In today’s digital age, where technology is advancing at an exponential rate, the vulnerabilities of the traditional banking system have become a pressing concern. While modern banking systems offer convenience and accessibility to customers, they are not without their flaws. The rise of hacking and cybercrime has exposed the weaknesses inherent in these systems, leaving both individuals and financial institutions vulnerable to devastating attacks.

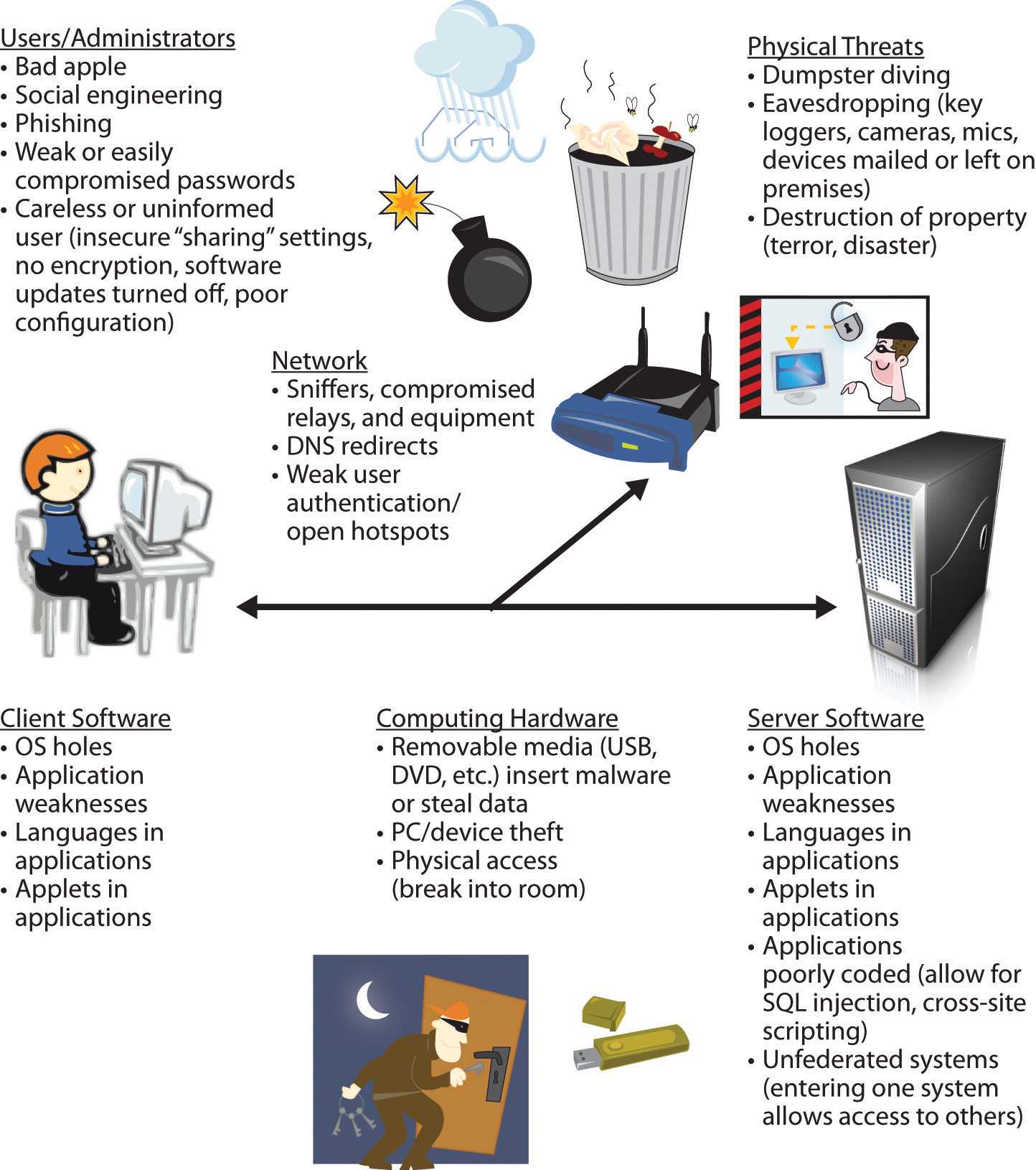

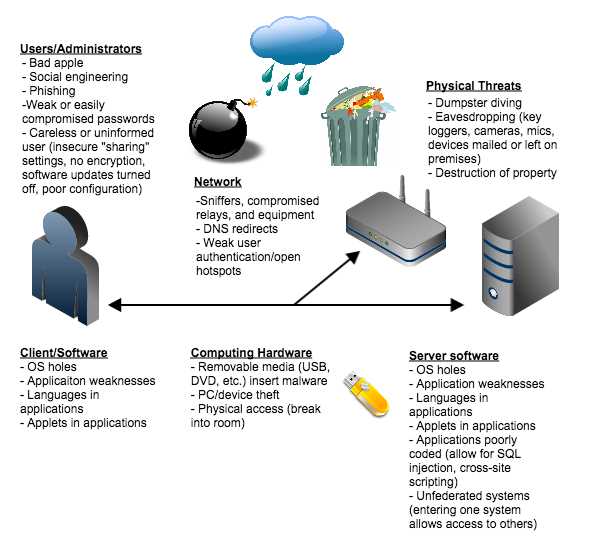

One of the key vulnerabilities of modern banking systems lies in their dependence on technology. From online banking platforms to mobile applications, these systems rely on a complex network of interconnected devices and software. Any weakness or vulnerability in this network can be exploited by cybercriminals to gain unauthorized access to sensitive information and funds. This vulnerability is compounded by the rapid evolution of technology, which often outpaces the ability of security measures to keep up.

Another weakness of modern banking systems is the human element. While banks invest heavily in security measures, they still rely on human employees to carry out their day-to-day operations. These employees may unintentionally open the door to cybercriminals through actions such as falling victim to phishing attacks or having their credentials compromised. Additionally, insiders with malicious intent can exploit their position of trust to gain access to confidential information or manipulate the system to their advantage.

