As the millennial generation continues to shape the future of banking, it’s no surprise that they are looking for innovative solutions that cater to their unique needs. Debank has emerged as the go-to solution for millennials, offering a range of features and benefits that are tailored to this tech-savvy and mobile-first generation.

One of the key reasons why Debank has become so popular among millennials is its user-friendly interface. With a clean and intuitive design, Debank makes it easy for millennials to manage their finances, track their expenses, and make payments with just a few taps on their smartphones. This ease of use is crucial for a generation that values convenience and efficiency.

In addition to its user-friendly interface, Debank also offers a range of features that are specifically designed to address the financial needs of millennials. For example, Debank allows users to set financial goals, track their progress, and receive personalized recommendations to help them achieve their goals. This level of customization and personalization is highly valued by millennials, who are looking for tailored solutions that suit their individual circumstances.

Another key feature that sets Debank apart from traditional banks is its focus on financial education. Debank offers a wealth of educational resources, including articles, videos, and webinars, to help millennials improve their financial literacy and make informed decisions about their money. This commitment to financial education reflects Debank’s understanding that millennials want more than just a banking app – they want a partner that can help them navigate the complexities of the financial world.

Overall, Debank has quickly become the go-to solution for millennials because it combines user-friendly design, tailored features, and a commitment to financial education. With Debank, millennials have access to a comprehensive banking platform that meets their unique needs and empowers them to take control of their finances. Whether they are saving for a house, planning for retirement, or simply managing their day-to-day expenses, millennials can trust Debank to be their partner every step of the way.

Simple and User-Friendly Interface

Debank offers a simple and user-friendly interface that makes it a go-to solution for millennials. Whether you are a beginner or an experienced user, Debank’s interface is designed to be intuitive and easy to navigate.

With a clean and modern design, Debank’s interface is organized in a way that allows you to quickly find the information you need. Important features are prominently displayed, making it easy to access your portfolio, track your investments, and manage your transactions.

The user-friendly interface of Debank also includes helpful tools and features that enhance your overall experience. With a minimal learning curve, you can easily connect your wallet, view your account balance, and monitor the performance of your assets.

Debank’s interface is also designed to be customizable, allowing you to personalize your dashboard and prioritize the information that is most important to you. Whether you prefer a simple overview or a detailed analysis, Debank gives you the flexibility to tailor the interface to meet your individual needs.

In addition to its simplicity and user-friendliness, Debank’s interface is also optimized for mobile devices. This means that you can easily access and manage your finances on the go, making it convenient for millennials who are always on the move.

Key features of Debank’s interface include:

- Intuitive navigation: Easily find the information you need with a few clicks.

- Personalization: Customize your dashboard to suit your preferences and priorities.

- Mobile optimization: Access and manage your finances on the go with your mobile device.

With its simple and user-friendly interface, Debank ensures that millennials can easily and effectively manage their finances in the ever-changing world of decentralized finance.

Comprehensive Financial Management

Debank is revolutionizing financial management for millennials with its comprehensive suite of tools and features. Whether you’re a seasoned investor or just starting out, Debank has everything you need to take control of your finances and make informed decisions.

With Debank, you can link all your financial accounts in one place, giving you a complete view of your financial health. From bank accounts and credit cards to investment portfolios and cryptocurrency wallets, Debank allows you to effortlessly track and manage your assets.

Track Your Spending

Debank’s powerful expense tracker helps you understand where your money is going, so you can make smarter spending choices. By categorizing your transactions and providing detailed insights, Debank empowers you to take control of your budget and cut unnecessary expenses.

Investment Analysis

Debank offers sophisticated investment analysis tools that give you a deeper understanding of your portfolio’s performance. With features like portfolio diversification analysis and risk assessment, you can optimize your investments and maximize your returns.

| Benefits of Debank’s Comprehensive Financial Management: |

|---|

| Conveniently link and manage all your financial accounts in one place |

| Gain insights into your spending patterns and make smarter financial decisions |

| Track the performance of your investments and optimize your portfolio |

| Access detailed reports and visualizations to monitor your financial health |

| Stay up-to-date with the latest financial news and market trends |

With its user-friendly interface and comprehensive features, Debank is the ultimate solution for millennials looking to take control of their finances. Don’t just take our word for it, check out the reviews on Debank to see how it has helped others achieve their financial goals.

