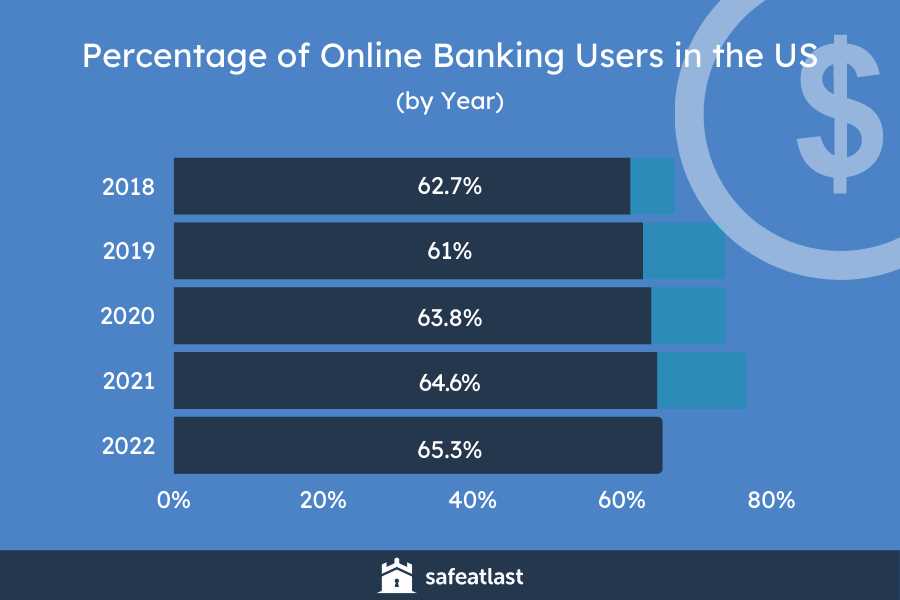

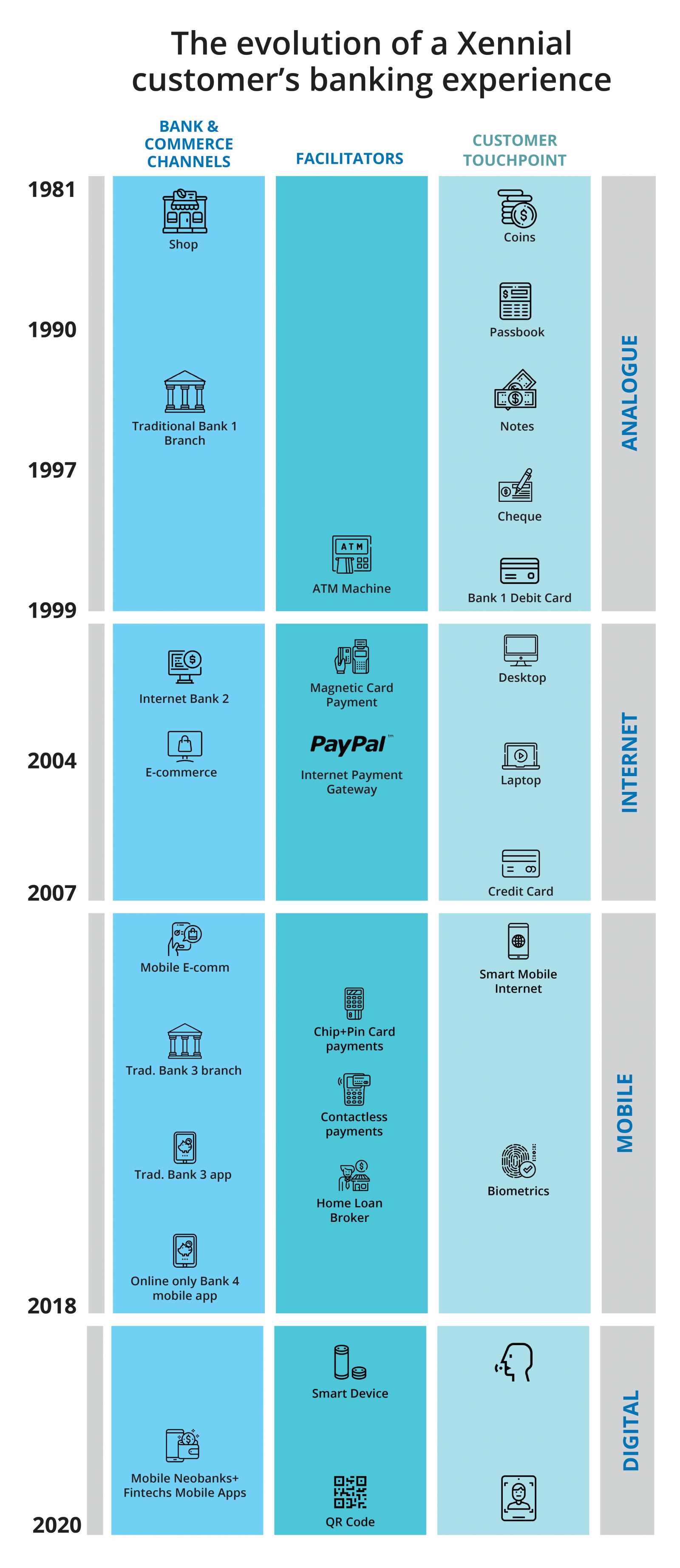

In the fast-paced world of digital banking, staying up to date with the latest innovations and trends is crucial. One such innovation that has gained significant attention is debank. Debank refers to the process of moving away from traditional brick-and-mortar banks and embracing the digital banking revolution. This article will provide you with all the essential information you need to know about debanking and how it is transforming the banking industry.

Debank offers several advantages over traditional banking methods. First, it provides convenience and accessibility. With debank, you no longer need to visit a physical bank branch or wait in long queues. Instead, you can handle all your banking needs from the comfort of your own home or on the go, using your smartphone or computer.

Another significant advantage of debanking is the cost savings. Traditional banks often have high fees and charges, but with digital banking, these costs are usually lower or even non-existent. This means that you can save money on transaction fees, account maintenance fees, and other related expenses.

In addition to the convenience and cost savings, debank also offers enhanced security. Digital banks employ state-of-the-art encryption and authentication measures to ensure the safety of your personal and financial information. This level of security gives you peace of mind, knowing that your data is protected against potential threats.

Overall, debanking is revolutionizing the way we manage our finances. It provides convenience, cost savings, and enhanced security. As digital banking continues to evolve, it is essential to stay informed about the latest advancements and trends in this rapidly changing landscape.

What is Debank?

Debank is an online banking platform that aims to revolutionize the way we manage our finances in the digital age. With the increasing popularity of internet banking, Debank provides a secure and convenient way for individuals and businesses to access and control their money.

Unlike traditional banks, Debank operates solely online, allowing customers to perform all their banking activities from the comfort of their own homes or offices. This eliminates the need for physical branches and offers a more efficient and streamlined experience.

Debank offers a range of services, including but not limited to:

-

Online Payments: Users can make quick and secure payments to individuals or businesses using Debank’s online payment system.

-

Account Management: Customers can easily manage their accounts, view their balances and transaction histories, and set up automatic payments and transfers.