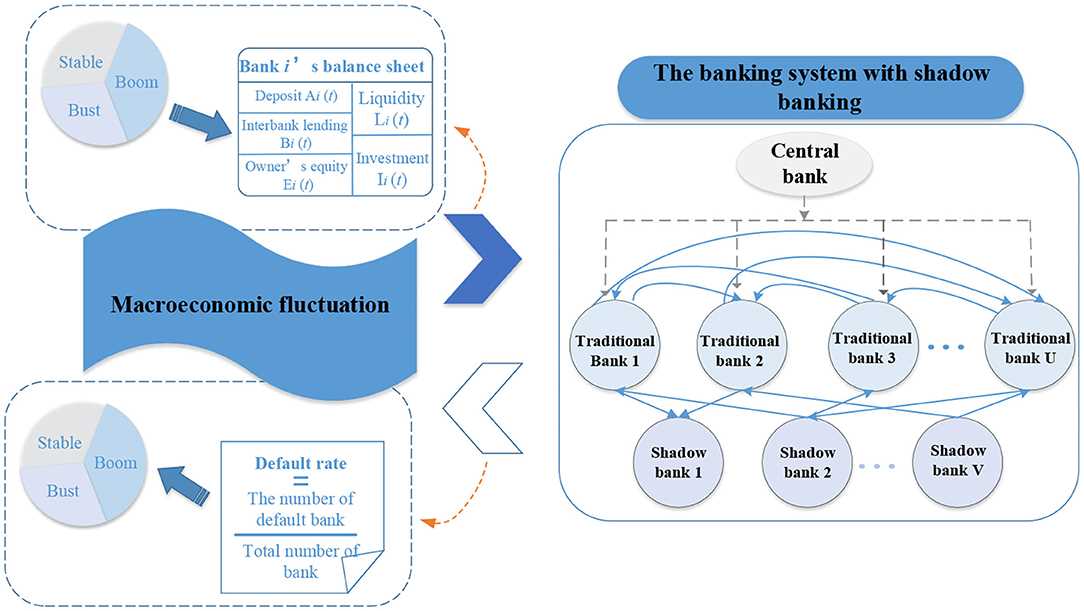

Furthermore, modern banking systems are often interconnected with other institutions and third-party service providers, creating additional vulnerabilities. A breach in one institution or service can have a cascading effect, spreading the impact of a cyberattack across the system. The interconnected nature of these systems also means that vulnerabilities in one component can be exploited to gain access to other components, potentially compromising the entire system.

In conclusion, the vulnerabilities of modern banking systems are a cause for concern and require continuous vigilance and improvement. From technology dependence to the human factor and interconnectedness, these weaknesses can be exploited by cybercriminals to devastating effect. It is crucial for financial institutions and individuals alike to stay informed, adopt robust security measures, and be vigilant in order to protect themselves against the evolving threats posed by modern banking vulnerabilities.

The Vulnerabilities of DeBank

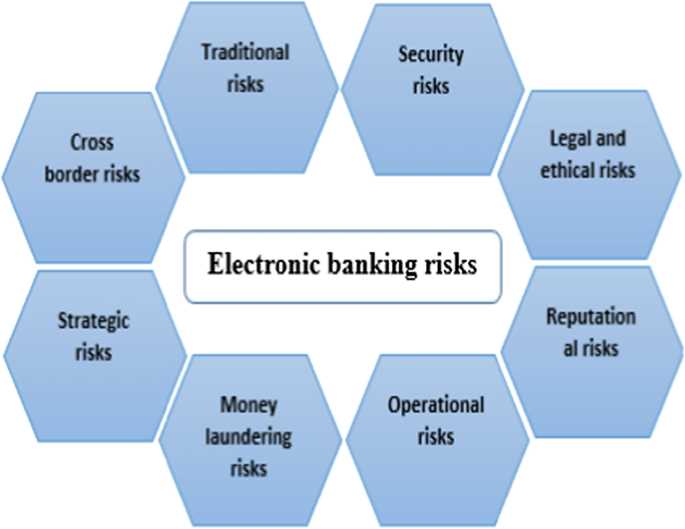

In today’s digital age, banking systems have become increasingly reliant on technology and interconnected networks. While this has brought numerous benefits and conveniences to customers, it has also exposed banks to various vulnerabilities and security risks. One such vulnerability is the potential for cyber attacks and data breaches.

Cyber Attacks

Cyber attacks have become a serious threat to the banking industry. Hackers are constantly developing new techniques to exploit weaknesses in banking systems and gain unauthorized access to sensitive financial information. They may use malware, phishing emails, or social engineering tactics to trick customers or bank employees into revealing their login credentials or other confidential data.

Once inside the system, hackers can potentially access and manipulate customer accounts, steal funds, or even commit identity theft. This not only puts customers at risk but can also have severe financial and reputational implications for banks.

Data Breaches

Data breaches have become a major concern for banks, as they can result in the exposure of sensitive customer information, such as names, addresses, social security numbers, and financial details. These breaches can occur due to vulnerabilities in the bank’s own systems or through third-party vendors and partners.

In the event of a data breach, banks must notify affected customers and take the necessary steps to mitigate the damage. This often involves providing credit monitoring services, reimbursing any fraudulent charges, and implementing stricter security measures to prevent future breaches.

Moreover, data breaches not only impact individual customers but can also lead to significant legal and regulatory consequences for banks. This includes fines, lawsuits, and damage to the bank’s reputation, which can have long-lasting effects on customer trust and loyalty.

- Weak Authentication and Authorization

- Insider Threats

- Third-Party Risks

- Emerging Technologies

Overall, while modern banking systems have revolutionized the way customers manage their finances, they are not without vulnerabilities. Banks must invest in robust cybersecurity measures, regularly update their systems, and stay vigilant against emerging threats in order to protect themselves and their customers from potential harm.