Intuitive Budgeting Tools

Debank offers a range of intuitive budgeting tools that make it easy for millennials to manage their finances and save money. With these tools, users can set up monthly budgets, track income and expenses, and analyze their spending patterns.

One of the key features of Debank’s budgeting tools is the ability to categorize expenses. Users can create custom categories for different types of expenses, such as rent, groceries, and entertainment. This allows them to see exactly where their money is going and identify areas where they can cut back.

Debank also provides visual representations of users’ spending habits, such as graphs and charts. These visualizations make it easy to see at a glance how much money is being spent in each category and identify trends over time. Users can also set financial goals within the app and track their progress towards these goals.

Another useful feature of Debank’s budgeting tools is the ability to set up automatic savings. Users can choose a target amount or percentage of their income to save each month, and Debank will automatically transfer the specified amount to a separate savings account. This helps millennials develop a savings habit without having to manually transfer money themselves.

In addition to these budgeting tools, Debank also offers personalized recommendations and tips to help users optimize their finances. This includes suggestions for reducing expenses, increasing savings, and improving credit scores.

Overall, Debank’s intuitive budgeting tools provide millennials with a user-friendly and effective way to take control of their finances and work towards their financial goals.

Efficient Expense Tracking

One of the biggest challenges that millennials often face is managing their expenses. With the increasing cost of living and the temptation to overspend, it’s crucial to keep track of where your money is going.

Debank offers a solution for efficient expense tracking, making it easier than ever to stay on top of your finances. The app allows you to record all your expenses in one place, categorize them, and create budgets to keep you on track.

Easy Expense Recording

With Debank, recording your expenses is a breeze. Simply input the amount, select the category, and add a brief description if needed. The app also allows you to upload receipts and attach them to your expenses for easy reference.

By keeping a record of every expense, you have a clear picture of where your money is going. This is especially helpful when it comes to spotting any unnecessary spending habits and making adjustments to your budget.

Smart Budgeting

Debank’s budgeting feature empowers you to take control of your finances. Set monthly budgets for different categories, such as groceries, dining out, or entertainment, and track your progress throughout the month.

If you start to approach your budget limit for a particular category, Debank will send you notifications to help you stay within your limits. This ensures that you are aware of your spending habits and can adjust accordingly if needed.

| Expense | Category | Description | Amount |

|---|---|---|---|

| Starbucks Coffee | Food & Drinks | Grande Cappuccino | $4.50 |

| Spotify Subscription | Entertainment | Monthly Subscription | $9.99 |

| Gym Membership | Fitness | Monthly Fee | $30.00 |

By utilizing Debank’s efficient expense tracking features, you can gain a better understanding of your spending patterns and make more informed financial decisions. It is the go-to solution for millennials who want to take charge of their finances and build a solid foundation for the future.

Seamless Integration with Banks

Debank offers seamless integration with various banks, making it the go-to solution for millennials who want to easily access and manage their financial accounts. With Debank, users can connect their bank accounts and view all their transactions and balances in one place.

Debank’s integration with banks also allows users to perform financial tasks such as transferring money, paying bills, and making deposits without the need to switch between different banking apps or websites. This convenience saves time and effort, providing a more streamlined banking experience for millennials.

Additionally, Debank ensures the security and privacy of users’ financial information by using advanced encryption and authentication methods. This means that millennials can trust Debank to handle their sensitive banking data with utmost care.

Furthermore, Debank’s seamless integration with banks includes real-time updates, providing users with instant notifications for any changes or activities in their accounts. This helps millennials stay on top of their finances and make informed decisions.

In conclusion, Debank’s seamless integration with banks offers millennials a convenient, secure, and efficient way to manage their financial accounts. With Debank, millennials can easily access and control their finances all in one place, saving time and effort.

