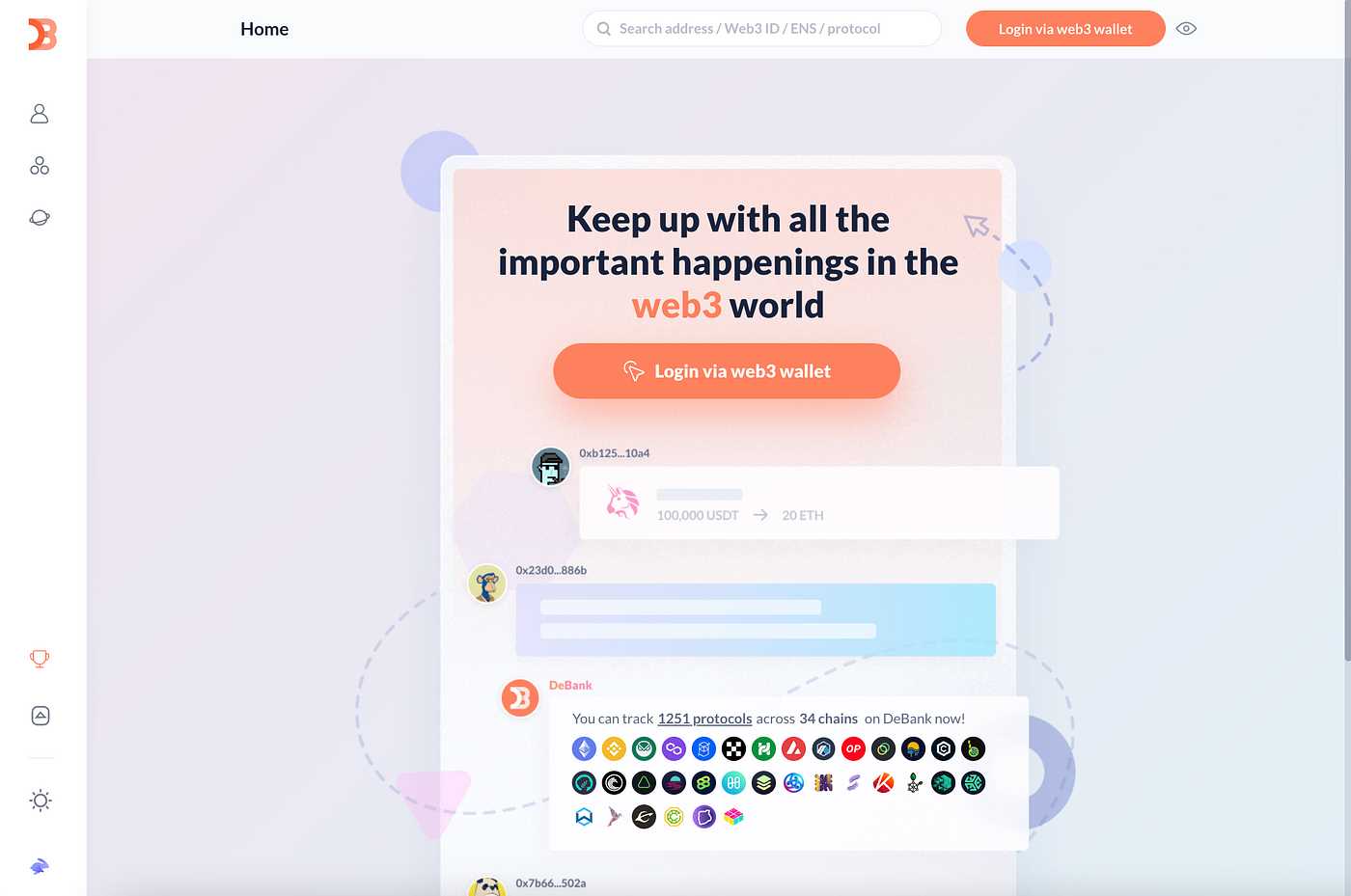

In today’s digital age, traditional banking methods are being disrupted and transformed by innovative technologies. One such technology, known as Debank, has emerged as a game-changer in the banking industry. Debank, short for decentralized banking, is a revolutionary concept that utilizes blockchain technology to provide secure and transparent financial services.

With Debank, individuals can enjoy a myriad of benefits that were previously unimaginable in traditional banking. First and foremost, Debank eliminates the need for intermediaries, such as banks, in financial transactions. This decentralized approach ensures that transactions are conducted directly between individuals, cutting out unnecessary fees and delays.

Moreover, Debank offers enhanced security and privacy for users. Traditional banks are vulnerable to cyberattacks and data breaches, compromising the personal and financial information of their customers. In contrast, Debank utilizes advanced encryption techniques and decentralized storage systems, making it virtually impossible for hackers to gain unauthorized access to users’ information.

In addition to improved security, Debank also provides greater financial inclusivity. Traditional banks often have strict criteria and requirements that limit access to financial services, making it difficult for individuals with limited resources or living in underserved communities to participate in the formal banking system. Debank removes these barriers by providing access to financial services for anyone with an internet connection and a smartphone or computer.

Furthermore, Debank enables faster and more efficient transactions. Traditional banks are notorious for their lengthy processing times, especially for cross-border transactions. By utilizing blockchain technology, Debank can facilitate near-instantaneous transactions, allowing individuals to send and receive money in a matter of seconds, regardless of their location.