By addressing these vulnerabilities head-on, banks can continue to enhance the security and resilience of their systems, ultimately providing a safer and more reliable banking experience for all.

Exploring the Weaknesses

In today’s modern banking systems, there are various vulnerabilities that malicious actors can exploit. These weaknesses can have dire consequences and pose a significant threat to the security and stability of the financial industry.

Insufficient Authentication Measures

One of the key weaknesses in modern banking systems is the existence of insufficient authentication measures. Many banks still rely on outdated methods such as passwords and PINs, which can be easily compromised by hackers. This puts customer accounts at risk of unauthorized access and financial fraud.

Moreover, even when banks implement two-factor authentication, it is often not properly enforced or is susceptible to social engineering attacks. This allows skilled attackers to bypass the security measures and gain unauthorized access to sensitive financial information.

Inadequate Data Protection

Another weakness in modern banking systems is the inadequate protection of customer data. With the increasing digitization of financial transactions, banks collect and store vast amounts of personal and financial information. However, many banks fail to implement adequate data protection measures to safeguard this valuable data.

Insufficient encryption methods and poor data storage practices can expose customer data to unauthorized access. This can lead to identity theft, financial fraud, and other forms of cybercrime. Furthermore, data breaches not only harm individuals but also erode public trust in the banking system as a whole.

It is essential for banks to invest in robust data protection measures, including advanced encryption technologies, secure storage systems, and regular security audits.

Lack of Cybersecurity Awareness and Training

A significant weakness in modern banking systems is the lack of cybersecurity awareness and training among both bank employees and customers. Many cyberattacks are successful due to individuals falling victim to social engineering tactics or falling for phishing scams.

Banks should prioritize educating their employees and customers about best practices for online security. This includes recognizing suspicious emails, avoiding unsafe websites, and using strong, unique passwords. By raising awareness and providing regular training, banks can help mitigate the risks posed by social engineering attacks.

Conclusion

Exploring the weaknesses in modern banking systems is crucial for understanding the vulnerabilities that exist and taking steps to address them. With the increasing sophistication of cyber threats, banks must continuously adapt their security measures and invest in robust technologies to protect their customers and the integrity of the financial industry.

To learn more about the vulnerabilities and weaknesses of modern banking systems, you can visit debank.lu.

In Modern Banking Systems

The advancement of technology has transformed the traditional banking systems into modern banking systems. These systems have significantly enhanced the efficiency and convenience of banking services. However, they have also exposed vulnerabilities that can be exploited by hackers and cybercriminals.

One of the vulnerabilities in modern banking systems is the increasing reliance on digital platforms. Online banking and mobile applications have made banking more accessible, but they are also more susceptible to hacking and data breaches. Cybercriminals can exploit vulnerabilities in these platforms to gain unauthorized access to personal and financial information.

Another vulnerability is the interconnectedness of banking systems. Financial institutions are interconnected through networks and platforms, facilitating seamless transactions and transfers. However, this interconnectedness also means that a breach in one system can have far-reaching consequences, potentially affecting multiple banks and customers.

The use of third-party providers and vendors introduces another vulnerability in modern banking systems. Banks often rely on third-party companies for various services, such as payment processing or software development. While these partnerships can bring cost savings and expertise, they also introduce potential security risks. If a third-party provider is compromised, it can expose the bank’s systems and customer data to unauthorized access.

Additionally, the rise of digital currencies and blockchain technology has introduced new vulnerabilities in modern banking systems. While these technologies offer benefits such as faster and more secure transactions, they also present challenges in terms of regulatory compliance and security. The use of cryptocurrencies can attract criminals looking to exploit loopholes in the system and launder money.

To mitigate these vulnerabilities, banks and financial institutions must invest in robust cybersecurity measures. This includes regular security audits, employee training on cybersecurity best practices, and implementing multi-factor authentication. It is also crucial for banks to collaborate with regulators and industry professionals to stay updated on emerging threats and best practices.