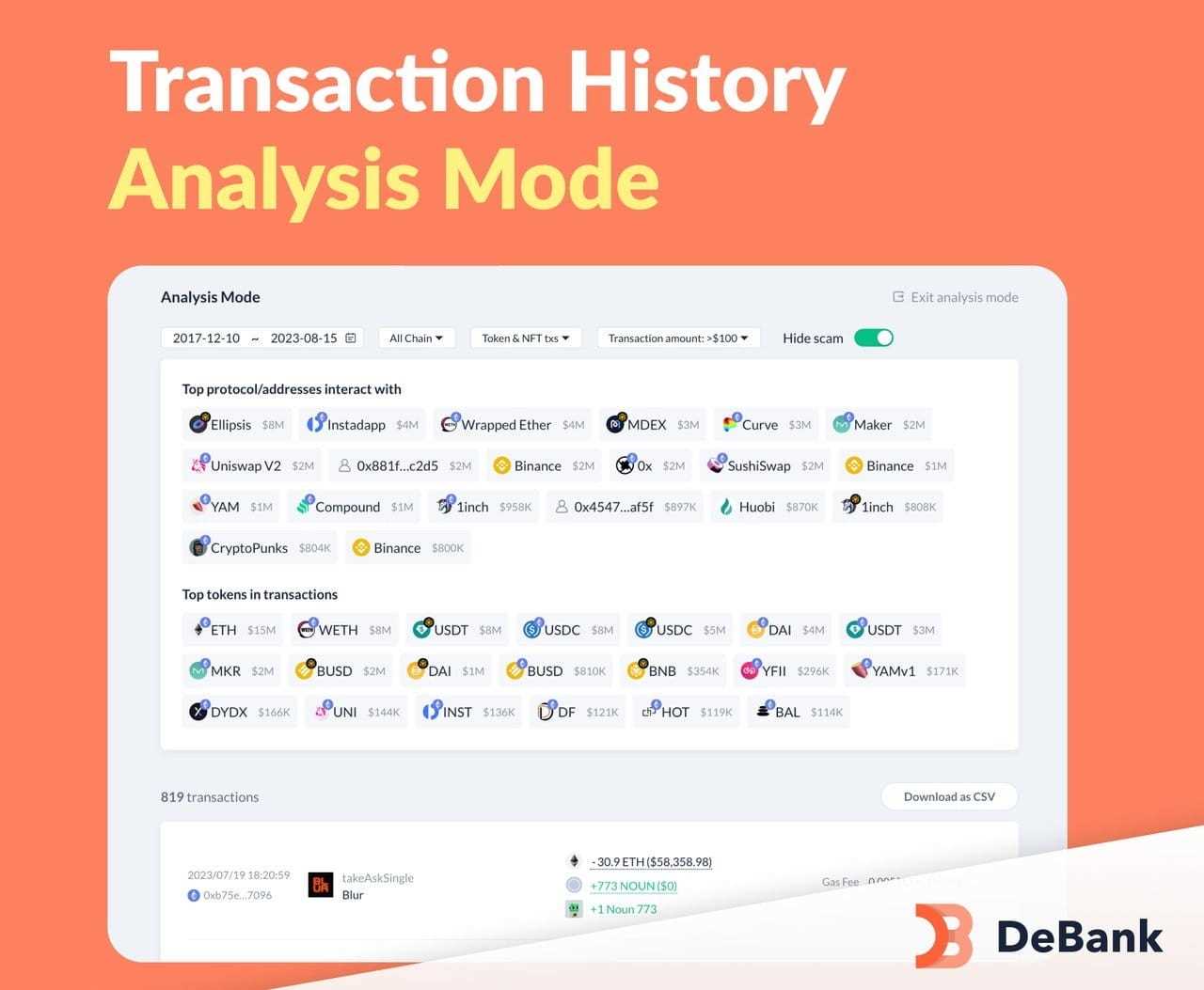

Instant Insights and Analytics

One of the standout features of Debank is its ability to provide users with instant insights and analytics regarding their financial health. By connecting your various accounts and financial sources, Debank is able to gather data and present it in a clear and concise manner, giving you a comprehensive view of your financial status.

