthorized access to banking systems. Cybercriminals may infect a user’s device with malware through infected files or links, allowing them to steal sensitive data or gain control of the device.

Ransomware attacks are particularly concerning for banks and financial institutions. In a ransomware attack, cybercriminals encrypt the victim’s data and demand a ransom payment in exchange for the decryption key. This can result in significant financial losses, as well as potential damage to the bank’s reputation.

The Impact of Data Breaches

Data breaches can have severe consequences for banks and their customers. The exposure of sensitive customer data can lead to identity theft, financial fraud, and unauthorized access to accounts.

Banks may also face legal and regulatory penalties for not adequately protecting customer data. Data breach incidents can result in lawsuits, fines, and damage to a bank’s reputation. Customers may become hesitant to trust the bank with their personal information, leading to a loss of business.

Preventing Data Breaches

Protecting against data breaches requires a multi-layered approach. Banks must implement robust security measures, such as encryption, firewalls, and intrusion detection systems, to protect customer data from unauthorized access.

Regular employee training and awareness programs are essential to educate staff about the latest cyber threats and best practices for data security. Banks should also conduct regular audits and penetration testing to identify and address any vulnerabilities in their systems.

In conclusion, data breaches and cyber threats remain a significant challenge for digital banking systems. Banks must take proactive measures to protect customer data and stay one step ahead of cybercriminals. By implementing comprehensive security measures and fostering a culture of cybersecurity awareness, banks can help safeguard their systems and maintain the trust of their customers.

The Role of Insider Threats

Insider threats are individuals who have authorized access to the digital banking system but deliberately misuse their privileges for personal gain or malicious intent. These individuals could be disgruntled employees, former employees, contractors, or even trusted partners.

What makes insider threats so dangerous is their level of access and knowledge of the system. They are intimately familiar with the inner workings of the digital banking infrastructure and can exploit its vulnerabilities without raising suspicion. They have the potential to cause significant damage and compromise sensitive customer data, leading to financial losses and reputational damage for the bank.

The motivations behind insider threats can vary. Some individuals may be driven by financial gain, seeking to exploit vulnerabilities in the system for personal profit. Others may be motivated by revenge or a desire to harm the organization they work for. Regardless of the motivation, the impact can be devastating.

Preventing insider threats requires a multi-layered approach. It starts with a rigorous employee vetting process that includes background checks, reference checks, and continuous monitoring of employee behavior. Implementing strong access controls and segregation of duties can also help mitigate the risk of insider threats. Regular security awareness training for employees can raise awareness about the importance of safeguarding sensitive information and the consequences of insider threats.

Additionally, implementing robust auditing and monitoring systems can help detect and track any suspicious activity within the digital banking system. This includes monitoring login attempts, access to sensitive data, and unusual behavior patterns. By detecting and acting upon early warning signs, banks can proactively prevent and mitigate the damage caused by insider threats.

In conclusion, while digital banking systems may have vulnerabilities that can be exploited by external hackers, the real Achilles’ Heel lies within the system itself – the insider threats. Understanding the role of insider threats, implementing robust security measures, and fostering a culture of security awareness is crucial to safeguarding digital banking systems and protecting customers’ sensitive information.

The Danger of Social Engineering

Social engineering is a tactic used by cybercriminals to manipulate people into giving up sensitive information or performing actions that can lead to security breaches. It is a psychological attack that relies on human interaction and manipulation, rather than exploiting technical vulnerabilities.

One common form of social engineering is phishing, where attackers send emails or messages pretending to be a trusted source in order to trick individuals into providing their passwords, usernames, or financial information. These messages often appear legitimate, with well-designed logos and professional language, making it difficult to detect their fraudulent nature.

Another form of social engineering is pretexting, where hackers create a fictional scenario or pretext to gain the trust of a target. This often involves pretending to be an employee, customer, or authority figure and using this position of trust to manipulate the target into divulging sensitive information.

Pretexting can also involve impersonation. Hackers may pretend to be someone they are not, such as a bank employee or tech support representative, in order to gain access to personal information or convince the individual to download malicious software.

Another technique used in social engineering is called baiting, which involves leaving a physical device, such as a USB drive, in a public place with the hope that it will be picked up and used by someone curious. The device may contain malware or be programmed to connect to a hacker-controlled network, giving the attacker access to the individual’s device.

It is critical for individuals to be aware of the dangers of social engineering and take steps to protect themselves. This includes being vigilant about the information they share online, being cautious of unsolicited communications, and employing strong security measures such as multi-factor authentication and regular updates of software and antivirus programs.

- Be wary of emails or messages requesting personal information or financial details.

- Verify the identity of individuals before sharing sensitive information.

- Do not click on suspicious links or download files from untrusted sources.

- Ensure software and antivirus programs are up to date.

- Regularly review and monitor financial accounts for any suspicious activity.

By being knowledgeable about social engineering tactics and being cautious in our interactions, we can better protect ourselves and our digital banking systems from potential threats.