While modern banking systems offer numerous advantages, they also present unique vulnerabilities that need to be addressed. By acknowledging and proactively addressing these vulnerabilities, banks can ensure the safety and security of their customers’ financial information in an increasingly digital and interconnected world.

Cybersecurity Risks

Cybersecurity is a major concern for modern banking systems, as they are constantly targeted by cybercriminals due to the significant financial assets and personal data they possess. With the increasing reliance on technology in banking, the risks are also evolving and becoming more sophisticated.

1. Data Breaches

One of the primary cybersecurity risks in modern banking is the threat of data breaches. These breaches can occur due to various reasons, such as hacking, phishing attacks, or malware infections. When sensitive customer data such as financial information, social security numbers, or login credentials are compromised, it can lead to identity theft, financial fraud, and other serious consequences. Banks need to invest in robust security measures to protect their systems and customers’ data.

2. Malware and Ransomware Attacks

Malware and ransomware attacks pose a significant threat to the security of banking systems. Cybercriminals can use malicious software to gain unauthorized access to banking networks, steal sensitive information, or disrupt banking operations. Ransomware attacks, in particular, can be devastating as they can encrypt critical data and demand a ransom for its release. Banks must implement strong anti-malware solutions and regularly update their security protocols to mitigate the risks posed by these attacks.

In addition to these primary risks, other cybersecurity threats include phishing scams, social engineering attacks, and insider threats. Phishing scams aim to deceive customers into revealing their personal information, while social engineering attacks target both customers and employees to gain unauthorized access to systems. Insider threats can occur when malicious individuals within the bank exploit their access privileges for personal gain or to compromise system security.

In conclusion, cybersecurity risks in modern banking systems are ever-evolving and require constant vigilance and investment in robust security measures. Banks need to stay updated with the latest cyber threats and technologies to protect their systems, customers’ data, and maintain trust in the banking industry.

Emerging Technologies

As modern banking systems continue to evolve, emerging technologies play a crucial role in shaping the future of the industry. These technologies have the potential to revolutionize the way we handle finances, improve security measures, and enhance the overall customer experience.

Blockchain

One of the most prominent emerging technologies in the banking sector is blockchain. This decentralized and secure technology provides a transparent and tamper-proof platform for transactions. By eliminating the need for intermediaries and enhancing data integrity, blockchain has the potential to streamline processes, reduce costs, and enhance security in the banking industry.

Artificial Intelligence

Another groundbreaking technology in the banking sector is artificial intelligence (AI). AI-powered systems and algorithms enable banks to automate various customer services, such as chatbots for customer support and personal financial management apps. By leveraging AI, banks can provide personalized recommendations, assist in fraud detection, and streamline data analysis to offer tailored financial solutions.

| Technology | Benefits |

|---|---|

| Blockchain |

|

| Artificial Intelligence |

|

While these emerging technologies offer numerous benefits, they also introduce new vulnerabilities. It is crucial for banks and financial institutions to carefully assess and address these vulnerabilities to ensure the security and reliability of the banking systems they deploy.

Social Engineering Attacks

Social engineering attacks are a type of deception that manipulates individuals into divulging confidential information or performing actions that could compromise the security of a banking system. These attacks exploit human psychology and trust to exploit vulnerabilities in the modern banking system.

Types of Social Engineering Attacks

There are several common types of social engineering attacks that target both customers and employees of banks:

- Phishing: Phishing attacks involve sending fraudulent emails or messages that appear to be from a legitimate source, such as a bank. These messages often trick recipients into clicking on malicious links or providing personal and financial information.

- Pretexting: Pretexting involves creating a fake scenario or identity to deceive individuals into revealing sensitive information. For example, a perpetrator may pose as a bank employee and request account details under the pretense of resolving an issue.

- Baiting: Baiting attacks involve enticing individuals with the promise of a reward or benefit in exchange for performing an action. For instance, a criminal might offer a prize in exchange for login credentials, leading to unauthorized access.

- Quid pro quo: Quid pro quo attacks involve offering a service or benefit in exchange for sensitive information. This can include promising a special financial opportunity in return for account details or passwords.