-

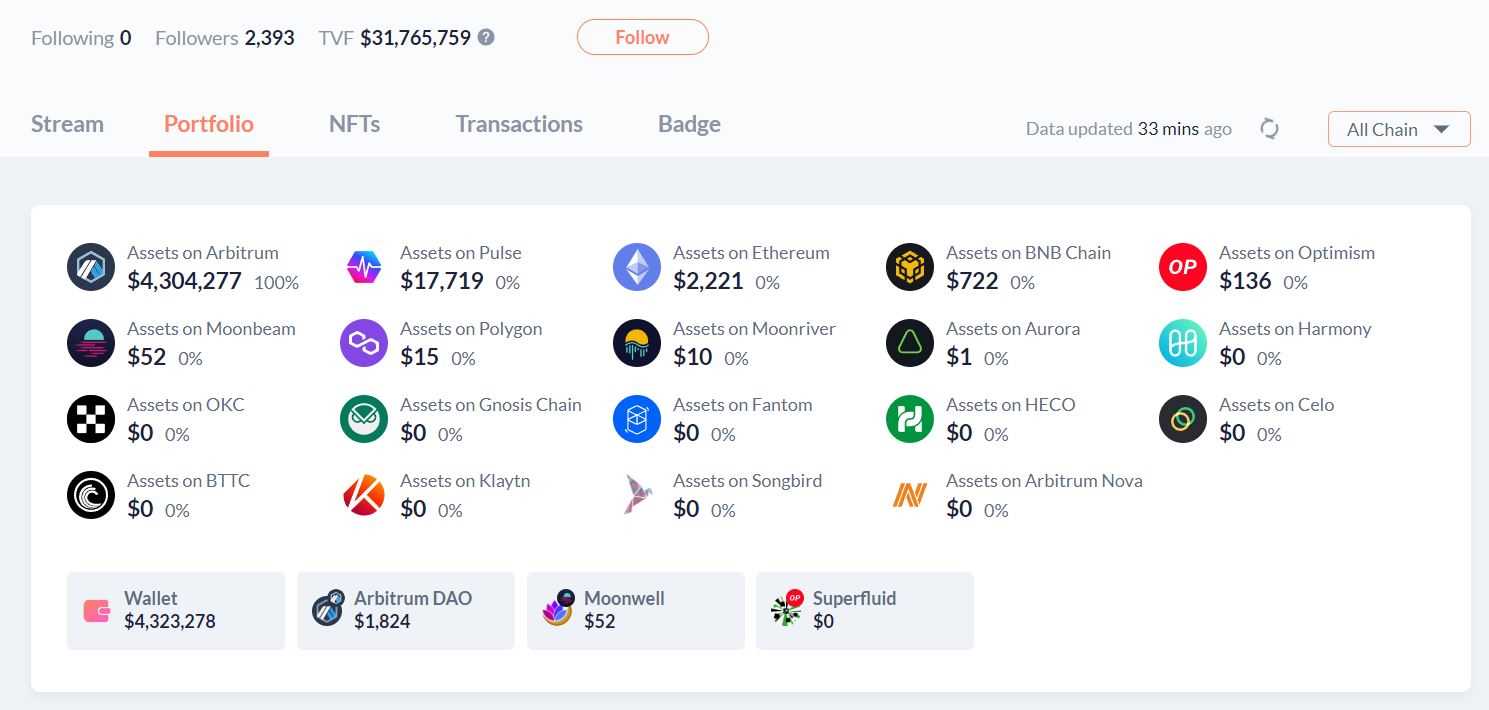

Investment Opportunities: Debank provides users with a platform to explore investment opportunities and manage their portfolios. For more information, visit the Portfolio debank.

Security and Privacy

Debank takes the security and privacy of its customers’ information very seriously. The platform uses advanced encryption technologies to protect sensitive data and implements strict security measures to prevent unauthorized access.

Furthermore, Debank adheres to strict data protection regulations and only collects and stores the necessary information required for account management and transaction processing.

The Future of Banking

With the rise of digital banking and the increasing demand for convenient financial services, Debank is at the forefront of the future of banking. By embracing technological advancements, Debank aims to simplify banking processes, enhance accessibility, and provide a seamless and secure banking experience for all its customers.

Benefits of Debank in the Digital Age

In the digital age, traditional banking methods are becoming outdated and inefficient. Debank, a digital banking platform, offers numerous benefits that cater to the needs of the modern individual. Here are some of the key advantages of using Debank:

1. Convenience

Debank allows users to access and manage their finances anytime, anywhere. With the use of mobile applications and online platforms, individuals no longer need to visit physical bank branches or wait in long queues. Debank provides a user-friendly interface that allows customers to perform various banking transactions with just a few clicks. This convenience saves time and makes banking more accessible for everyone.