With Debank’s intuitive interface, you can easily see your income, expenses, and financial transactions in real time. This allows you to make quick and informed decisions about how to manage your money effectively. Whether you want to track your spending habits, identify areas for savings, or monitor your investments, Debank’s instant insights and analytics have got you covered.

Furthermore, Debank offers customizable alerts and notifications, ensuring that you never miss an important financial update. Whether it’s a bill payment reminder or an investment opportunity, Debank will keep you in the know, helping you stay on top of your financial goals.

Track Your Spending Patterns

Debank’s instant insights and analytics make it easy for you to track your spending patterns. By categorizing your expenses and providing a visual breakdown, Debank allows you to see where your money is going. This can be incredibly helpful in identifying areas where you can cut back and save.

Whether it’s dining out, transportation, or entertainment, Debank’s analytics will show you exactly how much you’re spending in each category. This transparency empowers you to make informed decisions about your budget and take control of your finances.

Monitor Your Investments

In addition to tracking your income and expenses, Debank’s instant insights and analytics also provide a comprehensive view of your investments. Whether you have stocks, cryptocurrencies, or other assets, Debank will monitor their performance and display real-time updates.

By keeping track of your investments, you can easily see how they’re performing and make informed decisions about buying, selling, or holding onto them. Debank’s analytics provide valuable data such as price trends, historical performance, and portfolio diversification, empowering you to make the best decisions for your financial future.

Overall, Debank’s instant insights and analytics are a game-changer for millennials looking to take control of their finances. With its clear and concise presentation of financial data, customizable alerts, and comprehensive tracking, Debank is the go-to solution for anyone wanting to achieve their financial goals.

Secure and Private

One of the primary concerns for millennials when it comes to managing their finances is security and privacy. Debank understands this and prioritizes the protection of your personal and financial information.

Debank uses advanced encryption and security measures to ensure that your data is safe and secure. This includes keeping your account information encrypted and protected from unauthorized access.

In addition to strong security measures, Debank also values your privacy. We take your privacy seriously and do not share your personal information with third parties without your consent.

With Debank, you can have peace of mind knowing that your financial information is safeguarded and your privacy is respected.

Advanced Encryption

Debank implements advanced encryption technology to secure your data, making it virtually impossible for hackers to gain unauthorized access. This ensures that your account and financial information remains private and protected.

Anonymous Transactions

Debank provides an option for anonymous transactions, allowing you to retain your privacy when making payments or transfers. This feature is especially useful for millennials who value their privacy and want to maintain control over their financial activities.

By choosing Debank as your go-to solution, you can enjoy the peace of mind that comes with knowing your financial information is secure and your privacy is protected.

Personalized Recommendations

One of the standout features of Debank is its ability to provide personalized recommendations to its millennial users. Through sophisticated algorithms, Debank analyzes each user’s financial data and usage patterns to deliver tailored suggestions and advice.

These recommendations cover a wide range of financial areas, from budgeting and saving to investing and debt management. Debank takes into account factors such as income, expenses, goals, and risk tolerance to provide customized guidance.

For example, if a user is struggling to save money, Debank might suggest specific areas where they could cut back on expenses and provide tips on how to create a realistic budget. If a user is interested in investing, Debank could recommend suitable investment options based on their risk profile and financial goals.

Debank’s personalized recommendations are also designed to help users make smart financial decisions. For instance, if a user is considering taking on a loan, Debank can provide insights into interest rates, repayment terms, and the potential impact on their overall financial health.

In addition to its financial recommendations, Debank also offers personalized tips and advice on improving financial literacy. These insights help users develop a better understanding of basic financial concepts and empower them to make informed decisions about their money.

With Debank’s personalized recommendations, millennials have access to an invaluable tool that helps them navigate the complexities of personal finance and make sound financial choices.