In conclusion, Debank is revolutionizing the banking industry by offering a range of benefits that traditional banks simply cannot match. From eliminating intermediaries and providing enhanced security and privacy to promoting financial inclusivity and enabling faster transactions, Debank is paving the way for a more accessible, secure, and efficient banking experience for individuals around the world.

Increased Accessibility and Convenience

Debank is revolutionizing the banking industry by providing increased accessibility and convenience to its users. With Debank, individuals can access their accounts and perform transactions anytime, anywhere.

One of the key features of Debank is its user-friendly interface, which makes it easy for individuals of all ages and technological abilities to navigate and use the platform. Whether you are tech-savvy or not, Debank provides a seamless banking experience for all its users.

Furthermore, Debank offers a wide range of banking services such as online deposits, transfers, and payments. These services can be accessed and performed on mobile devices, tablets, and desktops, ensuring that users can manage their finances on the go.

Another convenience feature of Debank is its integration with various financial apps and platforms. Users can link their Debank accounts with popular payment apps, such as PayPal and Venmo, making it easy to send and receive money.

In addition, Debank has partnered with financial institutions and merchants to provide online shopping and payment options. Users can easily make purchases and pay bills directly from their Debank accounts, eliminating the need for carrying cash or using multiple platforms.

Overall, the increased accessibility and convenience provided by Debank is transforming the way individuals bank. It offers a one-stop solution for all banking needs, making it easier and more efficient for users to manage their finances.

If you want to experience the benefits of increased accessibility and convenience in banking, check out Farming debank today!

Enhanced Security Measures

Debank is at the forefront of introducing cutting-edge security measures to ensure the safety and protection of its users’ financial information. By integrating advanced encryption technology, Debank ensures that all data transmitted between users and the platform remains secure and confidential.

One of the key security features of Debank is its two-factor authentication (2FA) system. With 2FA, users are required to provide an additional layer of verification in addition to their username and password. This can come in the form of a unique code sent to their registered mobile device or an authentication app. By implementing 2FA, Debank significantly reduces the risk of unauthorized access to user accounts.

Furthermore, Debank employs robust monitoring systems to detect and prevent fraudulent activities. Through real-time monitoring and analysis of user transactions, any suspicious activities or anomalies can be swiftly identified and acted upon. This helps to protect users from potential financial losses and ensures the integrity of the platform.

In addition to these proactive security measures, Debank also places a strong emphasis on user education and awareness. The platform provides comprehensive resources and guidelines on best practices for online security, such as creating strong passwords, avoiding phishing scams, and regularly updating software.

The implementation of these enhanced security measures sets Debank apart in the banking industry. Users can have peace of mind knowing that their financial information is protected with state-of-the-art security protocols.

| Enhanced Security Measures Highlights: |

|---|

| – Advanced encryption technology ensures data confidentiality |

| – Two-factor authentication adds an extra layer of verification |

| – Real-time monitoring detects and prevents fraudulent activities |

| – User education and awareness promote online security |

Cost Efficiency

The benefits of utilizing Debank in the banking industry are numerous, and one of the significant advantages is its cost efficiency. Traditional banking systems often involve high transaction fees and maintenance costs, which can eat into a company’s profits or burden individual consumers.

Debank, on the other hand, operates on decentralized blockchain technology, reducing the need for intermediaries and expensive infrastructure. This significantly lowers the costs associated with banking operations, making financial services more accessible and affordable for everyone.

With Debank, customers can enjoy lower transaction fees and reduced account maintenance costs. The elimination of intermediaries streamlines processes, eliminating unnecessary overheads and increasing overall efficiency.

In addition, Debank’s smart contract capabilities automate manual processes, saving time and labor costs. It minimizes human error, ensuring accuracy and reliability in transactions and record-keeping. Moreover, Debank’s transparency reduces the risk of fraud and embezzlement, further reducing costs for both businesses and consumers.

The cost efficiency of Debank opens up new opportunities for individuals and businesses to access financial services that were previously inaccessible or too expensive. It also promotes economic growth by lowering barriers to entry and fostering innovation and competition within the banking industry.

Conclusion

Debank’s cost efficiency is one of the key factors that make it a revolutionary force in the banking industry. By leveraging blockchain technology and eliminating unnecessary intermediaries, Debank significantly reduces costs, making financial services more accessible and affordable for everyone. As a result, it is leveling the playing field and driving innovation and growth within the industry.

Streamlined Transactions

Debank’s revolutionary platform has simplified the process of conducting transactions for both banks and customers. With traditional banking methods, transactions can often be time-consuming and cumbersome, requiring extensive paperwork and multiple signatures. However, Debank has streamlined this process, making transactions faster and more efficient.

Through Debank’s secure digital platform, users can easily initiate and complete transactions with just a few clicks. The platform is designed to be user-friendly, allowing customers to navigate through the process seamlessly. Whether it is sending money to another account, making payments, or managing investments, Debank ensures a smooth transaction experience.

Furthermore, Debank’s platform integrates with various banking systems, allowing for seamless communication and integration between different financial institutions. This eliminates the need for manual input of data and reduces the chances of errors or discrepancies. Customers can experience hassle-free transactions without worrying about compatibility issues between different banks.