2. Enhanced Security

Debank prioritizes the security of its customers’ information and transactions. With advanced encryption and authentication methods, the platform ensures that sensitive data remains confidential and protected from unauthorized access. Additionally, Debank implements multi-factor authentication and biometric identification technologies, such as fingerprint or facial recognition, for added security. This gives users peace of mind and confidence in conducting their banking activities in the digital realm.

Furthermore, Debank offers real-time notifications and alerts to keep users informed about any suspicious activities or potential fraud. This proactive approach allows customers to take immediate action and prevent any unauthorized transactions.

Overall, Debank’s security measures go above and beyond traditional banking methods, providing a safe and trustworthy digital banking experience.

In conclusion, Debank offers a wide range of benefits that align with the demands of the digital age. Its convenience, enhanced security measures, and user-friendly interface make it an attractive choice for individuals seeking a more efficient and accessible banking experience.

How Debank Works

Debank is a revolutionary platform that combines the convenience of digital banking with the security of traditional banking. With Debank, you can manage all of your financial accounts in one place, making it easier than ever to stay in control of your finances.

1. Connect Your Accounts

The first step to using Debank is to connect your existing bank accounts to the platform. Debank uses industry-leading security measures to ensure that your sensitive information is protected. Once your accounts are connected, you will be able to view all of your balances and transactions in one place.

2. Track Your Spending

Debank provides powerful tools for tracking your spending and budgeting. You can categorize your transactions, set spending limits, and receive notifications when you approach your limits. By visualizing your spending habits, you can make smarter financial decisions and avoid unnecessary expenses.

3. Set Goals and Save

Debank allows you to set financial goals and track your progress towards them. Whether you’re saving for a vacation, a new car, or a down payment on a house, Debank can help you stay on track. You can set up automatic transfers to your savings account and monitor your savings growth over time.

4. Pay Bills and Transfer Money

With Debank, you can pay bills and transfer money to other accounts seamlessly. Say goodbye to the hassle of writing checks or visiting multiple banking websites. Debank makes it easy to manage all of your payments and transfers in one place.

5. Stay Informed

Debank provides you with important updates and insights about your finances. You can receive notifications about upcoming bills, low balances, or suspicious activity. With Debank, you’ll always be in the know.

Overall, Debank is a game-changer in the world of digital banking. Its intuitive interface, robust features, and industry-leading security make it the perfect tool for managing your finances in the age of digital banking.

Security Measures of Debank

Security is a top priority at Debank, as we understand the importance of keeping our users’ financial information safe and secure. We have implemented a number of stringent security measures to protect against any potential risks or threats.

Encryption and Data Protection

All user data is encrypted at rest and in transit using the most secure encryption algorithms available. This ensures that even if there is a breach, the data remains protected and unreadable to unauthorized individuals.

Two-Factor Authentication (2FA)

We strongly encourage our users to enable two-factor authentication for their accounts. This adds an extra layer of security by requiring a second form of verification, such as a unique code sent to their mobile device, in addition to their regular login credentials.

More importantly, Debank does not store any user 2FA codes on its servers, further safeguarding against any potential compromises.

Regular Security Audits and Penetration Testing

To ensure the continued effectiveness of our security measures, we conduct regular security audits and penetration testing. This allows us to identify any vulnerabilities in our systems and address them before they can be exploited.

Secure Infrastructure

Our platform is hosted on highly secure servers with a robust infrastructure. These servers are located in geographically distributed data centers and are protected by physical security measures, such as 24/7 monitoring, firewalls, and access controls.

User Education

We believe that user education is crucial in maintaining a secure environment. We provide educational resources and best practice guidelines to our users to help them understand potential risks and how to protect themselves from common threats.