Impact and Prevention

Social engineering attacks pose a significant threat to the security of modern banking systems. They can lead to unauthorized access, data breaches, financial loss, and reputational damage. To mitigate the risk of social engineering attacks, banks must implement strong security measures:

- Education and Awareness: Banks should educate customers and employees about the types of social engineering attacks and how to recognize and report suspicious behavior. This includes training individuals to verify the legitimacy of requests for personal information.

- Multi-factor Authentication: Implementing multi-factor authentication can provide an additional layer of security by requiring users to provide multiple forms of identification before accessing accounts or performing transactions.

- Monitoring and Detection: Banks should employ advanced monitoring systems to detect suspicious patterns or behaviors that may indicate a social engineering attack. This can involve analyzing account activity, network traffic, and user behavior.

- Robust Policies and Procedures: Banks must establish and enforce stringent policies and procedures for handling sensitive information, including verifying identities, limiting access privileges, and regularly updating security protocols.

By addressing the vulnerabilities associated with social engineering attacks, banks can enhance the overall security of their systems and maintain customer trust and confidence in their services.

Data Breaches

Data breaches are a major concern in modern banking systems. They occur when unauthorized individuals gain access to sensitive information stored by a bank, such as customer data, financial information, or login credentials. These breaches can have severe consequences for both banks and their customers.

One common vulnerability that can lead to data breaches is weak security measures. Banks must implement robust security protocols, including secure firewalls, encryption, and multi-factor authentication, to protect customer data from unauthorized access. However, when these security measures are not properly implemented or regularly updated, hackers can exploit these weaknesses and gain unauthorized access to sensitive information.

Types of Data Breaches

Data breaches can occur in various ways. Some of the most common types include:

- Phishing Attacks: Hackers use deceptive tactics, such as sending fake emails or creating fake websites, to trick customers into providing their login credentials or other sensitive information.

- Malware Attacks: Malicious software, such as viruses or ransomware, can be used to gain unauthorized access to a bank’s systems and steal sensitive information.

- Insider Threats: Employees or contractors with access to sensitive data may misuse their privileges and deliberately leak or steal confidential information.

- Third-Party Compromises: Banks often work with third-party vendors or partners who may have access to customer data. If these third parties have inadequate security measures in place, it can result in a data breach.

It is important for banks to be vigilant and proactive in identifying and addressing vulnerabilities to prevent data breaches. Regular security audits, employee training, and advanced threat detection systems can help mitigate the risk of data breaches and protect customer information from falling into the wrong hands.

Weak Authentication

One of the major vulnerabilities in modern banking systems is weak authentication. Authentication is the process of confirming the identity of a user or system. In the context of banking, authentication is crucial for ensuring that only authorized individuals have access to sensitive financial information and transactions.

However, weak authentication mechanisms can make it easier for attackers to gain unauthorized access to a user’s banking account. This can lead to financial loss, identity theft, and other malicious activities.

Some common examples of weak authentication include the use of weak passwords, lack of multi-factor authentication, and the use of outdated authentication technologies. Weak passwords are easy for attackers to guess or crack, especially if they use common words or simple combinations of characters.

Additionally, the absence of multi-factor authentication is another weakness in many banking systems. Multi-factor authentication adds an extra layer of security by requiring users to provide multiple pieces of evidence to prove their identity, such as a password and a unique code sent to their mobile device. Without this additional layer of protection, a single stolen or compromised password can grant an attacker full access to a user’s banking account.

Outdated authentication technologies, such as static PIN numbers or easily replicable physical tokens, also pose a significant risk. These methods can be easily bypassed or manipulated by attackers, as they lack the robust security features and encryption protocols of modern authentication systems.

To mitigate the vulnerabilities associated with weak authentication, banks and financial institutions should prioritize the implementation of strong password policies, enforce the use of multi-factor authentication, and regularly update their authentication systems to incorporate the latest security technologies.

Overall, addressing the weaknesses in authentication is crucial for enhancing the security and resilience of modern banking systems.