Efficiency and Cost Savings

Debank’s streamlined transaction process not only improves efficiency but also results in cost savings for both banks and customers. By reducing the amount of time and resources required for each transaction, banks can operate more efficiently, saving on operational costs.

For customers, the streamlined process saves them valuable time and effort. They no longer need to visit banks in person or wait for lengthy processing times. This convenience translates into cost savings for the customers as they do not have to spend additional money on transportation or other related expenses.

Enhanced Security

In addition to simplifying transactions, Debank’s platform also prioritizes security. Every transaction made through the platform is encrypted and protected using the latest security protocols. This ensures that customers’ financial and personal information is safeguarded from unauthorized access.

Debank employs advanced authentication methods to verify the identities of users, adding an extra layer of security to the transaction process. Customers can rest assured that their transactions are handled securely and confidentially.

In conclusion, Debank’s streamlined transaction process has revolutionized the banking industry by simplifying and enhancing the overall transaction experience. Its user-friendly platform, seamless integration with banking systems, efficiency, cost savings, and enhanced security make it an essential tool for both banks and customers.

Empowering Customers

Debank’s revolutionary technology is empowering customers to take control of their finances like never before. Through its user-friendly interface and comprehensive features, Debank is putting the power in the hands of the customers.

One of the key ways Debank empowers customers is by providing real-time updates and notifications on their account activity. Whether it’s receiving instant alerts for any suspicious transactions or being notified about upcoming bill payments, customers can stay informed and feel confident that their financial information is secure.

Another way Debank is empowering customers is through its personalized financial recommendations. By analyzing a customer’s spending patterns and financial goals, Debank is able to provide tailored recommendations for budgeting, saving, and investing. This level of personalized guidance helps customers make informed decisions and achieve their financial objectives.

Debank also empowers customers by simplifying the banking experience. With its intuitive interface, customers can easily navigate through their accounts, view their balances, transfer funds, and pay bills. This streamlined approach saves customers time and eliminates the hassle of visiting a bank branch or making phone calls.

Furthermore, Debank’s customer support team is always available to assist customers with any questions or concerns they may have. Whether through live chat, email, or phone, customers can reach out to Debank for help at any time. This accessibility ensures that customers feel supported and valued throughout their banking journey.

Overall, Debank is revolutionizing the banking industry by empowering customers to take control of their finances. With its real-time updates, personalized recommendations, simplified banking experience, and accessible customer support, Debank is providing customers with the tools and resources they need to achieve financial success.