Goal Setting and Progress Tracking

Debank provides an intuitive and user-friendly platform for millennials to set their financial goals and track their progress. Whether it’s saving for a dream vacation, buying a new car, or paying off student loans, Debank helps users stay focused and motivated.

Setting Goals

With Debank, setting goals has never been easier. Users can define their financial objectives, such as the amount of money they want to save or a specific debt they want to pay off. The platform also allows users to set a target date to achieve their goals, giving them a clear timeline to work towards.

Debank offers a wide range of goal categories to choose from, including savings, investments, retirement planning, and debt management. This allows millennials to align their goals with their long-term financial plans and aspirations.

Tracking Progress

Tracking progress is an essential part of achieving financial goals, and Debank makes it simple and convenient. Users can easily input their financial data, such as income, expenses, and savings, into the platform, which automatically generates personalized financial reports and visualizations.

With the progress tracking feature, millennials can see how far they’ve come and stay motivated to continue working towards their goals. The platform also provides insights and recommendations to help users make informed financial decisions and optimize their progress.

Furthermore, Debank offers a goal milestone feature that allows users to celebrate their achievements along the way. This not only provides a sense of accomplishment but also encourages users to stay committed and actively work towards their financial objectives.

Overall, Debank’s goal setting and progress tracking features empower millennials to take control of their finances, set realistic goals, and track their progress with ease. By providing personalized insights and continuous motivation, Debank becomes the go-to solution for millennials looking to achieve financial success.

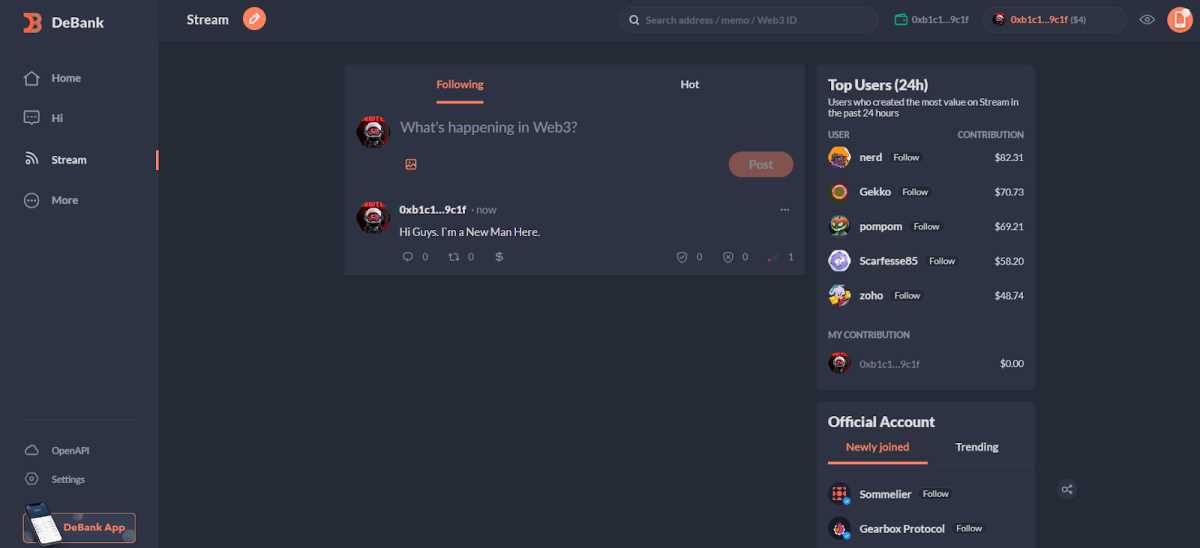

Social Sharing Features

Debank is the perfect solution for millennials not only because it simplifies financial management but also because it offers built-in social sharing features. With these features, millennials can easily share their financial successes, goals, and experiences with their friends and followers on social media platforms.

By sharing their financial achievements, millennials can inspire others to take control of their finances and make smart financial decisions. Debank’s social sharing features allow users to post screenshots of their investment portfolios, savings milestones, or even personal finance tips and tricks.