Lack of Regulatory Oversight

One of the major weaknesses present in digital banking systems is the lack of regulatory oversight. Unlike traditional banking institutions that are subject to strict regulations and oversight by government agencies, digital banks often operate in a regulatory gray area.

This lack of regulatory oversight can leave digital banks vulnerable to various forms of risks and abuses. Without proper regulatory frameworks in place, digital banks may not have adequate procedures and protocols to ensure the security of customer funds and personal information. This can make them an attractive target for cybercriminals and hackers.

In addition, the lack of regulatory oversight can also lead to issues of unfair practices and discrimination. Digital banks may have the ability to manipulate interest rates or impose hidden fees without facing any consequences. This can result in an unfair disadvantage for customers who may not have access to the information or resources to protect themselves.

Furthermore, the absence of regulatory oversight can hinder the resolution of disputes and complaints. Customers of digital banks may find it difficult to seek redress in cases of fraud or disputes over transactions. Without a regulatory body overseeing these institutions, it can be challenging to hold them accountable for their actions.

In conclusion, the lack of regulatory oversight in digital banking systems exposes customers to various risks and vulnerabilities. In order to protect consumers and ensure the stability of the digital banking industry, it is crucial for governments and regulatory bodies to establish clear and robust regulatory frameworks for digital banks.

The Importance of User Education

One of the most critical aspects in the realm of digital banking systems is user education. As technology advances, it is essential for users to stay informed and educated about the potential risks and vulnerabilities that exist in digital banking platforms.

1. Awareness of Scams and Phishing Attacks:

Users should be educated about the various types of scams and phishing attacks that can target their digital banking accounts. They should be aware of the signs that indicate a potential scam or phishing attempt, such as suspicious email requests for personal information or unverified links.

2. Password Security and Best Practices:

User education should emphasize the importance of strong passwords and best practices for creating and managing them. Users should be encouraged to use unique passwords for each online account, avoid using easily guessable passwords, and regularly update their passwords to enhance security.

3. Two-Factor Authentication:

Users should be educated about the benefits of enabling two-factor authentication (2FA) for their digital banking accounts. 2FA adds an extra layer of security by requiring users to provide two forms of identification, such as a password and a verification code sent to their mobile device.

4. Mobile Banking Security:

With the rise of mobile banking, users should be educated about the potential security risks associated with using banking apps on their smartphones. They should understand the importance of keeping their mobile devices updated with the latest security patches and using reputable banking apps downloaded from trusted sources.

5. Safe Internet Practices:

Users should be educated about safe internet practices, such as avoiding public Wi-Fi networks for banking transactions, using secure and encrypted websites (https), and being cautious when downloading files or clicking on suspicious links.

6. Regular Account Monitoring:

Finally, users should be encouraged to regularly monitor their digital banking accounts for any unauthorized activities or suspicious transactions. They should know how to review their account statements and promptly report any discrepancies to their bank.

In conclusion, user education plays a vital role in enhancing the security and resilience of digital banking systems. By equipping users with the necessary knowledge and skills, they can become proactive in protecting their accounts from potential threats and vulnerabilities.

Potential Impact on Financial Stability

As digital banking systems become more prevalent, there is a growing concern about the potential impact on financial stability. While digital banking offers many benefits such as convenience and accessibility, it also presents new vulnerabilities and risks that could have serious consequences for the stability of the financial system.

One potential impact on financial stability is the increased risk of cyber attacks. With digital banking, there is the possibility of unauthorized access to sensitive financial information and funds. Hackers can exploit weaknesses in digital banking systems to steal money, commit fraud, or disrupt financial transactions. Such attacks can have a cascading effect, causing panic among account holders and leading to a loss of trust in the financial system.

Another potential impact is the heightened risk of systemic failures. Digital banking systems rely heavily on technology, and any glitches or technical malfunctions can disrupt the entire system. In the event of a system-wide failure, customers may be unable to access their accounts or perform transactions, leading to financial distress and potential economic instability. Moreover, the interconnectedness of digital banking systems means that a failure in one institution could have ripple effects on others, amplifying the impact on financial stability.

Additionally, the increased reliance on digital banking systems may exacerbate existing inequalities in access to financial services. While digital banking offers convenience for those with internet access, it may leave behind individuals or communities without reliable internet connectivity or the necessary digital literacy skills. This lack of inclusivity can deepen existing economic disparities and hinder financial stability in the long run.

In conclusion, while digital banking systems offer numerous advantages, their vulnerabilities and risks pose a potential threat to financial stability. To mitigate these risks, financial institutions and regulators must prioritize cybersecurity measures, invest in robust technological infrastructure, and ensure the inclusivity of digital banking services. By doing so, they can help safeguard the stability of the financial system in the face of evolving digital threats.

Mitigating Risks and Strengthening Security Measures

Ensuring the security of digital banking systems is paramount in order to protect users’ sensitive financial information from cyberattacks. There are several key steps that DeBank and other digital banking institutions can take to mitigate risks and strengthen their security measures:

1. Implementing Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring users to provide a second form of identification, such as a fingerprint or a unique code generated by a mobile app, in addition to their passwords. This helps prevent unauthorized access to users’ accounts even if their passwords are compromised.