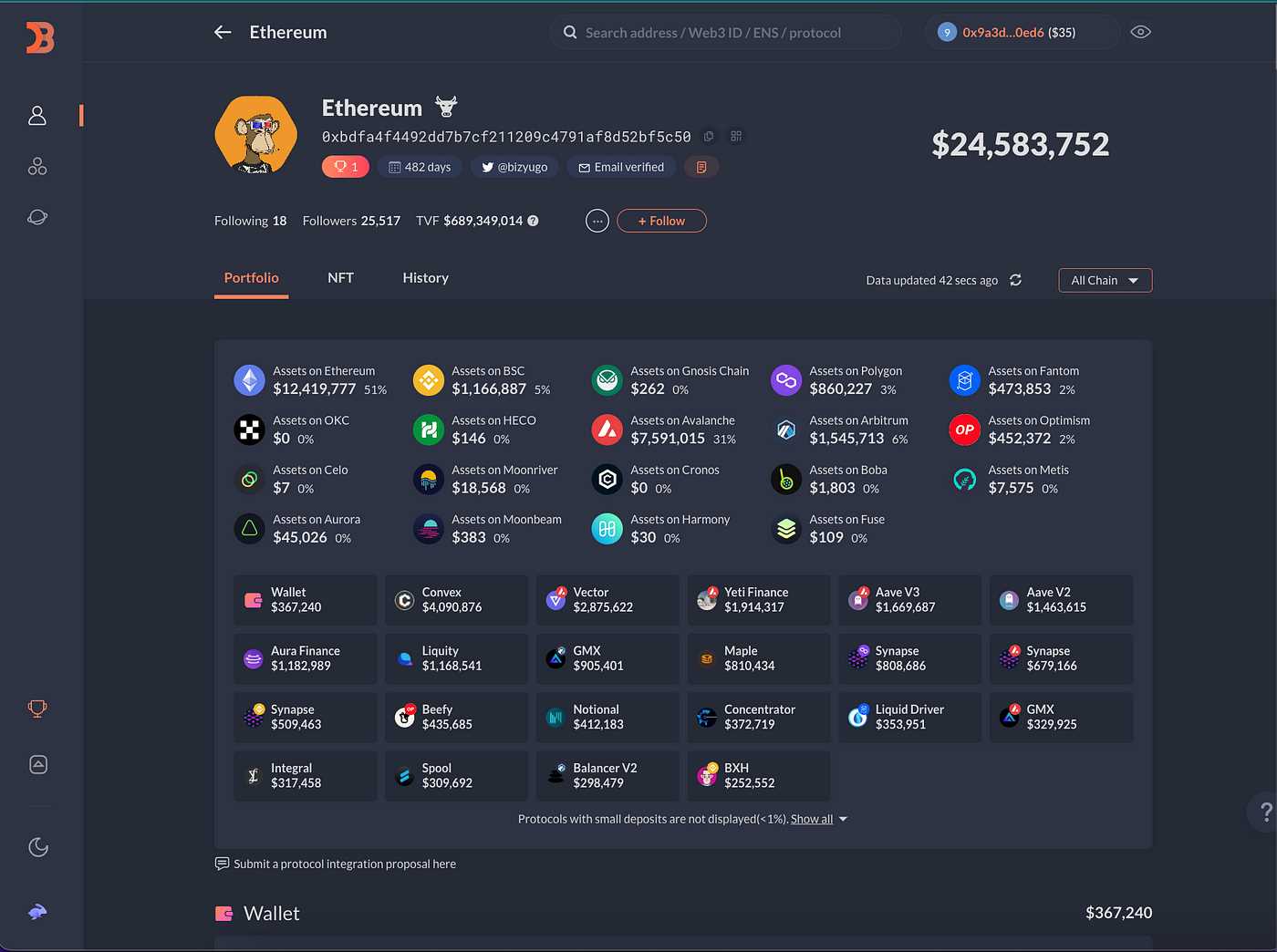

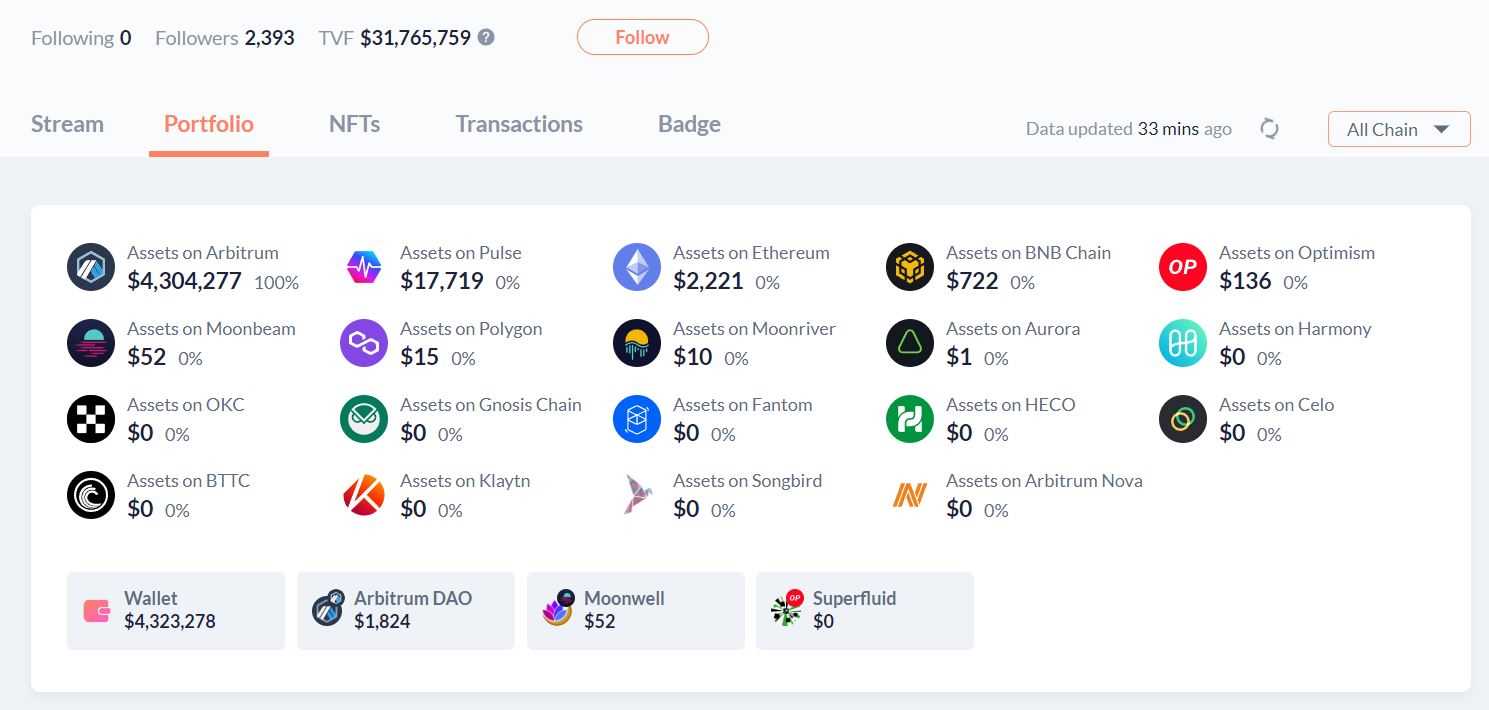

Real-time Financial Insights

Debank offers real-time financial insights, giving users a detailed view of their financial transactions and account balances. This feature allows users to monitor their finances and make informed decisions about budgeting and spending.

With Debank, users can easily track their expenses, categorize them, and see how their spending habits align with their financial goals. The platform provides visualizations and graphs that make it easy to understand where money is being spent and how it can be better managed.

One of the key advantages of Debank’s real-time financial insights is that it eliminates the need for manual tracking of expenses. Users no longer have to rely on paper receipts or spreadsheets to keep track of their spending. Instead, all their financial information is available at their fingertips, providing a clear picture of their financial health.