- We emphasize the importance of creating strong, unique passwords and regularly updating them.

- We warn against sharing sensitive information, such as login credentials or personal details, through unsecured channels.

- We encourage users to be vigilant about phishing attempts and to report any suspicious activities.

By implementing these security measures and promoting user awareness, Debank strives to provide a safe and secure digital banking experience for all users.

Integration of Debank with Other Financial Apps

Debank, the leading digital banking platform, offers seamless integration with other financial apps, providing users with a comprehensive and connected financial ecosystem. Through its open API, Debank allows users to link their accounts and access a wide range of financial services all in one place.

By integrating with other financial apps, Debank enables users to view their account balances, transaction history, and make payments directly from the platform. This eliminates the need to switch between multiple apps, saving time and providing a more convenient banking experience.

Furthermore, the integration of Debank with other financial apps allows for a more holistic view of personal finances. Users can aggregate their accounts from various banks and financial institutions, providing a comprehensive overview of their financial health. This enables better budgeting and financial planning, as users can easily track their income, expenses, and savings across different accounts.

In addition to traditional banking services, Debank’s integration with other financial apps also extends to investment and wealth management. Users can link their investment accounts, allowing them to monitor their portfolio performance and execute trades directly from the platform. This seamless integration provides users with a comprehensive view of their financial investments and simplifies the management of their investment portfolios.

Moreover, the integration of Debank with other financial apps opens up opportunities for innovative third-party services. Users can take advantage of advanced financial tools, such as expense tracking apps, personal finance management apps, and even AI-driven financial advisors, all within the Debank platform. This integration not only enhances the user experience but also promotes financial literacy and helps users make informed financial decisions.

|

Integration with other financial apps also provides enhanced security measures. With Debank acting as a central hub, users can authenticate their accounts and transactions through a single sign-on process. This adds an extra layer of security, reducing the risk of unauthorized access and fraud. |

In conclusion, the integration of Debank with other financial apps offers users a comprehensive and connected financial ecosystem. Users can access a wide range of financial services, including banking, investments, and third-party tools, all within the Debank platform. This integration not only saves time and enhances convenience but also promotes financial health and helps users make informed financial decisions.

Debank: The Future of Banking

In today’s digital age, traditional banking is being reimagined and reshaped by technological advancements. One of the most exciting innovations in the banking industry is Debank, which promises to revolutionize the way we conduct our financial transactions.

Debank, short for “Digital Banking,” is an online platform that combines the convenience of traditional banking with the efficiency and security of digital technology. It allows users to access their accounts, make payments, transfer funds, and perform other financial activities online, eliminating the need for physical bank branches.

With Debank, customers can enjoy a seamless and personalized banking experience. They can access their accounts from anywhere, at any time, using their mobile devices or computers. This means no more waiting in long queues at the bank or dealing with limited banking hours.

Furthermore, Debank leverages advanced encryption and authentication techniques to ensure the security and privacy of users’ personal and financial information. It employs robust cybersecurity measures to protect against fraud and unauthorized access, giving customers peace of mind that their money and data are safe.

Another key feature of Debank is its ability to integrate with other financial services and apps. This means that users can connect their bank accounts to budgeting apps, investment platforms, and other financial tools, allowing them to manage all their financial activities in one place.

In addition to these benefits, Debank is also committed to financial inclusivity. It aims to provide banking services to underserved populations who may not have access to traditional banks. By leveraging technology, Debank can reach these individuals and offer them the financial tools they need to participate in the digital economy.

In conclusion, Debank is set to be the future of banking. By combining the best of traditional banking with the advancements of digital technology, it offers a convenient, secure, and inclusive banking experience. As more people embrace the digital age, we can expect Debank to play a significant role in shaping the future of the banking industry.

Debank’s Impact on Traditional Banking

In the age of digital banking, Debank has emerged as a disruptive force that is reshaping the traditional banking landscape. With its innovative approach to financial services, Debank is challenging the status quo and forcing traditional banks to adapt or risk becoming obsolete.