Millennials are known for their desire to connect and engage with others, including sharing their own experiences and seeking advice. With Debank’s social sharing features, millennials can build an online community of like-minded individuals who are also focused on improving their financial well-being.

Moreover, Debank’s social sharing features can also provide opportunities for networking and collaboration. By connecting with others who share similar financial goals, millennials can learn from each other, exchange knowledge, and even find investment opportunities or business partners.

However, it’s important to note that Debank prioritizes user privacy and security. Users have the option to select what information they want to share and with whom. With these customizable privacy settings, millennials can maintain control over their personal financial data while still being able to utilize the social features of the app.

Overall, Debank’s social sharing features not only make financial management more interactive and engaging but also foster a sense of community and provide opportunities for millennials to learn, inspire, and collaborate.

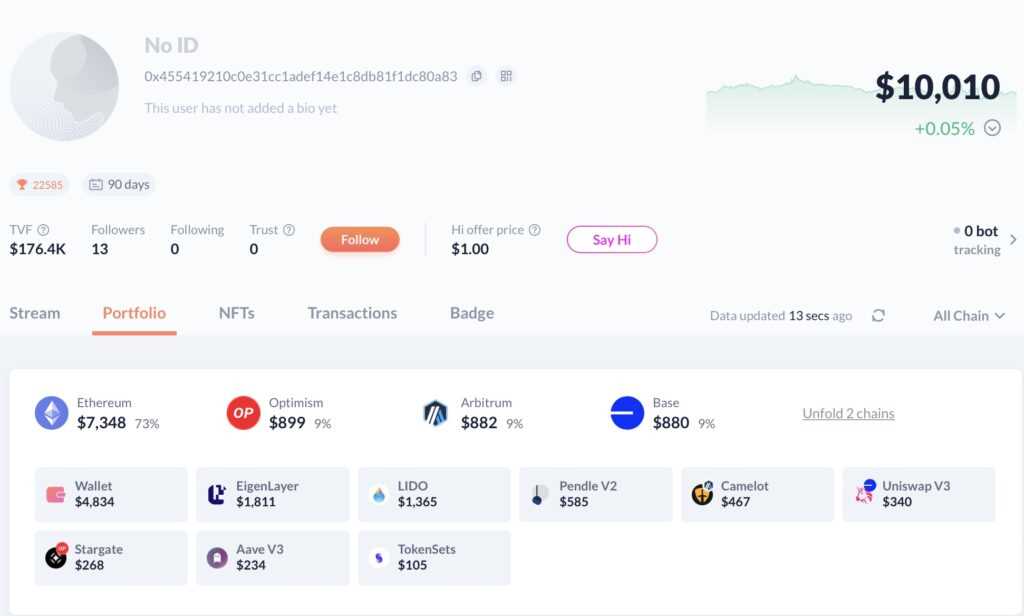

Investment Portfolio Management

Debank offers a comprehensive investment portfolio management solution for millennials, making it the go-to platform for managing your investments. With Debank, you can easily track, analyze, and optimize your investment portfolio all in one place.

The platform allows you to connect your brokerage and bank accounts, giving you a complete overview of your investment holdings. You can view detailed reports and performance metrics for each asset class, including stocks, mutual funds, ETFs, and more.

Debank’s intuitive interface provides real-time updates on market trends and news, helping you make informed investment decisions. Whether you’re a seasoned investor or just starting out, Debank’s portfolio management tools make it easy to stay on top of your investments.

One of the key features of Debank is its portfolio rebalancing tool. This tool automatically adjusts your portfolio to maintain the desired asset allocation based on your risk tolerance and investment goals. It takes into account market conditions and rebalances your portfolio accordingly, ensuring that you stay on track.

In addition to portfolio management, Debank also offers investment advice and guidance. The platform provides personalized recommendations based on your investment profile and goals, helping you optimize your portfolio for maximum returns.