Insufficient Password Policies

One of the major vulnerabilities in modern banking systems is the presence of insufficient password policies. Weak password policies can make it easier for hackers to gain unauthorized access to sensitive financial information and carry out fraudulent activities.

1. Weak Password Requirements

One common issue is the lack of strong password requirements. Many banks still allow customers to set weak passwords that are easily guessable or crackable. This includes passwords that are too short, lack complexity, or contain common words or phrases.

For example, a bank may allow users to set passwords that are only six characters long and do not require a combination of letters, numbers, and special characters. This makes it easier for attackers to use brute-force methods or common password lists to gain access to accounts.

2. Lack of Password Rotation

Another vulnerability is the lack of password rotation policies. Some banks do not require customers to change their passwords regularly, leaving accounts vulnerable to attacks for extended periods of time. This is especially problematic if a user’s password is compromised but they are unaware of it.

Banks should implement password rotation policies that prompt users to change their passwords at regular intervals, such as every 60 or 90 days. This can help mitigate the risk of unauthorized access and protect customer accounts from being compromised.

3. Inadequate Account Lockout Mechanisms

Additionally, insufficient account lockout mechanisms can make it easier for attackers to gain unauthorized access. Some banks do not enforce temporary account lockouts after a certain number of failed login attempts, allowing attackers to repeatedly guess passwords without consequence.

- Banks should implement account lockouts after a certain number of failed login attempts, such as locking an account for 30 minutes after five unsuccessful attempts.

- This can help prevent brute-force attacks and deter attackers from gaining unauthorized access to user accounts.

Overall, banks need to strengthen their password policies to ensure the security of customer accounts. This includes implementing strong password requirements, requiring regular password rotations, and enforcing account lockout mechanisms after multiple failed login attempts.

Multi-Factor Authentication

Ensuring the security and privacy of customer data is a paramount concern for banks and financial institutions. One of the key components in strengthening the defense against potential threats is the use of multi-factor authentication (MFA) systems. MFA provides an additional layer of security by requiring users to provide multiple forms of identification before granting access to their accounts.

How does it work?

MFA typically combines two or more of the following factors:

1. Something you know:

This factor involves a knowledge-based authentication method, where users are required to provide something only they know, such as a password, PIN, or answer to a security question.

2. Something you have:

This factor relies on possession of a physical object, such as a smart card, security token, or mobile device, which generates a one-time password (OTP).

3. Something you are:

This factor involves using biometric authentication measures, including fingerprint or iris recognition, voice or facial identification, to verify the user’s identity.

MFA significantly reduces the risk of unauthorized access to accounts, as it requires potential attackers to possess multiple factors to gain entry. Even if one factor is compromised, the extra layer of authentication acts as an additional deterrent, making it much harder for attackers to breach the system.

The Benefits of Multi-Factor Authentication

Implementing MFA can provide several advantages to banks and their customers:

– Enhanced security: MFA significantly strengthens the security of online banking systems, making it more difficult for cybercriminals to gain access to sensitive information and carry out fraudulent activities.

– Protection against credential theft: With the growing prevalence of data breaches and password leaks, MFA adds an extra safeguard against malicious actors who attempt to use stolen credentials.

– User convenience: While MFA introduces an additional step during the login process, advancements in technology have made it more convenient for users to authenticate their identities using various methods, such as biometrics or mobile apps.

In conclusion, multi-factor authentication offers an effective and efficient solution to combat the vulnerabilities in modern banking systems. By implementing MFA, banks can greatly enhance the security of customer data and protect against cyber threats in an ever-evolving digital landscape.

Biometric Authentication

Biometric authentication refers to the use of unique human characteristics, such as fingerprints, facial features, or iris patterns, to verify the identity of an individual. This technology provides an additional layer of security in modern banking systems.

One of the main advantages of biometric authentication is its high level of accuracy. Unlike passwords or PINs, which can be easily forgotten or stolen, biometric attributes cannot be easily replicated. Each person’s biometric data is unique, making it extremely difficult for unauthorized individuals to gain access to sensitive information or perform fraudulent transactions.