Debank also offers tools that allow users to set financial goals and track their progress towards achieving them. Whether it’s saving for a vacation or paying off debt, Debank provides the tools and insights to help users stay on track and reach their financial goals.

Key Features:

- Real-time transaction monitoring

- Expense tracking and categorization

- Visualizations and graphs

- Financial goal setting and tracking

Benefits:

- Better understanding of spending habits

- Improved budgeting and financial decision-making

- Elimination of manual expense tracking

- Increased financial awareness and control

Overall, Debank’s real-time financial insights provide users with the tools and information they need to take control of their finances and make smarter financial decisions.

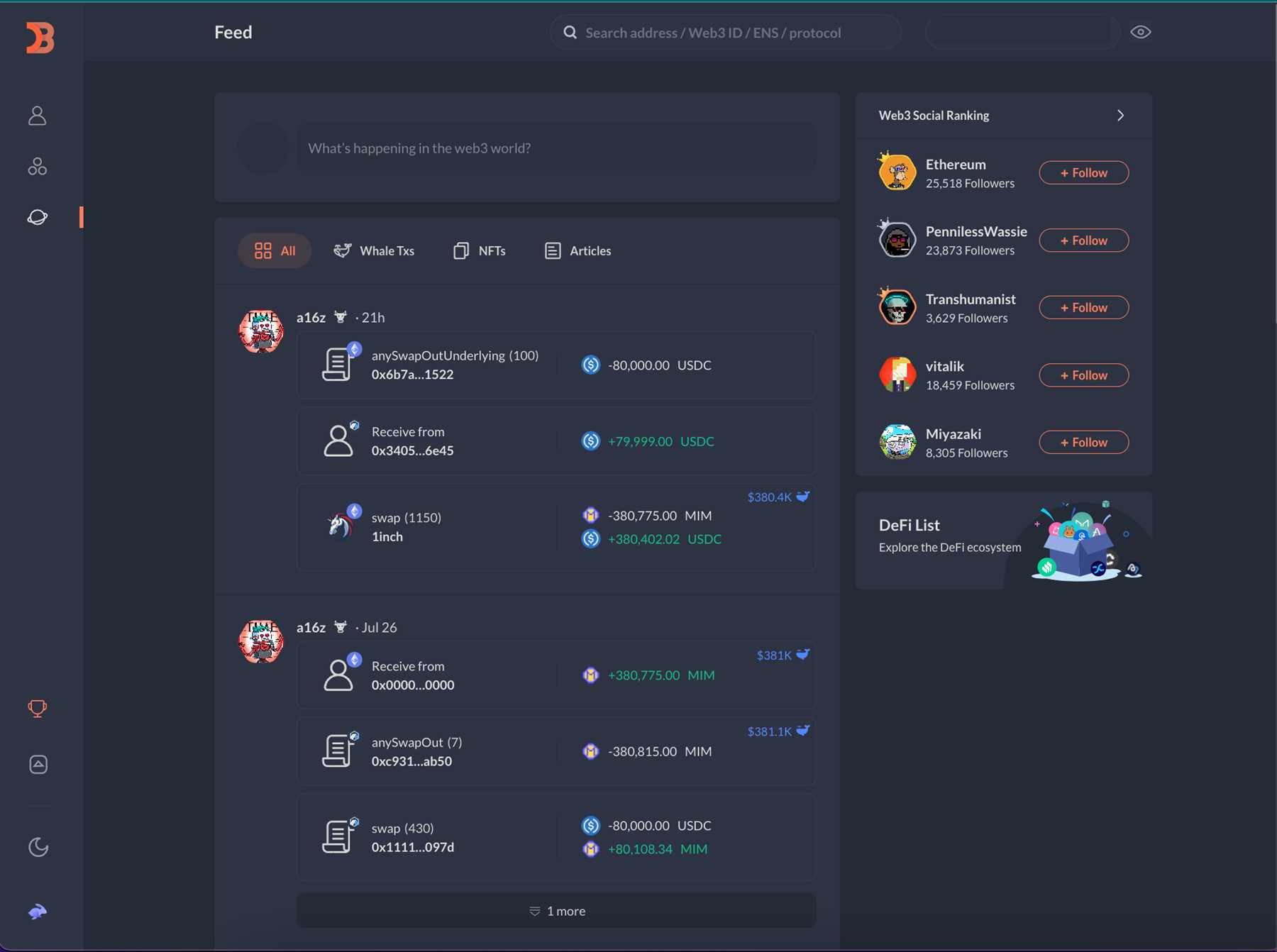

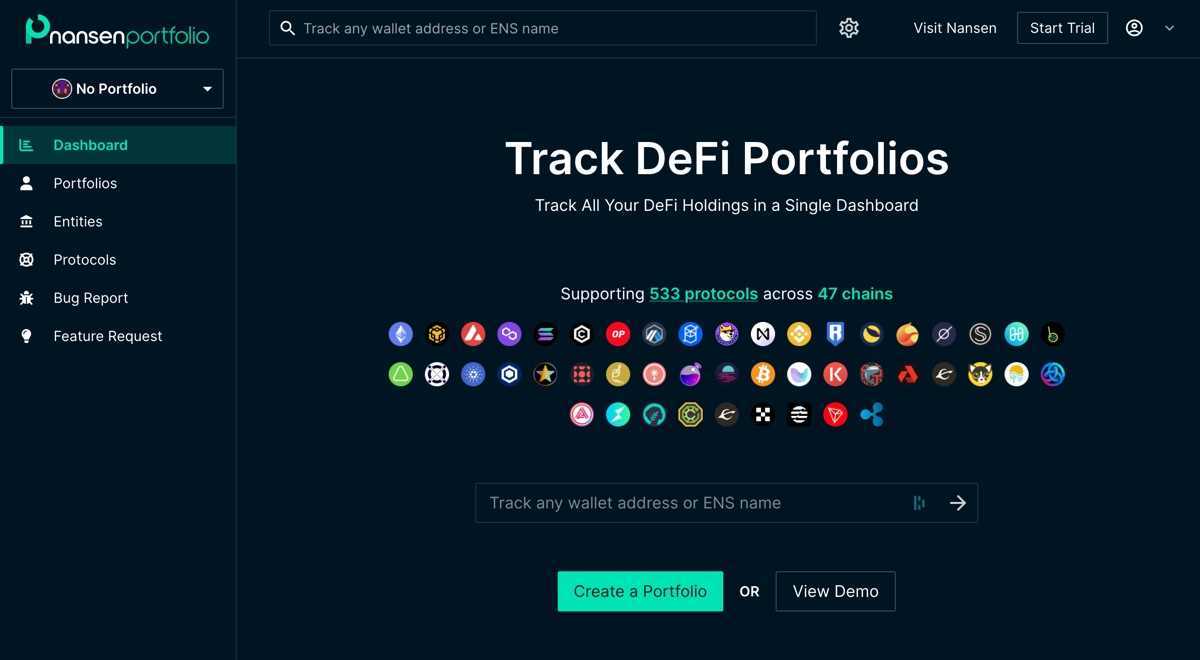

Seamless Integration with Other Financial Services

Debank is not just a standalone banking platform; it has been designed to seamlessly integrate with other financial services, creating a holistic approach to managing your finances. By connecting with various third-party applications and services, Debank offers users a comprehensive view of their financial situation in one place.

One of the key benefits of Debank’s seamless integration is the ability to link your bank accounts, credit cards, and investment portfolios. This allows you to access all of your financial information in one central location, making it easier to track your spending, manage your investments, and stay on top of your financial goals.

Easy Transactions and Payments

With Debank’s integration with payment services, you can effortlessly make transactions and payments directly from the platform. Whether you need to pay bills, transfer funds, or make a purchase, Debank streamlines the process, saving you time and effort. You no longer need to switch between different apps or websites to complete your financial transactions.

In addition, Debank’s integration with financial planning tools allows you to set up budgets, track your expenses, and monitor your financial progress. With all of your financial data in one place, you can make informed decisions about your spending habits and identify areas where you can save money.

Secure and Convenient Access to Financial Data

Debank takes security seriously. When integrating with other financial services, Debank ensures that your personal and financial data is protected using robust encryption and security measures. You can trust that your information is safe and secure.

Furthermore, Debank offers convenient access to your financial data from any device with an internet connection. Whether you’re at home, in the office, or on the go, you can easily log in to your Debank account and manage your finances whenever and wherever you need to.