- Track and analyze your investment portfolio

- Connect your brokerage and bank accounts

- View detailed performance metrics for each asset class

- Stay updated on market trends and news

- Automatically rebalance your portfolio

- Receive personalized investment recommendations

With Debank’s investment portfolio management solution, millennials can take control of their financial future and achieve their investment goals with confidence.

Rewards and Incentives

Debank offers a wide range of rewards and incentives to its millennial users, making it the go-to solution for this tech-savvy generation. By using the Debank app, millennials can earn points for various activities such as making purchases, referring friends, and engaging with the platform.

Earning Points: Users can accumulate points by simply using their Debank debit card for everyday expenses. Each transaction made using the card earns them a certain number of points, which can later be redeemed for rewards.

Referral Program: Debank also has a lucrative referral program where users can invite their friends to join the platform. When a referred friend signs up and makes their first transaction, both the referrer and the friend receive bonus points. This incentivizes millennials to spread the word about Debank and encourages them to actively engage with the app.

Exclusive Offers: Debank partners with various brands and businesses to offer exclusive discounts and deals to its users. These partnerships allow millennials to save money on their favorite products and services, further enhancing the appeal of using Debank.

Rewards Catalog: The points earned by millennials can be redeemed for a wide range of rewards, from cashback offers to gift cards and merchandise. This gives users a sense of achievement and motivation to continue using Debank and earning more points.

Personalized Recommendations: Debank’s intelligent algorithm analyzes users’ spending habits and preferences to provide personalized rewards and recommendations. This ensures that millennials receive relevant offers and incentives that align with their interests, driving engagement and loyalty.

In conclusion, Debank’s rewards and incentives program not only provides financial benefits and savings to its millennial users but also creates a sense of excitement, achievement, and personalization. This makes Debank the go-to solution for millennials who want to make the most out of their financial transactions.

Constant Updates and Improvements

Debank is committed to providing the highest quality of service to its users, and this is evidenced by their constant updates and improvements to the platform. The team at Debank is constantly working to enhance and refine the user experience, making it easier and more intuitive for millennials to navigate the app.

With regular software updates, Debank ensures that users always have access to the latest features and improvements. Whether it’s implementing new security measures, adding new tools and functionalities, or simply improving the overall design and user interface, Debank consistently strives to stay ahead of the curve.

The app’s developers actively seek out user feedback and take it into consideration when making updates and improvements. This ensures that Debank remains a user-centric platform that meets the evolving needs of millennials. By listening to user suggestions and incorporating them into their development process, Debank is able to create a product that truly resonates with its target audience.

In addition to regular updates, Debank also actively seeks out partnerships and collaborations with other fintech companies. By leveraging the expertise and resources of these partners, Debank is able to access cutting-edge technology and provide even better services to its users.

Overall, Debank’s dedication to constant updates and improvements sets it apart as the go-to solution for millennials. With a commitment to staying ahead of the technology curve and providing the best possible user experience, Debank ensures that its users have access to the latest tools and services they need to manage their finances effectively.

FAQ:,

What is Debank and why is it important for millennials?

Debank is a financial technology platform that provides millennials with solutions to manage their finances more efficiently. It allows them to track their expenses, create budgets, and set financial goals. Debank is important for millennials because it helps them take control of their financial lives and make informed decisions.

How does Debank help millennials track their expenses?

Debank provides millennials with a user-friendly interface where they can link their bank accounts and credit cards. It automatically categorizes their transactions and creates visual reports, allowing them to see exactly where their money is going. This helps millennials track their expenses and identify areas where they can cut back.

Can millennials create and manage budgets with Debank?

Yes, millennials can create and manage budgets with Debank. They can set spending limits for different categories, such as groceries, dining out, and entertainment. Debank will notify them when they are close to exceeding their budget, helping them stay on track and avoid overspending.

Does Debank provide any tools for millennials to set financial goals?

Yes, Debank provides millennials with tools to set and track financial goals. They can set goals for saving money, paying off debt, or investing. Debank will show them their progress towards these goals and provide recommendations on how to achieve them more quickly.