Moreover, biometric authentication offers convenience for users. With the integration of biometric sensors in mobile devices, individuals can now easily authenticate themselves by simply using their fingerprint or scanning their face. This eliminates the need to remember complex passwords or carry around physical tokens, making the authentication process quicker and more user-friendly.

Despite its advantages, biometric authentication is not without vulnerabilities. One concern is the potential for biometric data to be hacked or compromised. If a bank’s biometric database is breached, it could result in the theft of sensitive biometric information, which cannot be changed like passwords can. To mitigate this risk, banks must implement robust security measures to protect biometric data, such as encryption and the use of secure servers.

Another challenge is the accuracy and reliability of biometric sensors. Factors such as poor image quality, environmental factors, or physical changes in an individual’s biometric features can lead to false rejects or false accepts. To address this, banks need to regularly update their biometric systems and conduct thorough testing to ensure reliable and accurate authentication.

In conclusion, while biometric authentication presents significant advantages in terms of security and convenience, banks must also be aware of the vulnerabilities associated with its implementation. By employing strong security measures and continuously improving biometric technology, banks can leverage this authentication method to enhance the overall security of modern banking systems.

Insider Threats

One of the significant vulnerabilities in modern banking systems is the presence of insider threats. Insider threats refer to the risks posed by individuals who have authorized access to sensitive information or critical banking systems. These individuals could be employees, contractors, or partners who misuse their privileges for illicit activities.

The actions of insiders can range from unintentional mistakes to intentional and malicious activities. Some common examples include:

- Employee negligence: Employees may unknowingly compromise sensitive data by mishandling it or failing to follow proper security protocols.

- Employee misconduct: Employees with malicious intent can abuse their access rights to steal or manipulate data for personal gain or to aid external attackers.

- Insider collusion: Multiple insiders, working together, can orchestrate an attack to bypass security measures and gain unauthorized access.

- Insider trading: In financial institutions, employees with access to privileged information may engage in illegal insider trading activities.

Insider threats pose a significant challenge to modern banking systems due to their unique characteristics. Unlike external hackers, insiders already have authorized access, making it easier for them to exploit vulnerabilities without raising suspicion. Furthermore, insiders often have a deeper understanding of internal systems and security measures, allowing them to bypass controls more effectively.

To mitigate insider threats, banks and financial institutions employ several strategies:

- Implement strict access control policies: Banks should carefully manage user access rights, granting privileges on a need-to-know basis and regularly reviewing and revoking access when necessary.

- Monitor and audit user activities: Continuously monitoring and logging user activities can help detect any suspicious behavior and provide evidence in case of an incident.

- Implement segregation of duties: Separating critical tasks and ensuring that no single individual has complete control over a process can minimize the risk of insider collusion.

- Provide comprehensive security awareness training: Education and training programs can help employees understand the importance of security, identify potential threats, and report any suspicious activities.

- Regularly conduct risk assessments and security audits: Periodic evaluations of existing security measures can help identify vulnerabilities and implement necessary improvements.

Overall, addressing insider threats is crucial for ensuring the security and integrity of modern banking systems. By implementing robust security measures and promoting a culture of security awareness, banks can reduce the risks associated with insider threats and protect their customers’ assets.

FAQ:,

What are some of the vulnerabilities in modern banking systems?

Some of the vulnerabilities in modern banking systems include cyber attacks, data breaches, insider threats, and infrastructure failures.

How do cyber attacks affect modern banking systems?

Cyber attacks can disrupt banking systems and compromise sensitive customer data. They can lead to financial losses for both the bank and its customers.

What is an insider threat in the context of banking systems?

An insider threat refers to the risk posed by individuals within the organization who have authorized access to sensitive data, but use it maliciously or negligently.

How can modern banking systems protect against vulnerabilities?

Modern banking systems can protect against vulnerabilities by implementing strong cybersecurity measures, conducting regular risk assessments, and educating employees and customers about security best practices.