Overall, Debank’s seamless integration with other financial services makes it a powerful tool for managing your finances. By consolidating your financial information and providing easy access to a range of financial services, Debank simplifies the way you manage your money, ultimately helping you achieve your financial goals.

Improved Customer Service

Debank is revolutionizing the banking industry by providing improved customer service. Traditionally, banks have faced challenges in meeting the diverse needs and preferences of their customers. However, with Debank, customers have access to a wide range of services and features that enhance their overall banking experience.

Personalized Assistance: Debank provides personalized assistance to its customers, allowing them to receive tailored guidance and support. Whether it’s help with account management, financial planning, or investment advice, customers can rely on Debank to provide them with the assistance they need.

24/7 Support: Another key benefit of Debank is its 24/7 support. Customers can access assistance at any time of the day or night, ensuring that their banking needs are always met promptly. This round-the-clock support helps to improve customer satisfaction and ensures that customers feel supported and valued.

Convenient Communication: Debank prioritizes convenient communication channels to further enhance customer service. Customers can reach out to Debank through various channels such as phone, email, or online chat. The availability of multiple communication options provides customers with flexibility and convenience in contacting Debank.

Seamless Digital Experience: Debank offers a seamless digital experience to its customers, allowing them to conduct their banking activities easily and efficiently. Through the Debank mobile app or website, customers can manage their accounts, make transactions, and access a range of banking services with just a few taps or clicks.

Efficient Issue Resolution: In case of any issues or concerns, Debank ensures efficient resolution to minimize customer inconvenience. The customer support team is well-trained and equipped to handle customer inquiries and problems effectively, ensuring that issues are resolved in a timely manner.

In summary, Debank’s focus on improved customer service sets it apart from traditional banks. Through personalized assistance, 24/7 support, convenient communication channels, a seamless digital experience, and efficient issue resolution, Debank is revolutionizing the way customers interact with their banks and elevating the overall banking experience.

Simplified Loan Applications

Debank’s innovative platform has revolutionized the loan application process, making it easier and more convenient for borrowers to access the financing they need. By streamlining the application process, Debank is saving time and reducing paperwork for both borrowers and lenders.