2. Regularly Updating Software: Keeping the digital banking software up to date is crucial in order to patch any vulnerabilities that may have been discovered. Regular software updates also ensure that the latest security features and protocols are implemented, providing better protection against potential threats.

3. Conducting Regular Security Audits: Regular security audits help identify any weaknesses or vulnerabilities in the digital banking system. By conducting thorough audits, DeBank can proactively identify and address any potential security flaws before they can be exploited by malicious actors.

4. Investing in Employee Training: Ensuring that employees are well-trained in security best practices is essential in maintaining a strong security posture. All staff members should be educated on how to recognize and respond to phishing attempts, social engineering attacks, and other common tactics employed by cybercriminals.

5. Encouraging Strong User Passwords: Educating users about the importance of strong and unique passwords can go a long way in preventing unauthorized access to their accounts. Implementing password complexity requirements and providing guidelines for creating strong passwords can help users protect their accounts.

6. Monitoring and Analyzing Network Traffic: Implementing robust network monitoring tools can help detect any unusual network activity or potential threats. By continuously analyzing network traffic, DeBank can quickly respond to any suspicious activity and take proactive measures to protect the system and its users.

In conclusion, mitigating risks and strengthening security measures is crucial in ensuring the security and integrity of digital banking systems. By implementing two-factor authentication, regularly updating software, conducting security audits, investing in employee training, encouraging strong user passwords, and monitoring network traffic, DeBank and other digital banking institutions can enhance their security posture and better protect their users from potential cyber threats.

The Future of Digital Banking Security

As digital banking continues to evolve and become more prevalent in our society, the need for strong security measures to protect customer data and assets is of paramount importance. In this ever-changing technological landscape, it is crucial for banks to stay one step ahead of cybercriminals and continually adapt their security infrastructure to combat emerging threats.

Biometric Authentication

One trend that is already gaining traction in the world of digital banking security is the use of biometric authentication. Gone are the days of simple passwords and PINs; banks are now embracing fingerprint scanning, facial recognition, and even iris scanning as means of verifying a customer’s identity. With biometric authentication, banks can ensure that only authorized individuals have access to sensitive financial information, providing an added layer of security and convenience.

Artificial Intelligence and Machine Learning

Another area where the future of digital banking security is heading is the integration of artificial intelligence (AI) and machine learning (ML) technologies. By leveraging AI and ML algorithms, banks can identify patterns and anomalies in customer behavior that may indicate fraudulent activity. These technologies can also be used to detect and prevent cyberattacks in real-time, providing banks with the ability to respond swiftly to potential threats.

AI-powered chatbots are also being utilized to enhance customer service in digital banking. These virtual assistants can provide quick and accurate responses to customer queries, while also analyzing customer interactions to detect any suspicious activity. Through constant learning and improvement, these chatbots can become adept at recognizing and mitigating security risks.

Continuous Security Monitoring

In the future, digital banking systems will increasingly rely on continuous security monitoring to identify and address vulnerabilities in real-time. Rather than reactive measures, banks will adopt a proactive approach to security, utilizing advanced monitoring tools and systems that can detect and respond to threats as they occur. This will enable banks to stay ahead of cybercriminals and minimize the potential damage caused by security breaches.

Conclusion:

The future of digital banking security lies in the integration of biometric authentication, AI and ML technologies, and continuous security monitoring. By embracing these advancements, banks can create robust and resilient security systems that protect customer data and instill trust in the digital banking experience. However, it is essential for banks to stay vigilant and continually upgrade their security infrastructure to adapt to the ever-evolving cyber threat landscape.

FAQ:,

What are the weaknesses in digital banking systems?

The weaknesses in digital banking systems can vary, but some common ones include vulnerabilities to cyber attacks, data breaches, identity theft, and fraud. These weaknesses can result in financial losses, compromised customer data, and damage to the reputation of the bank.

How do cyber attacks target digital banking systems?

Cyber attacks targeting digital banking systems can occur through various methods, such as phishing emails, malware, and direct hacking attempts. These attacks aim to gain unauthorized access to sensitive customer information, banking credentials, and funds.

What measures can be taken to strengthen digital banking security?

To strengthen digital banking security, banks can implement various measures such as multi-factor authentication, encryption, intrusion detection systems, regular security audits, and employee training on data security and cyber threats. Additionally, customers can also play a role by using strong passwords, regularly updating their devices and banking apps, and being cautious of phishing attempts.

How can identity theft and fraud be prevented in digital banking?

Preventing identity theft and fraud in digital banking involves implementing measures such as robust identity verification procedures, real-time transaction monitoring, enhanced data encryption, and customer education on safe online banking practices. It’s also important for banks to have fraud detection and prevention systems in place to detect and respond to suspicious activities.

What are the consequences of data breaches in digital banking systems?

Data breaches in digital banking systems can lead to significant consequences, such as financial losses for customers and the bank, reputational damage, legal implications, and loss of customer trust. Additionally, compromised personal and financial information can be used for identity theft, leading to further financial harm for individuals.