One of the key ways that Debank is impacting traditional banking is through its emphasis on convenience and accessibility. Unlike traditional banks, which often require customers to visit physical branches and endure long wait times, Debank allows users to access their accounts and perform transactions from anywhere, at any time. This level of convenience is attracting a new generation of customers who value speed and efficiency.

In addition to convenience, Debank is also offering a wider range of services and features than traditional banks. Through its digital platform, customers can not only perform basic banking transactions, but also access investment opportunities, insurance products, and other financial services. This diversification of offerings is attracting customers who want a one-stop-shop for all their financial needs.

Furthermore, Debank is capitalizing on the power of technology and data to personalize the banking experience. By leveraging advanced analytics and machine learning algorithms, Debank is able to gain insights into customer behavior and preferences, allowing it to offer tailored recommendations and personalized offers. This level of customization was previously unheard of in traditional banking, where customers were often treated as a one-size-fits-all group.

However, Debank’s impact on traditional banking is not without its challenges. Traditional banks are facing the pressure to adapt and digitize their operations in order to compete with Debank. This requires significant investments in technology infrastructure and human resources. Additionally, concerns around security and privacy are also a factor that traditional banks need to address in order to win back customer trust.

In conclusion, Debank’s impact on traditional banking is undeniable. Its emphasis on convenience, broader range of services, and personalized experience are revolutionizing the industry. Traditional banks must embrace the digital revolution and evolve their business models to stay relevant in this new era of banking.

Challenges and Risks of Using Debank

While Debank offers many advantages and convenience in the age of digital banking, it also presents some challenges and risks that users should be aware of.

1. Security Concerns

One of the primary risks associated with using Debank is security concerns. As a digital platform, Debank relies on encryption and other security measures to protect user information. However, no system is completely foolproof, and there is always a risk of data breaches or hacking attempts. Users should be cautious about sharing sensitive information and ensure that they are using secure devices and networks when accessing their Debank accounts.

2. Limited Services

While Debank offers a range of banking services, it may not provide all the financial services that traditional banks offer. Users may find that certain types of accounts, investment products, or specialized services are not available on Debank. It is important for users to assess their banking needs and determine if Debank is suitable for their specific requirements.

3. Regulatory Challenges

Debank operates within the framework of existing financial regulations, but the rapidly growing digital banking sector often faces challenges in terms of regulatory compliance. Changes in legislation or new regulations could impact the operations of Debank and potentially affect users’ access to services or the level of protection provided. Users should stay informed about any regulatory changes that may affect their Debank accounts and adjust their banking strategies accordingly.

In summary, using Debank offers many benefits, but it is not without its challenges and risks. Users should carefully assess the security measures in place, consider the limitations of services offered, and stay informed about any regulatory challenges that may arise. By understanding these risks and taking appropriate precautions, users can make the most of the convenience and opportunities provided by Debank in the age of digital banking.

FAQ:,

What is Debank?

Debank is a digital banking platform that allows users to manage their finances online. It offers a range of services, including checking and savings accounts, credit cards, and loans.

How can I open an account with Debank?

To open an account with Debank, you can visit their website and fill out an online application. You will need to provide personal information, such as your name, address, and social security number. Once your application is approved, you will be able to access your account online.

What are the advantages of using Debank?

There are several advantages of using Debank. First, it offers convenience and flexibility, as you can access your account anytime, anywhere. Second, it provides a range of financial services, allowing you to manage all aspects of your finances in one place. Third, it offers competitive interest rates and low fees. Finally, Debank is committed to keeping your personal and financial information secure.

Is my money safe with Debank?

Yes, your money is safe with Debank. It is a regulated financial institution and takes several measures to ensure the security of your funds. These measures include state-of-the-art encryption technology, multi-factor authentication, and regular monitoring of transactions for suspicious activity. Additionally, Debank is a member of the FDIC, which means that your deposits are insured up to $250,000 per depositor.