Gone are the days of filling out endless forms and providing stacks of documentation. With Debank, the loan application process has been simplified to just a few steps. Borrowers can now complete their applications online, from the comfort of their own homes or offices.

Debank’s platform uses advanced technology to facilitate a seamless application experience. Through a user-friendly interface, borrowers can provide all the necessary information and documents with just a few clicks. The platform also offers helpful prompts and guidance along the way, ensuring that borrowers provide accurate and complete information.

Time-Saving Benefits

One of the key benefits of Debank’s simplified loan applications is the time it saves borrowers. With the traditional loan application process, borrowers would have to visit a bank or lender in person, fill out numerous forms, and submit supporting documents. This would often take days or even weeks to complete, causing delays in accessing much-needed funds.

Now, with Debank, borrowers can complete their applications in a matter of minutes. The digital platform eliminates the need for physical visits and allows borrowers to apply for loans at any time, day or night. The automated process also speeds up the review and approval process, resulting in faster access to funds.

Reduced Paperwork

Another advantage of Debank’s simplified loan applications is the reduction in paperwork. Traditional loan applications typically require borrowers to submit various documents, such as bank statements, pay stubs, and tax returns. This can be time-consuming and cumbersome.

With Debank, borrowers can securely upload their documents directly to the platform. This eliminates the need for physical copies and reduces the risk of lost or misplaced paperwork. Lenders can access the necessary documents electronically, making the entire process more efficient and convenient.

Overall, Debank’s simplified loan applications are changing the way borrowers access financing. With a streamlined process, borrowers can save time, reduce paperwork, and get the funds they need faster than ever before.

Personalized Banking Experience

One of the key benefits of using Debank is the personalized banking experience it offers to its users. Unlike traditional banks that treat all customers the same, Debank understands that each individual has unique financial needs and preferences.

With Debank, users have the ability to customize their banking experience according to their own requirements. They can choose from a variety of features and services that best suit their needs, such as customizable account settings, transaction notifications, and personalized financial advice.

Customizable Account Settings

Debank allows users to personalize their account settings to match their specific banking preferences. Whether it’s setting up a recurring payment, customizing transaction limits, or selecting preferred communication channels, Debank caters to the individual needs of each user.

Transaction Notifications

With Debank, users can opt-in to receive transaction notifications via email or SMS. This not only helps them stay updated on their financial activities but also provides an extra layer of security, as any unauthorized activity can be quickly detected and reported.

Moreover, users can set personalized thresholds for transaction notifications, allowing them to stay informed on transactions that are of particular interest or importance to them.

Personalized Financial Advice

Debank leverages advanced technologies, such as artificial intelligence and machine learning, to provide personalized financial advice to its users. Through analyzing the user’s financial data and spending patterns, Debank can offer tailored recommendations on savings, investments, and budgeting.

This personalized advice helps users make informed financial decisions and achieve their long-term financial goals.

In conclusion, Debank’s emphasis on personalization sets it apart from traditional banks. By allowing users to customize their banking experience, receive transaction notifications, and access personalized financial advice, Debank empowers individuals to take control of their finances and improve their overall financial well-being.

Sustainable Growth and Stability

One of the key benefits of Debank is its focus on sustainable growth and stability in the banking industry. Traditional banks often prioritize short-term profits and rapid expansion, which can lead to risky investments and irresponsible lending practices. This volatility can have disastrous consequences, as was seen in the 2008 financial crisis.

Debank, on the other hand, takes a more cautious and responsible approach to growth. It prioritizes long-term sustainability and stability, ensuring that it remains resilient even in times of economic downturns. By analyzing data and implementing risk management strategies, Debank is able to mitigate potential threats and maintain a solid foundation.

Moreover, Debank embraces transparency and accountability, two crucial factors for sustainable growth. By providing customers with detailed information about their investments and transactions, Debank fosters trust and confidence. This allows customers to make informed decisions and reduces the likelihood of fraudulent activities or hidden risks. The use of blockchain technology further enhances transparency, as all transactions are recorded on an immutable and decentralized ledger.

The sustainability and stability that Debank brings to the banking industry have numerous advantages. Firstly, it reduces the likelihood of market crashes and financial crises. By implementing robust risk management practices, Debank can identify potential threats and take proactive measures to mitigate them.

Furthermore, sustainable growth and stability benefit customers as well. They can have peace of mind knowing that their funds are being managed responsibly and with their best interests in mind. This encourages customer loyalty and fosters long-term relationships between Debank and its clients.

In conclusion, Debank is revolutionizing the banking industry by prioritizing sustainable growth and stability. Its cautious approach to expansion, transparency, and proactive risk management strategies make it a reliable and trustworthy option for customers. By promoting responsible banking practices, Debank is contributing to a more stable and resilient financial system.

Efficient Fund Management

One of the key benefits of using Debank is its efficient fund management system. With traditional banking methods, managing funds can be time-consuming and complicated. However, Debank streamlines this process by providing users with a user-friendly interface and advanced tools.

Using Debank, individuals and businesses can easily track and analyze their financial transactions, giving them a clear picture of their financial health. This allows users to make smarter financial decisions and optimize their fund allocation.

Real-time Monitoring

Debank’s real-time monitoring feature provides users with up-to-date information about their funds. Users can view their account balance, transaction history, and investment performance in real-time, allowing them to stay informed about their financial situation at all times.

This real-time monitoring feature is particularly beneficial for investors, as it helps them make timely investment decisions based on market trends and performance. It also allows them to quickly react to any potential risks or opportunities that arise.

Automation and Customization

Debank offers automation and customization features that simplify fund management. Users can set up automatic transfers, bill payments, and savings goals, saving them time and effort.

Additionally, Debank allows users to customize their dashboard and reports according to their preferences. This enables users to focus on the specific information that is most relevant to them, making fund management more efficient and effective.

In conclusion, Debank’s efficient fund management system simplifies the process of managing funds, providing users with real-time information, automation, and customization. This helps individuals and businesses make informed financial decisions and optimize their fund allocation.

Collaborative Banking Solutions

Debank is at the forefront of revolutionizing the banking industry by offering collaborative banking solutions. These solutions enable banks to work together, share resources, and combine their expertise to create a more efficient and customer-centric banking experience.

One of the key collaborative solutions offered by Debank is an interconnected network of banks that allows for seamless communication and cooperation. This network enables banks to share customer data, streamline processes, and improve the quality of their services.

Through collaborative banking solutions, banks can also pool their resources to develop new products and services. This includes sharing the cost of research and development and leveraging each other’s technological capabilities. By working together, banks can innovate faster and bring new solutions to market more quickly.

Another benefit of collaborative banking solutions is the ability to offer customers a wider range of services. With interconnected banks, customers can access a variety of products and services from different financial institutions, all within a single platform. This enhances convenience and allows customers to tailor their banking experience to their specific needs.

|

In addition, collaborative banking solutions help banks meet regulatory requirements more effectively. By working together, banks can pool their knowledge and resources to ensure compliance with regulations and improve overall risk management. |

Collaborative banking solutions also promote competition within the industry. By allowing banks to work together, they can leverage each other’s strengths and create a more competitive environment. This benefits customers by encouraging innovation and driving down costs. |

In conclusion, collaborative banking solutions offered by Debank are transforming the banking industry by fostering cooperation and innovation. These solutions enable banks to work together, share resources, and offer customers a more diverse range of products and services. By embracing collaborative banking, financial institutions can adapt to changing customer expectations and stay competitive in a rapidly evolving industry.

Future of Debank in the Industry

The future of Debank in the banking industry is incredibly promising. As more and more people become aware of the benefits and convenience of digital banking, the demand for innovative FinTech solutions will continue to grow. Debank is well-positioned to capitalize on this trend and revolutionize the way we bank.

One of the main advantages of Debank is its ability to provide a seamless and efficient banking experience. By leveraging the power of blockchain technology, Debank eliminates the need for intermediaries, streamlines transactions, and reduces costs. This not only benefits consumers by saving them time and money, but also creates a more secure and transparent banking system.

Additionally, Debank has the potential to reach underserved populations who currently lack access to traditional banking. With its inclusive and user-friendly platform, Debank can provide financial services to individuals who may not have access to a physical bank or who may have limited financial literacy. This can help promote financial inclusion and empower individuals to take control of their finances.

The future of Debank also holds exciting possibilities for partnerships and collaborations. As more financial institutions recognize the value of digital banking and seek ways to enhance their services, Debank can forge strategic alliances to expand its reach and offer even more innovative solutions. This could include integrations with existing banking infrastructure or partnerships with FinTech companies to combine their respective strengths.

Furthermore, as technology continues to evolve, Debank can leverage advancements in artificial intelligence and machine learning to enhance its capabilities. By analyzing vast amounts of data, Debank can provide personalized financial guidance and recommendations tailored to each individual’s unique needs and goals. This can help users make more informed financial decisions and improve their overall financial well-being.

In conclusion, the future of Debank in the banking industry looks promising. With its seamless and efficient banking experience, inclusive platform, and potential for partnerships and advancements in technology, Debank is poised to revolutionize the way we bank and shape the future of the industry.

FAQ:,

What is Debank?

Debank is a digital banking platform that aims to revolutionize the banking industry by offering a wide range of benefits to its users. It provides a seamless and convenient way to manage finances, make transactions, and access various banking services, all from the comfort of your smartphone or computer.

How does Debank revolutionize the banking industry?

Debank revolutionizes the banking industry by leveraging technology to provide a more efficient, convenient, and user-friendly banking experience. It eliminates the need for traditional brick-and-mortar bank branches by offering all banking services online. This allows users to access their accounts and carry out transactions at any time and from anywhere. Additionally, Debank utilizes advanced security measures to ensure the safety of users’ financial information.

What are the benefits of using Debank?

Using Debank offers several benefits to users. Firstly, it provides convenience by allowing users to manage their finances and perform transactions at any time and from anywhere. Users can easily check their account balance, transfer funds, pay bills, and more with just a few clicks. Secondly, Debank offers better interest rates on savings accounts and lower fees compared to traditional banks, saving users money in the long run. Lastly, Debank provides excellent customer service through its digital channels, ensuring prompt and efficient support.

Is Debank secure?

Yes, Debank takes security very seriously and utilizes advanced measures to ensure the safety of users’ financial information. It employs encryption technology to protect data during transmission, and implements robust authentication protocols to prevent unauthorized access to accounts. Additionally, Debank regularly updates its security systems to stay ahead of emerging threats and vulnerabilities in the ever-evolving digital landscape.